The adventures of investing in Fannie Mae and Freddie Mac stock, or how to lose 99% in a government deal

Fannie and Freddie have a hybrid legal form: they are basically government agencies, “implicitly guaranteed” by the U.S. Treasury, as it was often said, but in reality fully guaranteed. At the same time, they also have private shareholders and publicly traded stocks. The shareholders expected to profit greatly by trading on the credit of the United States and the numerous other special advantages that Fannie and Freddie had been granted by politicians and regulators.

How did the shareholders do? For a long time, their optimistic expectations were more than justified. Then they lost close to everything. After that, Fannie and Freddie’s stocks became purely speculative vehicles, which made, first, big profits and then big losses. This essay chronicles the adventures of investing in the stock of these companies sponsored by, guaranteed by and later entirely controlled by the U.S. government.

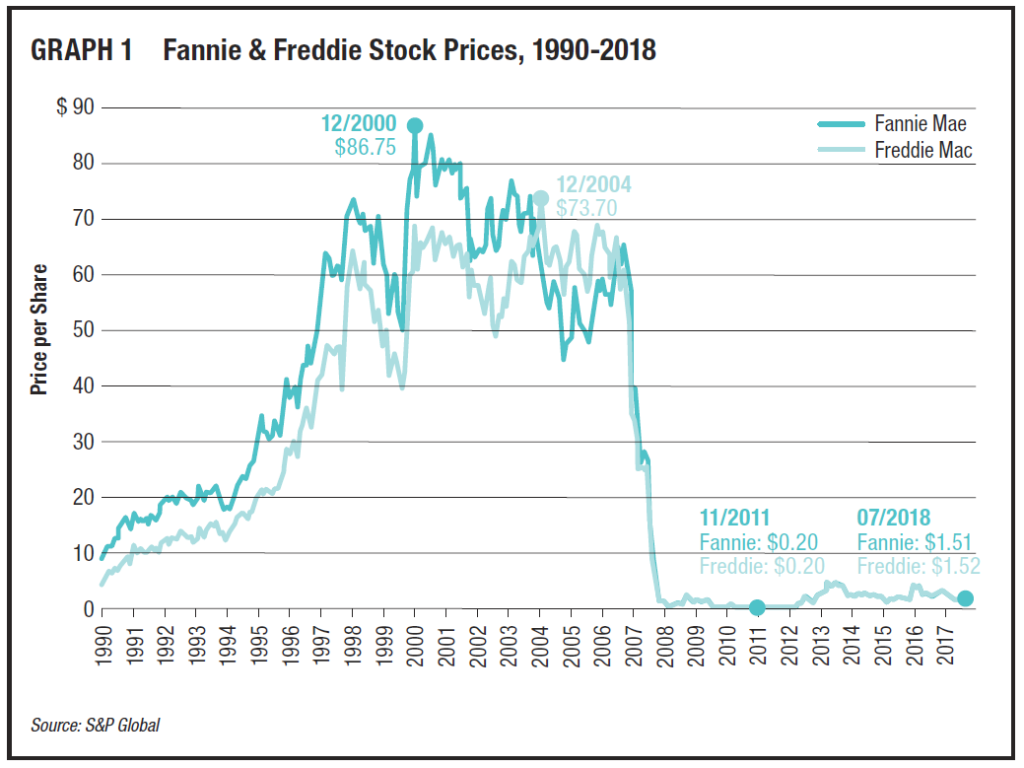

Fannie’s all-time high stock price was $86.75 per-share in December 2000. Ten years before, the price had been $8.91, so the aggregate gain in price over the 1990s was 874 percent. This means Fannie’s stock price went up on average 25 percent per-year for a decade. Not bad! Fannie created a powerful, ruthless and feared lobbying organization to protect its no-fee government guaranty and its other competitive privileges. Its political clout and its arrogance became legendary.

“Pride goeth before destruction and a haughty spirit before a fall,” says the Book of Proverbs. This was certainly true of Fannie with matching consequences for its private shareholders. From its peak, after Fannie’s massive losses put it into government conservatorship, its stock price dropped to a low of 20 cents per share in November 2011. That was a loss for the shareholders of 99.8 percent. Now, at the end of July 2018, Fannie’s stock price is somewhat higher, at $1.51. This still represents a loss of 98.3 percent from its peak.

Who would have thought that could happen? Probably nobody. But a fundamental characteristic of prices in a financial bust is that they can go down a lot more than you thought possible.

The shareholders of Freddie Mac experienced a similar elation and then collapse. Freddie’s all-time stock price high was $73.70 in 2004. Ten years earlier it had been $12.63, so the shareholders in this government deal had enjoyed a 484 percent aggregate gain over the decade, or on average over 19 percent per year. Then came the losses, the conservatorship, and the shriveling of its stock price to the trough of the same 20 cents per share in 2011. That meant a 99.7 percent loss from the peak. From the peak to now, the loss is 97.9 percent.

Reviewing the losses for the equity investors in these former political and stock-market darlings, one can only exclaim, “Mirabile dictu!” They form a memorable lesson.

The history of this adventure in investing to trade on the government’s guaranty is shown in Graph 1, which displays three decades of stock prices for Fannie and Freddie, from 1990 to July 2018.

At their stock price bottom of 20 cents per share, Fannie and Freddie were completely controlled by the government, but the two stocks continued to exist and trade. They became and remain a pure speculation on political events and the outcomes of various lawsuits that investors brought against the government. The lawsuits have been unsuccessful and the politicians, although they have debated the matter mightily, have not been able to agree on any legislative restructuring. As the Washington saying goes, “When all is said and done, more is said than done.” In this case, vast volumes have been said, but nothing has been done.

Fannie and Freddie continue to live on the government’s guaranty. They could not exist for one minute without it. Under the conservatorship agreement, the U.S. Treasury takes essentially all their profits, so their capital continues to round to zero. As long as this situation lasts, there can never be any cash for the shareholders, so the price of the shares is a pure gamble on the situation changing by some political outcome. This speculative essence has made Fannie and Freddie’s shares over the last seven years extremely volatile.

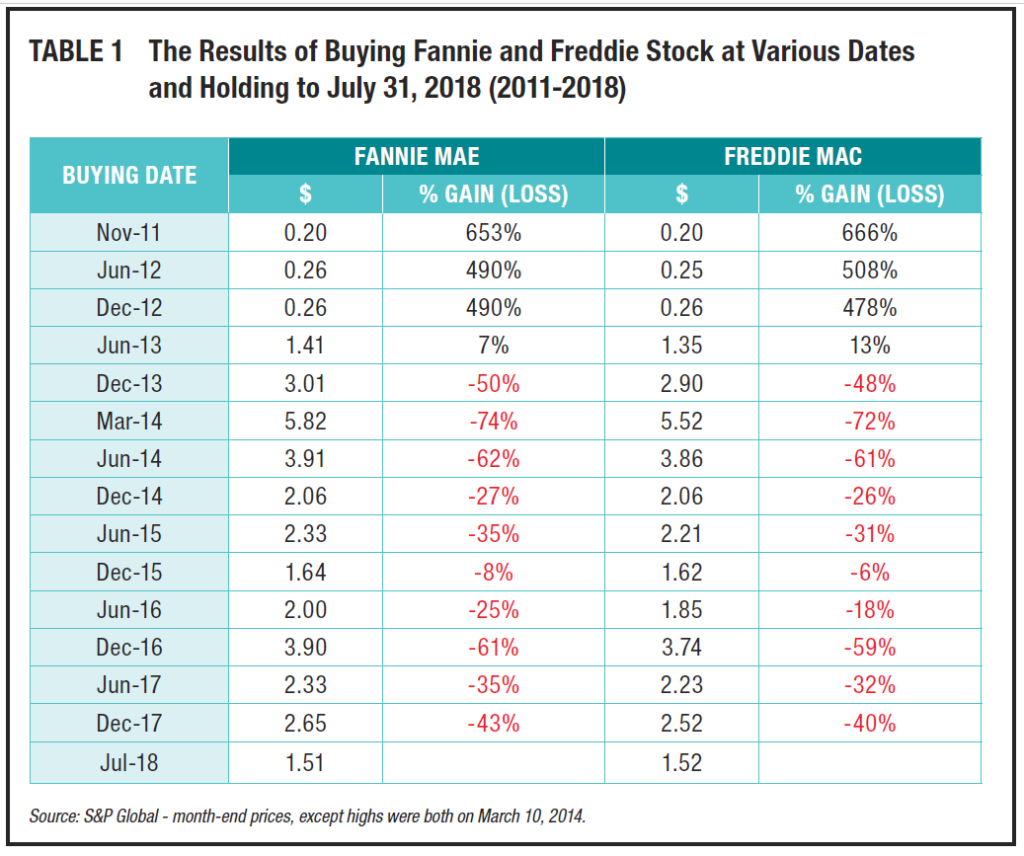

Had you had the courage to buy at 20 cents, you might have multiplied your investment up to 29 or 27 times, as the intervening highs have been $5.82 for Fannie and $5.52 for Freddie. But had you been tempted by the optimism of those highs while investing based on the possible actions of the government, you could once again have had huge losses – of over 70 percent.

Table 1 shows your returns had you bought Fannie or Freddie stock at the lows, or had you bought at various subsequent dates, including at the post-2011 highs, and in each case held the shares to July 2018.

As the table makes clear, such purchases during the speculative phase generated very large profits at first, and very large losses afterward, measured on the assumption that you held the shares until now. Of course, the results of interim purchases and sales could have varied a lot in both directions.

The end of this eventful history of Fannie and Freddie’s stockholders has not yet been written. Whatever future chapters may add, the story has demonstrated that, however attractive the deal is at first, the government can be a dangerous business partner over time.