Testimony In SUPPORT of Senate Joint Resolution 25, a Joint Resolution requiring the General Assembly to pass legislation to establish an open, competitive retail electric energy market

March 28, 2019

Committee on Transportation,

Infrastructure and Public Safety

Mr. Chairman and members,

My name is Josiah Neeley and I am an Energy and Environment Senior Fellow with the R Street Institute. R Street is a nonprofit, nonpartisan, public-policy research organization with a mission to engage in policy research and outreach to promote free markets and limited, effective government. Thank you for allowing me to testify today on this important topic.

I am here today to testify in support of Senate Joint Resolution 25. Electricity competition is a free-market policy supported by both economic logic and common sense. But more importantly, electricity competition is a tested policy that provides a proven benefit to states, both economically and environmentally.

For the past two decades, roughly a dozen states have operated under a competitive regulatory model. When we compare the performance of these states to those that have stayed with a monopoly model, we find that competition provides electric power that is cheaper and cleaner than that provided by Missouri’s current regulatory structure, yet is still just as reliable. The experience of these states can and should guide Missouri as it contemplates taking steps to introduce competition to its electricity market.

I would like to stress four points in particular:

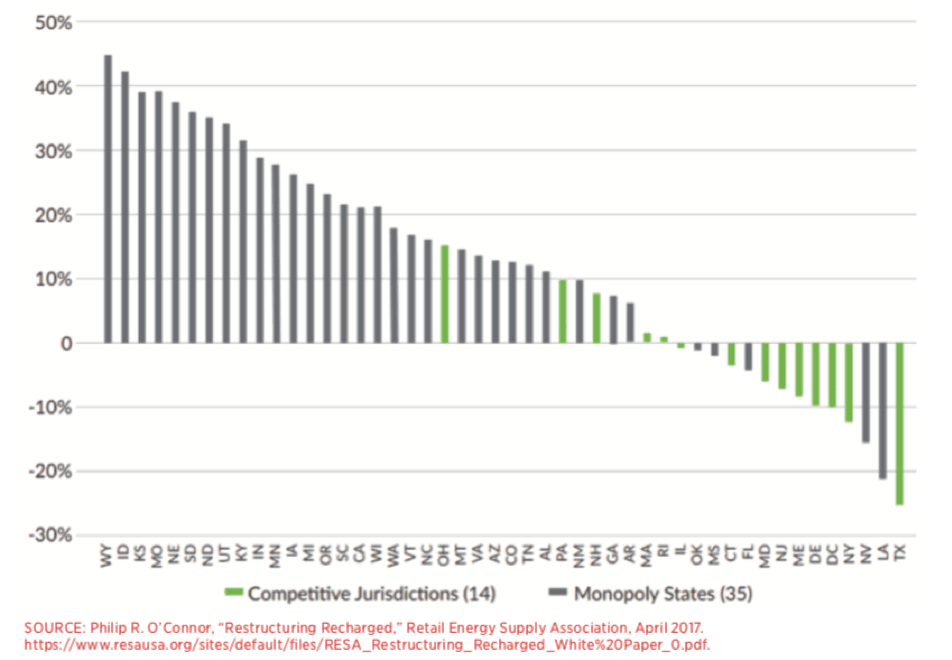

1. Competition would mean substantial savings for electricity customers. Over the past decade, electricity prices in restructured states have tended to fall or remain stable, while prices in monopoly states have tended to rise. From 2008 to 2016, the weighted-average price of electricity in monopoly states increased 15 percent, while it decreased 8 percent in restructured states.

Figure 1: State Ranking – All Sector Percentage Price Change, 2008-2016

These lower prices have translated into billions of dollars in cost-savings for electricity consumers. In fact, a joint report by the Illinois Chamber of Commerce, the Illinois Manufacturers’ Association, the Illinois Retail Merchants Association and the Illinois Business Roundtable notes that electricity restructuring resulted in $37 billion in consumer savings from 1998 to 2013 [1] Similarly, a study by researchers from Cleveland State University and Ohio State University found that since 2011, restructuring in Ohio has led to $15 billion in consumer savings.[2]

It is not surprising that competition would deliver lower prices. Whether it be car dealerships or washing machine vendors, businesses often try to attract customers by offering better prices than those of their competitors. Features of Missouri’s current regulatory model, though, would make a move to competition particularly likely to lower costs.

Currently in Missouri, utility rates are set based on what is needed for the utility to recover its costs, plus a percentage return on investment. This means that, paradoxically, the more a utility spends, the more it makes—even if that spending is wasteful. Utilities therefore have an incentive to invest in large, costly projects even if those same projects would not make sense in an open market.

I should stress that I am not blaming utilities here; they are simply responding rationally to the incentive structure that the government has put in place. But switching to a competitive structure would alter these incentives, making utilities more likely to adopt practices that reduce costs and, in turn, decrease consumer prices.

2. Competition would help make the grid more efficient. The past decade has seen major changes in the energy market, with new technologies across the board and, for some fuel sources, falling prices. More changes are on the way, particularly in the areas of distributed generation and demand response. Competition has helped to ease these transitions, and has added flexibility and resiliency to the grid.

Utilities in competitive markets have been quicker to adapt to these changes and to innovate. Monopoly utilities, by contrast, have often sought to stymie these developments or have ignored them altogether because they are insulated from competitive pressures. Monopoly jurisdictions, for example, typically have excess reserves far beyond what experts believe is the economically efficient level. This waste costs ratepayers money.

3. Competition is environmentally beneficial. States with competition have been quicker to adopt new, cleaner technologies and fuel sources. For instance Texas, a competitive state, generates the most wind power in the nation. By contrast, utilities in monopoly states have been more likely to keep older, polluting plants in operation even when they are uneconomical. Because of the cost-recovery issue mentioned above, it can make sense for these utilities to keep older coal plants in operation—even if it means installing costly emissions-control equipment required by federal regulations—rather than shuttering the plant in favor of lower-cost natural gas or renewable energy.

Even when it comes to traditional plants, generators in competitive states have done more to conserve fuel use than their counterparts in monopoly states, resulting in less pollution. For example, regulated coal plants often use a costlier fuel-procurement approach and hold higher levels of fuel inventory on-site than utilities in competitive states, which results in greater particulate-matter emissions.[3] By contrast, in states with competition, coal plant owners have tended to improve fuel efficiency, resulting in emissions reductions of between 4.6 and 7.6 percent in SO2, NOx and CO2 between 1991 and 2005.[4] Nuclear generators that are subject to competitive pressures have also improved their availability and reduced refueling outage times, resulting in a 10 percent gain in operating efficiency.[5]

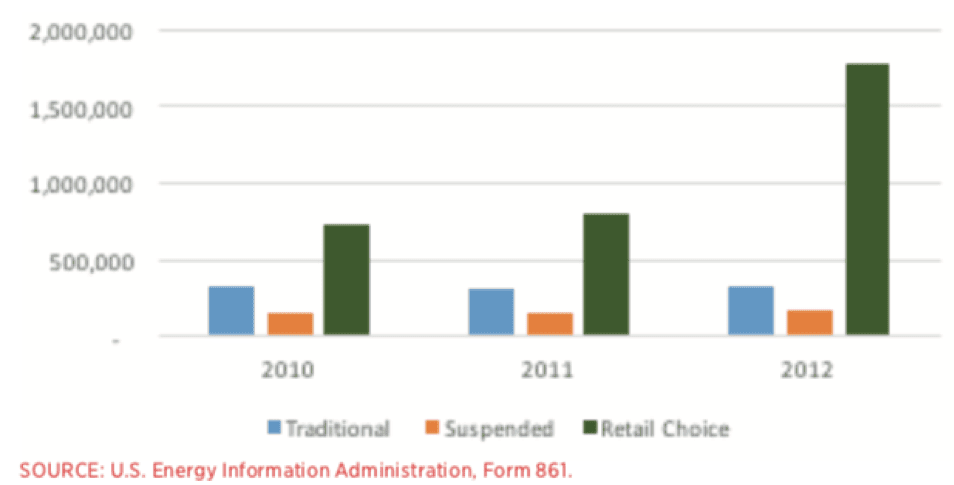

Retail competition has also made electricity providers more responsive to increasing demand for clean or green energy. Over the past decade, a growing number of customers have expressed a preference for green energy options. Providers in competitive areas have responded to this demand, while monopoly utilities have sometimes been slower to do so. In the span of just two years, for example, green choice customers in retail states more than doubled, while the number of customers in traditionally regulated states remained flat.

4. Electricity competition would also help make Missouri more attractive to businesses. Many large companies—from Walmart to General Motors to technology companies like Amazon and Microsoft—have adopted internal sustainability goals that require the purchase of renewable energy. In fact, corporate renewable energy procurement was roughly six times higher between 2015 and 2016 than in the late 2000s and early 2010s.[6] The availability of retail choice can be a critical factor for corporations in deciding where to locate, particularly for the technology industry and other large institutional buyers of renewable energy. Yet monopoly utilities have often been slow to respond to this demand and have offered green options that do not appeal to many consumers.

For all of these reasons, it makes sense to let Missouri citizens vote on whether they should join the 15 other states that have already embraced competition. I would be happy to answer any questions.

Josiah Neeley

Energy and Environment Senior Fellow

R Street Institute

jneeley@rstreet.org

[1] Illinois Chamber of Commerce et al., Electricity

& Natural Gas Customer Choice in Illinois—A Model for Effective Public

Policy Solutions, February 2014, pp. 1–2.

[2] Andrew R. Thomas et al., “Electricity

Customer Choice in Ohio: How Competition Has Outperformed Traditional Monopoly

Regulation,” Urban Publications, November 2016, 1.

[3] See Devin

Hartman, “Environmental Benefits of Electricity Policy Reform,” R Street Policy

Study 82, January 2017.

[4] H.R. Chan et al., “Efficiency and

Environmental Impacts of Electricity Restructuring on Coal-fired Power Plants,”

Journal of Environmental Economics and

Management, March 2013, at 32.

[5] James B. Bushnell and Catherine Wolfram,

“Ownership Change, Incentives and Plant Efficiency: The Divestiture of U.S.

Electric Generation Plants,” Flinders University School of Computer Science,

Engineering and Mathematics, Working Paper No. 140, March 2005.

[6] Bloomberg New Energy Finance, “2017 Sustainable Energy America Factbook,” 2017, p. 39.