Higher interest rates and the looming end of the second real estate double bubble

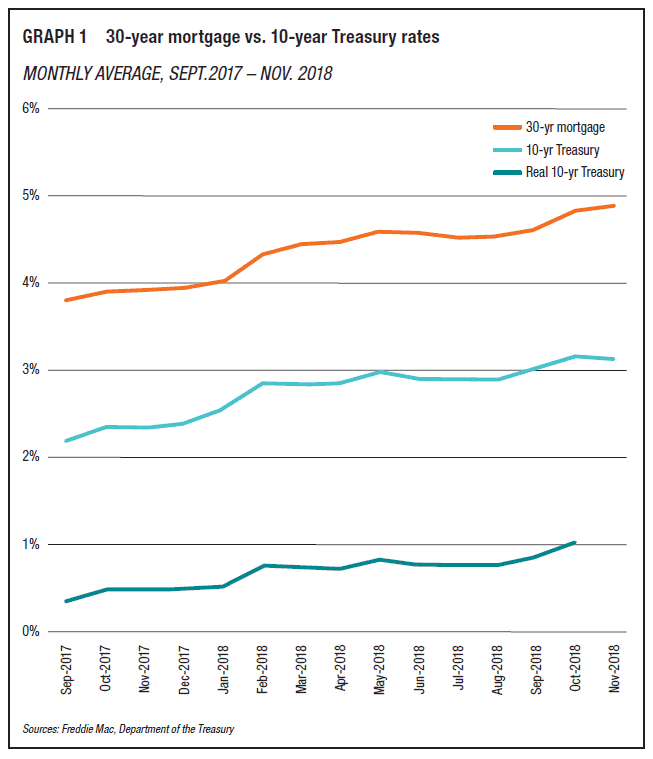

The real (inflation-adjusted) interest rate on the 10-year Treasury note has gone from about 0.4 percent to just over 1 percent. These rate movements from extraordinarily low levels to somewhat higher levels are shown in Graph 1.

A more normal real yield for the 10-year Treasury note might be about 2 percent, which would suggest with 2 percent inflation, a 10-year Treasury rate of 4 percent and a mortgage rate of 6 percent. That would have serious downward implications for the elevated level of U.S. house prices, which already stress buyers’ affordability.

As an example, suppose a buyer could just afford a typical monthly mortgage payment required to buy a typical $250,000 house with a 90 percent mortgage of $225,000, if the interest rate is 4 percent. If the interest rate goes up to 6 percent, the same payment can service a mortgage of only $180,000, or a house price of $200,000. A 2 percent rise in the interest rate reduces the price of the house the buyer can afford by 25 percent. (Of course, from 4 percent to 6 percent is a 50 percent increase in the interest to be paid.) Such math may well be working in the United States in the coming year.

Alan Greenspan, the famous chairman of the Federal Reserve from 1987 to 2006, made these apt comments in response to a question at an American Enterprise Institute conference I moderated in February 2018:

The real issue is that real long-term interest rates are exceptionally low. I’d argue that there’s both a stock bubble and a bond market bubble. And the bond market bubble is essentially the determining force. Real interest rates are at the lowest levels of extremity. If you’re at your lowest levels, there’s only one direction you can go. The stock market cannot go up, irrespective of the cash flow and everything else, if real long-term interest rates are rising. [excerpts, ellipses deleted]

This certainly seems right, and Greenspan could have added a real estate bubble, as well. In fact, the United States once again has a double bubble in real estate – for both houses and commercial real estate have experienced another unsustainable asset price inflation.

The basic financial math of rising interest rates of course applies to commercial real estate, as well as houses, bonds and stocks. As long-term interest rates rise, the discount rate to determine the present value of a commercial property rises, its present value falls and its price falls ceteris paribus.

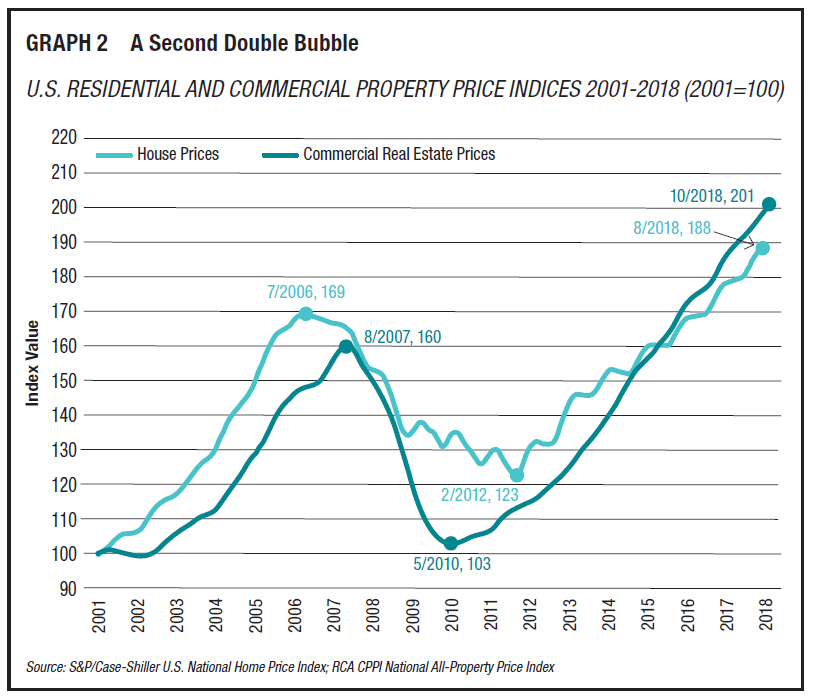

There have been remarkable swings in both U.S. house prices and commercial real estate prices in the eventful 21st century so far. It is clear that what is usually called the “housing bubble” of the 2000s, was in fact a double bubble. Then there was a double price collapse, and after that, a second double bubble in the 2010s.

In the first double price collapse, average U.S. house prices fell by 27 percent and commercial real estate prices by 36 percent. House prices bottomed in 2012 and have since risen 54 percent, to a new all-time high. Commercial real estate prices bottomed in 2010, and since have gone up 95 percent, and have also surpassed their former bubble peak. All this is shown in Graph 2.

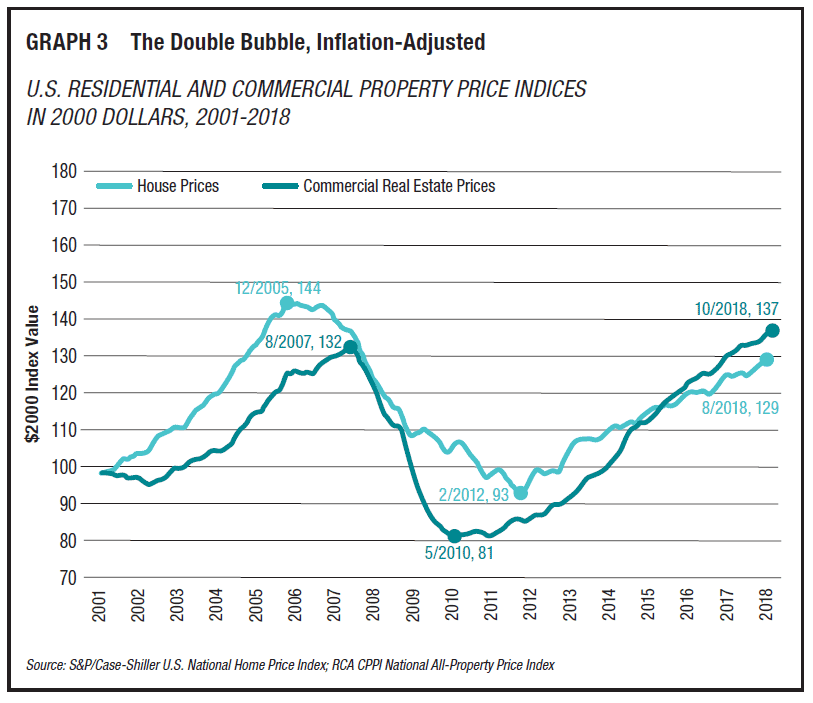

Graph 3 shows the price history adjusted for inflation. We find that average commercial real estate prices in real terms are now over their previous bubble peak, exceeding it by 3 percent. House prices in real terms have not reached their former peak, but are as high as in September 2004, when the first bubble was well advanced.

What is happening as interest rates rise? House sales have been slowing this year. “The fundamentals of the hottest housing markets around the country have been weakening for months, with declining sales and rising inventories,” the financial letter Wolf Street observes. Under the title, “Alarm Sounds for Home Sales,” the Wall Street Journal quotes a Texas housing consultant’s view that “We have this huge affordability crisis. With mortgage rates going higher, we’re hitting a ceiling.” Yes, and how about 6 percent mortgages? “6 percent is likely the pain-threshold for the housing market,” Wolf Street plausibly opines. “6 percent will block enough potential buyers from buying at current prices.”

A further element in U.S. housing finance is weakened credit standards from the dominating government mortgage agencies, implemented as house prices have escalated. As Edward Pinto, head of the AEI Center on Housing Markets and Finance, recently wrote, “The house price boom has been driven by two punchbowls: the Fed’s accommodative monetary policy, now being slowly withdrawn, and easy first-time buyer credit made available by federal agencies, which continues unabated.” With a serious fall in house prices, these lowered credit standards will, as after every boom, prove painful.

For the 5,339 U.S. banks with total assets of $10 billion or less, real estate loans are 75 percent of their total loans. These banks are essentially real estate banks. For the entire U.S. banking system, real estate loans are 49 percent of all loans. Thus, the whole banking system is concentrated in real estate risk. The real estate prices against which these loans are made are key to the performance of the banking system. We will see what happens if they again fall sharply.

The end of the second real estate double bubble is looming. But how will it end? The Federal Reserve is hoping that the asset price inflation it previously stoked can transition to a soft landing. Maybe it will, but if we get a hard landing, it wouldn’t be the first time. Will the renewed double bubble end with a bang or a whimper? That is the question.

Image by TheaDesign