State-By-State Scorecard on Electricity Competition Highlights Opportunities to Promote Savings, Boost Innovation

Active competition promotes innovation and efficiency—a principle that applies just as strongly to electricity markets as to other parts of the economy. Yet states vary widely in how they harness competition to serve customers and encourage entrepreneurs in electric power. Retail choice is a key way to empower customers, but it’s not the only option. Policies like consumer data access, competitive procurement, and structural limits that quarantine regulated monopolies all help competition do its thing. R Street’s recent State-By-State Scorecard on Electricity Competition evaluates states not by labels, but by the concrete steps taken to enable competition and limit monopoly. It gives policymakers a clear-eyed view of how their states stack up, along with practical tools for improvement.

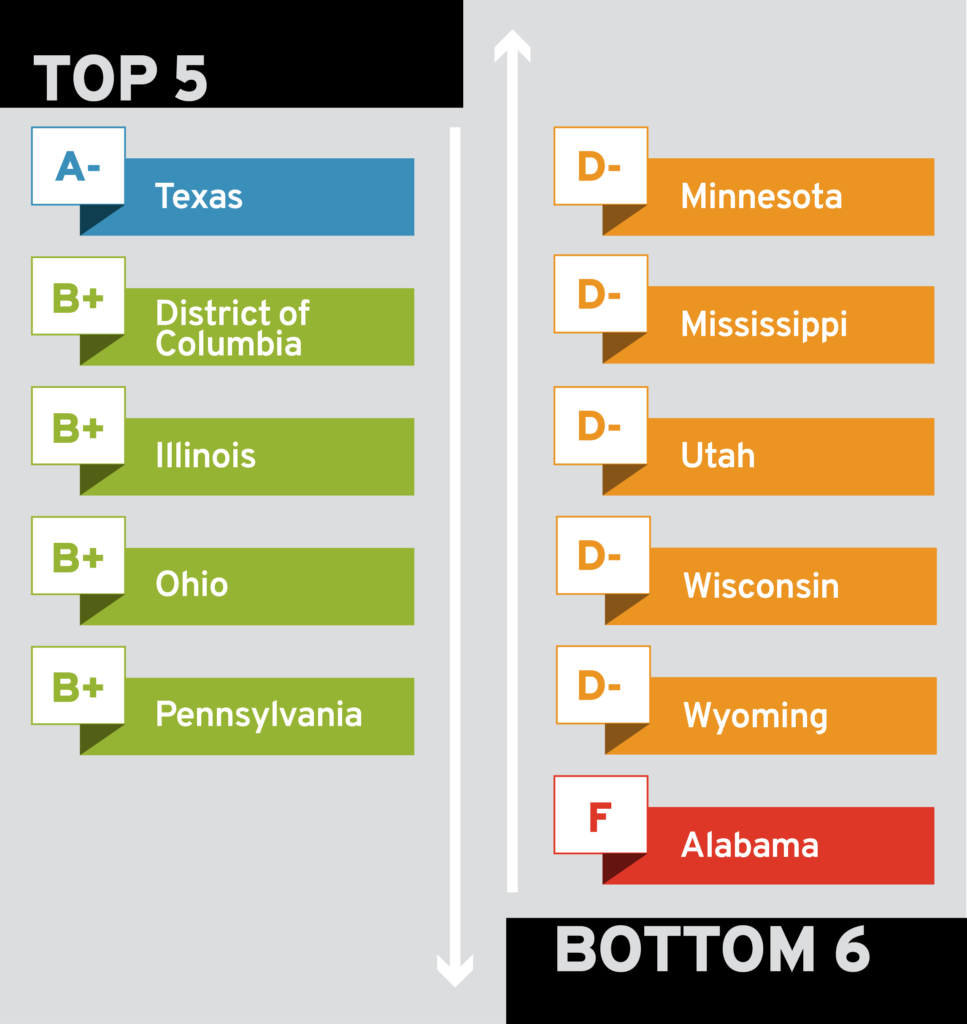

Figure 1 highlights the states/district at the top and bottom of our scorecard.

The scorecard highlights states that effectively employ competition and customer choice as well as those that have work to do in this area. Texas leads all states with an A-, closely followed by Illinois, Pennsylvania, the District of Columbia, and Ohio, each earning solid B+ grades. These top-performing states have translated pro-competitive policies into tangible economic gains, such as attracting data centers, encouraging clean-tech entrepreneurs, and providing money-saving tools to customers. Still, even the best states have room for improvement. Texas could expand customer choice beyond the Electric Reliability Council of Texas region, and other leading states could better quarantine regulated monopoly utilities. (Pennsylvanians take note: A recent proposal to let regulated distribution companies build power plants at customer expense would be a significant step backward.) At the bottom of the list, states like Alabama (F), along with Wisconsin, Wyoming, Utah, Mississippi, and Minnesota (all graded D), show substantial room for growth. Utah’s recent policy moves, including permitting limited large-customer choice, suggest positive momentum that could raise its score significantly in subsequent scorecard updates. Maryland offers a cautionary tale, as recent regulatory changes effectively crippled residential customer choice, thereby reducing competition and undermining consumer options.

R Street evaluated states using 10 core policy categories:

- Approaches to customer choice and competitive foundations

- Treatment of rate-regulated monopolies

- Alternatives within a traditionally regulated utility system

- Wholesale competition

- Price caps and limits on product differentiation

- Smart meters and metering data

- Customer education and access

- Regulatory staffing

- Consumer advocacy

- Complaint filing and resolution

We evaluated each state based on these factors, assigning higher baseline grades to those with full retail choice programs while crediting meaningful competitive elements in traditionally regulated states. Scores were then adjusted based on implementation quality, consumer protections, and market innovations. States earn the highest marks when they decisively quarantine monopoly utilities by clearly separating regulated monopoly activities from competitive markets. States receive partial credit when they adopt limited protections, such as ring-fencing rules that reduce (but do not eliminate) the risks of unfair competition. By outlining the factors and noting their influence on overall performance, the scorecard report helps policymakers see which policy choices move grades up or down.

Figure 2 shows the full list of states and their final grades.

Three sets of actions surface repeatedly in our recommendations across both traditionally regulated and retail-choice jurisdictions:

- Complete the rollout of smart meters and enable customer access to Green Button-quality, near-real-time data. Doing so lets people manage use, cuts costs, and spurs new service ideas.

- Strengthen an independent, well-resourced consumer advocate office that can appear in rate cases, track complaints, and keep both regulated utilities and competitive suppliers honest.

- Quarantine the monopoly by separating the regulated wires business from competitive ventures or (at minimum) tightening ring-fencing and affiliate rules to prevent cross-subsidies and self-dealing.

In retail-choice states, quarantining means keeping the wires utility out of generation and retail supply altogether; in traditionally regulated states, it means blocking the utility from rate-basing non-core businesses like electric vehicle (EV)-charging networks or other competitive services. Because these policies are already working well in some states, other states should consider implementing them.

Even states that already let customers shop for electricity can sharpen the edge of competition. Supplier-consolidated billing requires competitive suppliers (rather than the utility) to send invoices, thereby clarifying price signals and opening the door to new service bundles. Competition deepens when settlements rely on smart-meter interval data instead of static load profiles, allowing suppliers to craft usage-based products and rewarding customers for shifting demand. Real dynamism also depends on relaxing bans and caps that restrict rate structures or product differentiation. Connecticut’s variable-price prohibition chased several suppliers from the market, and Maryland’s new price-cap and contract-format rules have all but frozen residential choice. Embracing this trio of reforms—competitive billing, interval-data settlement, and regulatory flexibility—expands the retail ecosystem, supports energy-tech startups, and keeps downward pressure on bills by giving households and businesses better ways to manage their energy use.

States that maintain vertically integrated utility structures can still benefit from boosting competition at several levels. For example, competitive, all-source solicitations for new generation and non-wires solutions introduce head-to-head price pressure and deliver sizable savings. The report also notes that joining or fully committing to a regional transmission organization (RTO) provides another layer of wholesale competition, with RTO membership driving reliability and economic benefits to member utilities. Regulators can broaden choice incrementally by authorizing community-choice aggregation programs or allowing large commercial and industrial customers to shop for supply. Finally, granting third-party aggregators full access under Federal Energy Regulatory Commission Orders 745 and 2222 lets demand response and distributed energy resources compete on a more equal footing with traditional generation. Taken together, these measures better position traditionally regulated states to meet rising demand without placing added risks on captive ratepayers.

Driven by the adoption of EVs, electrified buildings, and large-scale data centers, rapid growth in electricity demand is reshaping the priorities of utilities and regulators across the country. FERC and others have identified rising demand as a defining challenge for the power sector in 2025 and beyond, underscoring the urgent need for states to rethink traditional regulatory frameworks and embrace market-oriented strategies. Flexible policy measures like competitive solicitations, smart-meter data access, and structural quarantine of monopoly utilities can attract private investment, contain costs, and ensure grid reliability amid soaring electricity use. States that fail to modernize their regulatory approaches risk higher consumer costs, infrastructure bottlenecks, and missed economic opportunities.

Every state has opportunities to harness competition more fully to empower consumers, spur innovation, and improve efficiency. Well-organized retail-choice states consistently earn high marks, but even leaders like Texas, Illinois, and Pennsylvania can do better. Hybrid states pairing regulated monopolies with wholesale competition outperform traditional models but leave valuable benefits untapped. Traditional regulated monopoly states consistently rank lowest, missing clear gains from competition, transparency, and innovation. Still, there are some encouraging signs: Utah and West Virginia recently opened limited direct access for large energy users—a cautious step toward more dynamic markets. With electricity demand rising quickly, policymakers can’t afford delays. Our report offers all U.S. states a clear and meaningful path toward effective consumer-focused competition.