Clean Energy Payment Program Likely to have Unrealistic Expectations

The program, as designed, would award a grant of $150 per megawatt hour (MWh) of generation above a 1.5 percent year over year increase from the prior year, provided that the utility reach at least a 4 percent year over year increase in its share of clean electricity production from the prior year. Entities that fail to meet the clean electricity targets will pay a penalty of $40 for each MWh of their target they fail to meet. The total program cost is estimated at $150 billion in the reconciliation package.

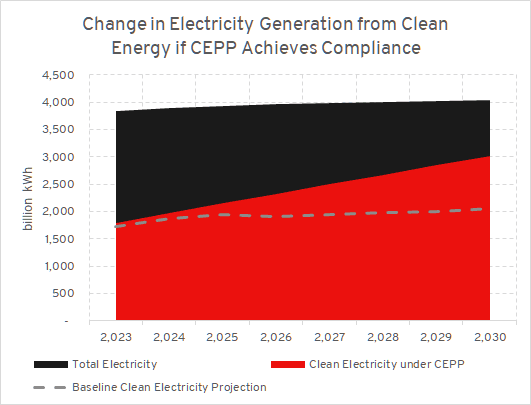

The chart below demonstrates what clean electricity production would look like assuming that the CEPP is perfect in its implementation and compliance. The baseline estimate comes from the Energy Information Administration (EIA), which is notoriously pessimistic in its expectations of renewable energy growth.

Source: R Street Calculations based on Energy Information Administration data.

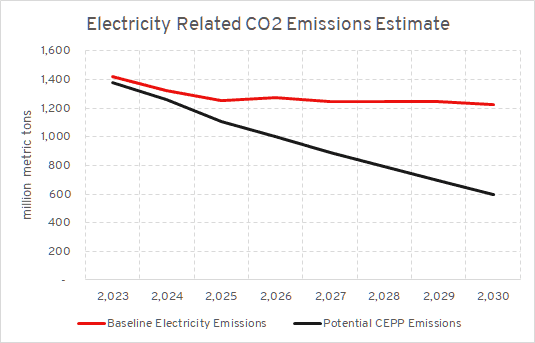

The program would theoretically result in the share of clean electricity production in the United States rising from its projected 50 percent in 2030 to 75 percent in 2030, with 974 billion more kilowatt hours (kWh) of clean electricity than the baseline projections. If the United States perfectly increased clean electricity generation shares by 4 percent each year, then over the eight years of its program (2023-2030) it would cost $131.3 billion, reduce emissions by 628 million metric tons in 2030 and 2.5 gigatons cumulatively, and have an estimated emission abatement cost of $52 per metric ton of CO2.

Source: R Street Estimates based on EIA Emission projections.

These electricity sources, though, will also be eligible for the proposed expansion of production tax credits (PTC) under the budget reconciliation effort, which would amount to a subsidy of $30 per MWh—3 cents per kWh assuming eligibility for bonus rates—and cost a total of $163.5 billion over the same period. Including the PTC would raise the emission abatement cost of the clean electricity effort to $117 per ton—substantially higher than the estimated $67 of the global social cost of carbon benefit (adjusted for inflation), and far higher than the potential $15 per ton of domestic social cost of carbon benefit. Additional clean energy deployment may reduce other emissions that carry significant social costs (co-benefits), such as particulate matter, however this is likely more limited than some analyses suggest because health-based regulations under the Clean Air Act will likely be tightened to capture these benefits regardless of climate policy. The selective eligibility for the CEPP is also poised to carry heavy co-costs in the form of entrenching inefficient monopoly utility practices that stifle opportunities for low cost clean energy deployment. The CEPP, as envisioned, is unlikely to be net positive in terms of costs and benefits if its implementation achieved perfect compliance evenly distributed across the United States.

The caveat of perfection in compliance, though, is critical—a perfect implementation of the CEPP could have domestic costs in the ballpark of global benefits, but it is very unlikely that such a benchmark is feasible. A meta-analysis of abatement costs found that renewable portfolio standards (RPS) cost between $0 – 190 per ton of CO2e abated—or up to nearly four-fold our estimate of the CEPP cost—and the subsidies for wind (i.e. the PTC) costs between $2 – 260 per ton of CO2e abated—again up to roughly four-fold our estimated cost of the PTC. Assessing these programs in isolation also ignores the costs of the supporting infrastructure required, such as transmission, leading to underestimation of the true cost of these policies. The real-world implementation of these programs typically results in costs that are higher and benefits that are lower compared to projections that optimistically assume optimal implementation.

Some energy economists are already predicting that the CEPP, if implemented as laid out in the current legislative text, may be far less efficient than a conventional RPS or clean electricity standard. This is because the asymmetry of the incentives versus the penalties ($150 subsidy versus a $40 penalty) creates perverse incentives for market participants to depress their clean energy deployment artificially in one year, paying a penalty of $40 for each MWh of shortfall, but then deploy more clean energy the following year to receive the payment of $150 per MWh, resulting in a net benefit of $110 MWh. Similarly, utilities could simply trade their clean electricity generators back and forth each year to alternate between paying a penalty and receiving a subsidy, allowing them to collect payments without having to build any new clean electricity at all.

In simple terms, to believe that the CEPP would achieve its goals also requires a suspension of belief that market participants would seek to maximize profits when the program design gives them an incentive to delay clean energy deployment to increase their future subsidy claims. Conventional economic understanding of monopoly utility providers also would indicate that any penalties or additional costs incurred because of the CEPP will be passed on to captive ratepayers, since many electricity providers do not operate in an environment of competition.

Furthermore, the CEPP and PTC design will likely reward utilities for undertaking action that they are already committed to. Many electricity providers are already promising to decarbonize fully, and several states already have RPS requirements for total clean energy. One analysis estimates that the current clean energy generation commitments from electric utilities would result in an increase of solar generation by 52 terawatt hours (TWh), and nuclear generation by 55 TWh—equal to roughly a tenth of the increase in clean electricity that would be achieved under a perfectly followed CEPP. Furthermore, it is expected that existing state-level RPSs already will require a 250 TWh increase in clean electricity generation from 2019 levels by 2030, roughly a quarter of what is hoped for under the CEPP, meaning a significant number of utilities that would receive payments under the CEPP would be getting paid for doing what they already would have done.

In recognizing that the CEPP’s construction and supplementary subsidies are likely to make it less efficient than a clean electricity standard or an RPS, it is also worth pointing out that those policy mechanisms are already considered to be inefficient compared to policies like carbon pricing. One study estimated that a carbon price is roughly twice as cost-effective as regulation, and similarly economic analysis of carbon pricing has found that optimally implemented revenue-neutral carbon pricing can improve economic growth—by using the carbon price to replace an even worse tax. In terms of ordinal policy preferences, the CEPP is far from being an early choice, and policymakers should not express preference for a CEPP unless they are confident that superior, more cost-effective policies are unattainable, as well as confident that either the costs of a CEPP could be reduced or the benefits of emission mitigation under a CEPP raised.

Critiques from supporters of the CEPP or similar mandates, though, may point out the lower levelized cost of renewable electricity compared to fossil energy, and as such argue that there are no economic harms from the CEPP. That would be a disingenuous argument because it ignores the heterogeneous nature of electricity demand. Electricity is needed even at times that a renewable energy source may not be able to produce it, and as such comparisons of levelized costs give essentially no useful insight as to the economic practicality of a renewable energy mandate. However, as a conventional rule of economics, investors are profit-seeking and will aim to maximize their revenues, so if it is economically optimal to deploy a clean energy source they will do so even without the presence of a subsidy. That the CEPP would require a subsidy to induce the behavioral change is in and of itself an indicator that it is intended to incentivize a suboptimal allocation of capital and will have an economic cost. Furthermore, claims of job creation from government spending should be viewed with similar skepticism, as the demand for labor hours prompted by subsidy in one industry ignores the diminished labor availability in a competing industry while simultaneously resulting in no increase in overall economy-wide production—simply, you can’t grow the economy by replacing construction workers’ shovels with spoons.

Ultimately, even if the CEPP does work as advertised, it would still fail to meet the basic economically beneficial criteria of having benefits that outweigh costs because the CEPP payments plus the PTC payments will exceed the capturable environmental benefit from the emission abatement. More realistically, the awkward design of the CEPP which intends to comply with the budget reconciliation rules of Congress—which were never intended to be used as a vehicle for grandiose policymaking—creates a situation of perverse incentives where the program is at best cost-ineffective and at worse even more inefficient than policies pursued under existing statutory authority. While it may be politically expedient to address climate change by any means necessary, policymakers should not abandon the precepts that good policy judiciously uses scarce resources to achieve an outcome of greater benefit than the cost.

Image credit: xiaoliangge