Testimony: Outlook for Energy and Minerals Markets in the 116th Congress

Thank you, Chairman Murkowski and

Ranking Member Manchin, for the opportunity to testify today. In this 116th

Session of the United States Congress, the electricity market will be wrapping

up a decade that has seen tremendous change. Natural gas has boomed as a source

of energy, coal has declined, and both because of policy interventions and

their falling costs, over the next two decades, renewable sources of energy are

poised to make up a significant, and perhaps even a majority, share of energy.

Few of these outcomes were predicted

at the outset of this century or even at the beginning of the last decade. That

fact—the unpredictability of the energy economy—suggests that it is important

to have an electricity market that does not pre-ordain outcomes through

mandates and subsidies. Instead, it is important to consumers that the market

prices electricity at its value, in real time and on that basis, sends

meaningful price signals to those who would develop, invest in or contract for new

and existing technologies.

There are many opportunities for

important reforms in the electricity markets. Most of these fall squarely in

the lap of the wholesale electricity markets’ federal regulator, the Federal

Energy Regulatory Commission (FERC). Still, others are the business of state

legislatures and public utility commissions. However, there are places where congressional

intervention, whether through legislation or oversight, would be useful.

Accordingly, my testimony highlights a

few of the issues associated with the evolving market for electricity and

begins with a law that has not aged especially well in light of all the changes

we have seen in the electricity market, the Public Utility Regulatory Policies

Act of 1978, or PURPA.

PURPA Reform

The most important section of PURPA

requires utilities to buy the energy and capacity of certain Qualifying Facilities

(QFs) at a non-discriminatory rate.[1]

FERC interpreted this to mean that the price paid to QFs should equal the

avoided cost or the price that a utility would otherwise pay to acquire the

same quantity of energy and capacity.[2]

However, this fair-sounding principle fails to work in practice.

For nearly a decade, I served as a

utility regulator at the Montana Public Service Commission. In determining PURPA

rates, I took estimates and projections of nearly a dozen different variables—for

example, the price of natural gas, the capital cost of new power plants or the

future tax that might be associated with a ton of carbon dioxide emissions—and ran

those estimates through a formula, which in turn spit out a number. My

colleagues and I then issued a regulatory order, which, with little confidence,

was our best estimate of the cost of energy over the next two decades. It is

almost needless to say that my projections were almost-always wrong. Sometimes

they were too low, in which case few, if any, QFs would contract with the

utility. And sometimes the prices I ordained were too high, in which case a

bonanza of QFs flooded the utility’s doors to take advantage of this generous

rate. This is where PURPA’s internal logic crumbles. PURPA developers typically

sign contracts when the avoided cost is too high, not when it is too low. Now

that FERC and the states collectively have four decades of experience under

PURPA, it is clear why PURPA projects tend to be some of the highest-cost

projects in any given jurisdiction.

The fundamental problem of PURPA is not the requirement that utilities purchase energy from independent developers, provided it is as or more affordable than if the utility built a project itself. Instead, the problem is the fact that the administrative price forecasting on which PURPA’s implementation relies is a suboptimal way to engage in what economists call “price discovery.” A competitive solicitation allows rival parties to bid against one another in the hope of obtaining the business of consumers. PURPA, meanwhile, turns “price discovery” into an act of litigation, with a QF and a utility each trying to convince a government regulator what the right “price” is. Ironically, PURPA today may actually be a barrier to state attempts to contract with lower-cost renewables. In August 2017, Public Service Co. of Colorado, an Xcel operating company, issued a competitive solicitation. It received a large number of extraordinarily low-cost bids for renewable energy. The Colorado Public Utilities Commission reviewed the bids and approved the utility’s proposal to select a number of independent projects that had submitted low bids. However, relying on PURPA, a bidder who was not awarded a contract asserted a right to sell the output of 17 projects totaling about 1,400 megawatts of generation to the utility, and claimed that it should be awarded an “avoided-cost” rate based on an administrative calculation using 2016 data. That rate would be significantly higher than prices that emerged from the solicitation. And because the utility does not actually require that amount of energy to serve its customers, accepting the jilted bidder’s PURPA claims would mean either canceling projects that were low-cost bidders or buying more energy than customers actually need.

Citing this example and others, the

National Association of Regulatory Utility Commissioners (NARUC) has issued a

proposal, which calls upon FERC to waive PURPA’s mandatory purchase obligations

for those states that have competitive frameworks for the procurement of energy

and capacity.[1] This would allow FERC to

establish regulations that ensure that the state frameworks are genuinely

competitive and open to QF technologies. And it would allow states to avoid the

sure-to-be-wrong rigmarole of decreeing prices through regulatory forecasts. FERC

already has granted a limited exemption to utilities in the footprints of

Regional Transmission Organizations (RTOs). Yet, even in those states outside

of RTOs, such as in the Western United States, the use of competitive

solicitations is widespread. In the Energy Policy Act of 2005, Congress has also

clearly signaled to FERC that the agency should be flexible as market models

for electricity develop. In NARUC’s proposal, FERC has an opportunity to reform

PURPA in a way that is even-handed to all. The agency should take that

opportunity.

State Subsidies and Competitive

Markets for Electricity

As the market for electricity has

changed, it has created winners—and losers. In many parts of the country, the

cost of new entry for certain power plants is less than the going-forward cost

of operating certain existing generators. In such conditions, an efficient

market will cause existing resources to retire in the face of lower-cost new

entrants. This trend is natural and economically rational—indeed, it is a sign

of innovation within an industry.

This trend is not solely due to

economics, however. It has been accelerated by state and federal policies.

State mandates and federal tax subsidies allow resources that would not

otherwise be economical to enter the market.[2]

At the same time, several states have recently adopted policies to subsidize the

continued operation of certain existing resources, which otherwise would have

retired in the face of competition by both subsidized and unsubsidized new

entrants.[3]

Still other jurisdictions, where power generation is owned by regulated

utilities, effectively have shielded power plants from the economic pressures

of competition, more subtly directing subsidies to out-of-market resources in

the form of ratepayer guarantees.[4]

In short, policymakers are subsidizing

certain resources to enter the market and policymakers are also subsidizing other

resources to prevent them from leaving. Moreover, while these policy interventions

were at one point relatively limited in nature, they have grown in number and

in scale over the last few years. These developments have borne out a

prediction made by the independent market monitor of one of the nation’s

largest electricity markets, PJM, when he observed that: “Subsidies are

contagious. Competition in the markets could be replaced by competition to

receive subsidies.”[5] According to a 2018 report

by the market monitor, in the PJM market alone, these subsidies were estimated

to total $3.8 billion, although the number would certainly be higher today.[6]

This is a significant number when compared to the total revenue resulting from the

PJM capacity auction—$10.3 billion for 2018.

The inevitable result of these subsidy

policies is that consumers, in one form or another, are paying for power plants

that they do not need. For this 2018/19 winter season, NERC projects that each

region of the country had significantly more resources available than were

needed when compared to total consumer demand and while including a margin for

reserves.[7]

When one turns to the summer analysis that NERC conducts, the story is much the

same, although the Texas electric market, which has a market design that

aggressively promotes economic efficiency, naturally has a much tighter

operating margin.[8]

FERC’s Regulation of Capacity Markets

If it were not for subsidies favoring

certain power plants, other unsubsidized resources would be economical. In an

effort to deal fairness to those unsubsidized market participants, the Regional

Transmission Organizations (RTOs) and the Federal Energy Regulatory Commission

(FERC) have frequently re-designed parts of the electric wholesale markets to

deliver them additional revenue. A special focus of these initiatives has been the

centralized capacity markets the eastern RTOs[9]

administer, where reforms have sought to mitigate the effect of subsidies and

preserve a “competitive” price signal to generators who do not benefit from

subsidies.

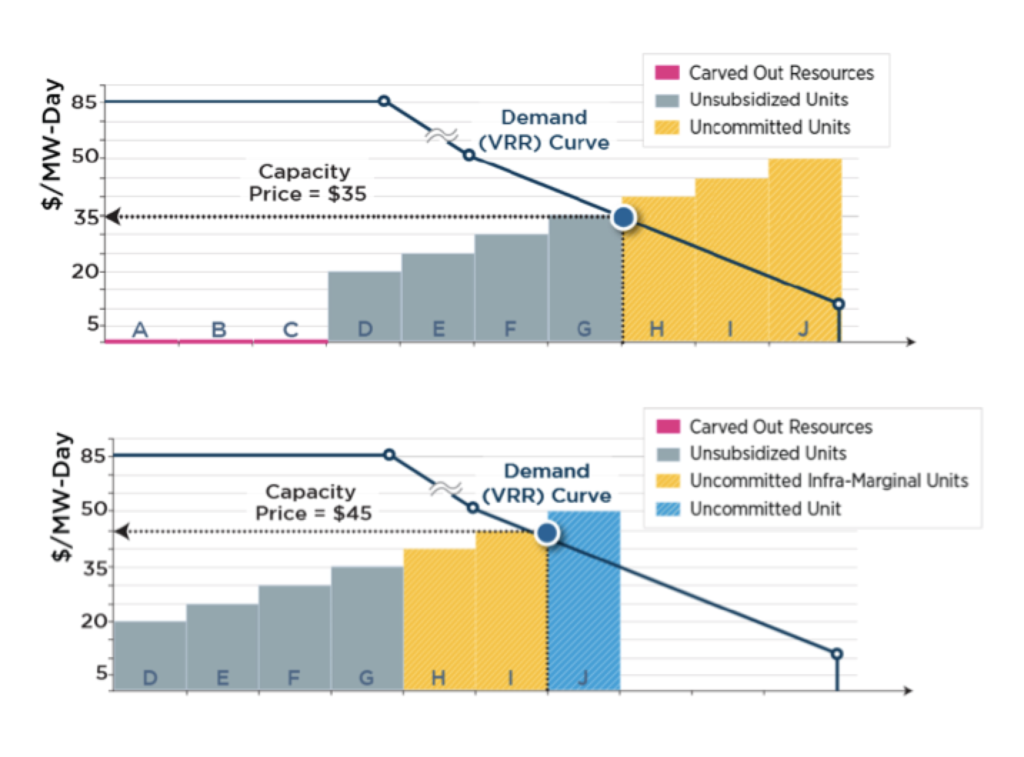

Though well intentioned, these efforts

are a road to nowhere. An instructive example in this regard is PJM’s proposal

for “carve out and repricing.” Under this market design, PJM would “carve out”

subsidized resources from participation in its capacity auction and “reprice”

the auction’s outcome as if those power plants did not exist. However, when

actual supply is artificially removed but demand is held steady, prices of

course rise. Illustratively, PJM’s proposal to carve out subsidized resources is

shown below:[10]

For whatever virtue there may be in

attempting to preserve a so-called “competitive” price signal, the PJM proposal

invents a kind of parallel universe in order to get the “right” (i.e., higher)

prices. PJM had asked FERC to rule on this proposal last month but the matter

remains pending as of the submission of this testimony. I am sympathetic to

those enterprises that have not received subsidies but face competition by

subsidized resources. However, I am concerned that the remedy PJM has proposed

is a reform that makes its market more and more an arbitrary, administrative construct

and less and less a market whose prices are the function of the real balance of

supply against demand.

The simple reality is that the only

way to eliminate subsidies is to eliminate the subsidies. Yet this kind of

preemption of state policies is not something that FERC has suggested. Indeed, it

has argued against it—making the regulator one of the few federal agencies to

adopt a self-denying, modest view of its powers.[11]

Congress’s Role relative to State

Subsidies

So what is to be done? In recent years,

the most dynamic movers of subsidies and out-of-market payments are state

legislatures and public utility commissions. Congress could pass a law

expressly countermanding state policies. However, this would represent a marked

shift in the division of federal and state jurisdiction over electricity

generation. Although the effects of power generation in large regional grids

are interstate in nature, the Federal Power Act and subsequent energy laws largely

reserve the authority over electricity generation to the province of state

policymaking. Congress’s decision to leave this networked industry in the hands

of local regulators causes this networked industry not to resemble others, like

telecommunications or railroads, which were, at first, gradually and then in

the 1980s and 1990s, quite rapidly federalized in order to promote consistent

standards and economic efficiency.

If Congress does not act, then a

two-staged future could occur. In the short term, I would expect more state

legislatures to adopt policies that subsidize politically favored sources of

electricity. However, in the medium-to-longer term, subsidies for electricity will

cause regulated rates in those subsidy-prone states to rise, even while the

overall effect of the subsidies—keeping more supply than is necessary to meet

regional consumer demand—will suppress prices available on the wholesale

market. PJM’s wholesale prices have declined 40 percent in the past decade,

even while regulated retail prices have increased.[12]

The consumers of subsidy-prone states

will thus pay higher rates and the ultimate winners—the beneficiaries of a

surplus that other states’ consumers have paid for—will be the consumers of

states that have been less profligate. In this way, the electricity markets have

a similar dynamic to dumping in the context of foreign trade: Dumping has

negative effects on local manufacturers but is fundamentally a wealth transfer

from the producing nation to the consumers of the nation who buy the product. In

the same way, a state that has not (yet) doled out subsidies to power

generation, like Ohio, may be crowded out of opportunities to develop power

plants that would be economical in a marketplace free of subsidies. Yet, Ohio’s

electricity consumers, large and small, ultimately would benefit from others

states’ decisions to subsidize their production.

Should they grow too ostentatious,

subsidy policies may generate a political feedback loop in the subsidizing

states, where politics can be expected to tolerate such a giveaway for only so

long. In places with rising regulated rates and falling wholesale costs, one

can already see the dissatisfaction on the part of consumers who would rather

pay the latter. This is what has given rise to Community Choice Aggregators in

California, to the movement by casinos and data centers in Nevada to directly

access the wholesale market and to demands by industrial customers in Michigan to

cap “direct access,” which limits participation. Ultimately, it will be the

dissatisfaction of the most essential component of the energy system—the

consumer—that will impose discipline on policymakers whose decisions raise

costs too radically. Empowering those consumers will help accelerate that

discipline.

Congress has previously invited states

to consider energy policies—instead of mandating them—on a host of topics, from

PURPA’s direction to consider time-of-use rates[13]

to the Energy Policy Act of 1992’s definition and direction to consider integrated

resource planning[14]

to the Energy Policy Act of 2005’s direction on net-metering.[15]

Rather than intervene with a heavy hand, what Congress can and should do, in

any general energy legislation, is to encourage states to consider increasing

customer choice. Additionally, through the Department of Energy, it should

consider making funds available to states who elect this policy in order to set

up an online marketplace for customers to shop for an energy provider of their

choice.[16]

Finally, Congress should consider requiring states to disclose the cost of

carbon reductions associated with particular subsidies and to consider

providing for a disclosure on consumers’ bills.[17]

This would help promote customer and policymaker consideration about

potentially cheaper ways to obtain the same reductions.

Electricity policy remains entirely

too paternalistic and there is today no sound policy reason why sophisticated

consumers of electricity should have to buy a product ordained for them by a

regulator. If more states allowed direct access to the wholesale market by even

their largest consumers of energy, policymakers would also be able to put to

the test the proposition underlying many subsidy policies: that consumers are

demanding clean energy. In my view, they are—and they will be willing to

contract for it separately, in quantities that they choose and at competitive prices.

Pricing Electricity at its True Value

in Wholesale Markets

The RTOs and FERC have consumed a

significant amount of time and resources attempting to fix the eastern RTOs’

capacity markets. At the same time, other problems of market design deserve

their urgent attention.

Many states have passed or will pass mandates

that require their utilities to procure a certain percentage of clean energy

resources by a certain year. The most ambitious states have pushed 100 percent

clean energy targets in just two or three decades. Much of this clean energy

will be weather-dependent renewable resources, especially wind and solar power.

Since the fuel for these resources is free, they are sometimes referred to as

“zero-marginal-cost” resources. While they have substantial capital costs in

the first place, once built and if properly maintained, they produce energy

essentially without cost in any given hour when their fuel (the sun or the

wind) is available. (In fact, because of federal production tax credits, which yield

a tax benefit equivalent of $24 per megawatt-hour but only when the wind produces, this form of subsidy actually causes

certain wind generators to be willing to pay

customers to take their energy output.[18])

Axiomatically, in the auctions of RTOs, the wholesale price of energy is a

function of the most expensive unit of supply necessary to meet consumer demand.

However, when a system is so dominated by renewables that its output is

sufficient to meet customers’ needs, the wholesale price of energy may be zero

or even become negative.

Yet, there will also be periods when

the sun is not shining and the wind is not blowing. Some of these periods are highly

predictable—the evening for solar. Some are somewhat predictable—for example, the

relative intensity of the wind by season, e.g., in a place where Santa Ana winds

tend to blow. And some of these periods are hardly predictable at all—as in the

case of a passing cloud or the vacillations in wind speed on a gusty day.

The longer periods of intermittency

introduced by renewables, as well as the more unpredictable episodes of

volatility, have profound implications for the grid. The energy markets’ prices

should appropriately reflect these more volatile system conditions and periods

of scarcity. Such prices provide an economic signal for the construction and

operation of the most cost-effective and reliable set of resources that can

make up the gap when other resources are temporarily , or for hours, or for

days, unavailable. In the future, what we had come to think of as “capacity”

resources will instead need to fill this breach flexibly but durably and be

compensated by or on the basis of the energy-market prices during times of

system scarcity or stress.[19]

At the moment and for a variety of technical reasons, the prices in RTOs during

times of system stress or scarcity do not reflect these tight system conditions.

Instead, during these periods, market operators all too often take

administrative actions that have the effect of suppressing the market price, while

socializing the cost of system scarcity or stress.

FERC should begin to address these

more essential questions of electricity market regulation in the 21st century.

A good starting point is for FERC to give priority consideration to the

proposals that will emerge from PJM’s work on energy price formation and

reserve products.[20]

As a second-order issue and after it concludes its work on energy pricing

reforms, FERC should then consider whether additional safeguards associated

with add-on reliability products or standards are needed. Politics has forced

this issue into a defining role of electricity-market discussions but it is, in

fact, a sideshow to the basics of electricity market reform, which should convey

appropriate economic incentives to generators to assure reliability. An

appropriate end result to such work would be an electricity market that fully

supplants today’s mandatory capacity markets.

Ensuring Energy Transport Networks are

Robust

Finally, it is necessary to ensure

that the underlying networks on which the market in electricity relies—the

electric and natural gas transmission systems—remain robust and reliable.

Siting both natural gas pipelines and

electric transmission lines has become more challenging over the past ten

years. Environmentalists have routinely objected to natural gas pipelines,

although it is natural gas more than any other source of electric power that

has achieved the greatest carbon-emissions reductions in the electricity sector.[21]

Electric transmission, meanwhile, is cost-effective only when sited above

ground, except in very limited circumstances; landowners and neighbors object

to it on aesthetic and land-use grounds. For different reasons, probably more

of each of this infrastructure is necessary, at least in certain places. More

electric transmission will be necessary in order to ensure renewable energy

resources can reach population centers, and in doing so a grid should be knit

together that has more diversity of resources—and thus less of the volatility

described above. Natural gas transmission, meanwhile, is a cornerstone of

reliable grid operations. Although some have suggested that such assets will

not be needed in a system largely dominated by renewables, this is inapposite:

Gas transmission provides a form of energy storage that can be called upon

during periods of renewable intermittency and volatility. Even if less natural

gas is ultimately used in power plants to generate electricity, having more gas

transmission capacity—as well as back-up fuel sources for those power plants—is

a reliable feature that becomes more important in a system with, for example,

less coal and more renewables.

These issues of infrastructure siting

have taken on a dimension wherein certain states obstruct the energy policies

of other states that are geographically unlucky. New England’s RTO, the ISO-New

England, has repeatedly warned that without additional natural gas capacity,

its system faces reliability risks.[22]

In 2015, New England’s governors unanimously adopted a policy statement calling

for additional gas infrastructure.[23]

Meanwhile, New York has imposed a de

facto moratorium on natural gas pipelines—using state authority over water

permits to frustrate a largely FERC-jurisdictional process under the Natural

Gas Act. This means that New England states cannot access one of the most

productive gas fields in North America, located across New York in Pennsylvania

and Ohio.

Similar issues arise in electricity

transmission. Several interstate transmission lines have been proposed to

facilitate the development of renewable energy, and approvals have been obtained

in one state, only to be blocked in others.[24]

This has prevented interior states with rich renewable resources from

developing their energy economy and it has also prevented states interested in

purchasing renewables from accessing their intended supply.

Although not related to domestic

electricity production, a similar story has unfolded with the State of

Washington and Cowlitz County’s environmental review of the Millennium Bulk

Terminals’ proposal for a coal export facility at Longview, Washington. Wyoming

and Montana have both extensively promoted the coal mined in the Powder River

Basin for Asian export but those development prospects have effectively been

blocked by a single state.[25]

Congress should therefore consider

whether individual states should be permitted to frustrate the energy policies

of other states so wantonly. Some scholars have suggested empowering the FERC

“to approve all modes of interstate energy transport.”[26]

I would not go that far. However, it is necessary to have a backstop federal

permitting regime, which could act as a “tie breaker” when one state has sited

or declared through policy the need for energy infrastructure and another has

declined to permit or rejected a permit for the same. Additional protections

could be written into such a statute, including a requirement that linear

infrastructure have a certain amount of its mileage signed up through voluntary

landowner agreements before it may resort to eminent domain. Or, for those

projects where the off-taker entity is an affiliate of the developer of the

transmission line or pipeline, a stricter standard for project necessity might

apply. But, for projects that have an arm’s-length and voluntary relationship

between the infrastructure owner and the entity or entities paying for it, the

federal statute could allow permitting to be accomplished more easily, on the

basis that stronger evidence exists as to need.

Once again, it has been my pleasure to

testify before you today. I appreciate the Committee’s consideration of my

views, and I wish you luck and wisdom as you approach your work in this session

of Congress.

[1] Travis Kavulla and Jennifer Murphy, “Aligning PURPA

with the Modern Energy Landscape: A Proposal to FERC,” National Association of

Regulatory Utility Commissioners, October 2018. https://pubs.naruc.org/pub.cfm?id=E265148B-C5CF-206F-514B-1575A998A847.

[2] However, for the first time this year, Lazard

projects that the average unsubsidized levelized

cost of energy produced by new wind is less than the average LCOE of existing

coal. “Levelized Cost of Energy Analysis,” Version 12.0, Lazard, 2019. https://www.lazard.com/perspective/levelized-cost-of-energy-and-levelized-cost-of-storage-2018. It should be noted that the LCOE analysis employed

by Lazard has its critics and other authors suggest that the LCOE of new

renewables remains higher than the marginal cost of existing plants. See, for

example,Gurcan Gulen, “Electricity

Markets, the Grid, and the Net Social Cost of Energy,” forthcoming.

[3] New York, Illinois, New Jersey and Connecticut.

[4] About one-third of the United States population is

served by vertically integrated utilities, the power-generation-related revenue

of which is a function of the generation’s cost to operate, rather than its

value in the wider wholesale market.

[5] “Statement of Joe Bowring, Independent Market Monitor

for PJM,” FERC Technical Conference on State Policies and Wholesale Markets, May

1-2, 2017, p. 3. https://www.ferc.gov/CalendarFiles/20170426150935-Bowring,%20Monitoring%20Analytics.pdf.

[6] “The Value of Markets,” PJM, June 2018, p. 5. https://www.pjm.com/-/media/about-pjm/newsroom/fact-sheets/the-value-of-pjm-markets.ashx.

[7] “2018/2019 Winter Reliability Assessment,” North

American Electric Reliability Corporation, p. 7. https://www.nerc.com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC_WRA_2018_2019_Draft.pdf.

[8] “2018 Summer Reliability Assessment,” North American

Electric Reliability Corporation, 2018. https://www.nerc.com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC_SRA_05252018_Final.pdf. The Public Utility Commission of Texas recently

modified the method by which operating reserves are procured by the market,

making the procurement more robust in times when customer demand and

weather-dependent intermittent resources are volatile

[9] By “eastern RTOs,” I include PJM, ISO-New England and

the New York ISO. Each of these operate markets where incumbent utilities do

not own the bulk of power generation on a traditional “cost-of-service” basis,

and where power generators instead expect those revenues derived from RTOs’

energy and capacity auctions either to make up the bulk of their revenues, or

to form the basis on which forward contracts and hedges are priced. Other RTOs,

including the Midcontinent ISO, the Southwest Power Pool and the California ISO

largely exist to optimize the dispatch of resource entry and exit decisions that

occur at a more granular state- or utility-level.

[10] Images taken from “Initial Submission of PJM

Interconnection,” FERC Dkt EL18-178-000, Oct. 2,2018, pp. 66-67.

[11] Brief of the

United States and the Federal Energy Regulatory Commission as Amici Curiae in

Support of Defendants-Respondents and Affirmance, Case No. 17-2433 (7th

Circuit, 2018). Available at: https://www.ferc.gov/legal/court-cases/briefs/2018/7th17-2433etalVillageofOldMillCreekAmicusBrief.pdf.

[12] “The Value of Markets,” p. 2. https://www.pjm.com/-/media/about-pjm/newsroom/fact-sheets/the-value-of-pjm-markets.ashx.

[13] Public Utility Regulatory Policies Act of 1978, 92

Stat. 3117 (codified at 16 USC § 2621)

[14] Energy Policy Act of 1992, 106 Stat. 2776 (codified

at 16 USC §§ 2602, 2621).

[15] Energy Policy Act of 2005, 119 Stat. 594, 962

(codified at 16 USC § 2621).

[16] While large customers are sophisticated enough to

shop for electricity providers on their own, websites established in certain

states with customer-choice policies that allow residential customers to shop

around are transparent, easy-to-use tools that allow customers to choose

between different rate plans, contract lengths and products (e.g.,

all-renewable) See, for example, http://www.powertochoose.org.

[17] The PJM market monitor independently calculated that

the implied cost of carbon reductions associated with the solar renewable

energy credit obligation of the District of Columbia is $861.52 per tonne—a

cost which is orders of magnitude above the cost of carbon reductions obtained

by more efficient policies in the region. This fee is charged to district

residents through a non-bypassable fee on the distribution side of the customer

bill, which means that even the District’s policy of customer choice does not

allow customers to avoid it. However, if more transparently priced on the

customer bill, it might create momentum to seek alternative, more

cost-effective policies. See: “Quarterly State of the Market Report for PJM:

January through June,” Monitoring Analytics, LLC, August 2018, p. 329.

[18] The production tax credit (PTC) is being phased out but many wind projects

have been safe-harbored by IRS guidance associated with the beginning of these construction

projects. For projects that began construction during or before 2016, the full

value of the PTC for ten years is given. The PTC steps down by 20 percent each

year thereafter and, unless Congress renews the program, is unavailable for

projects that commence in 2020 or after. See: “Renewable Energy Tax Credit,” U.S.

Dept. of Energy, accessed Jan. 31, 2019. https://www.energy.gov/savings/renewable-electricity-production-tax-credit-ptc.

[19] A short explanation of the principles behind this are

laid out in William Hogan, “In My View: Best Electricity Market Design

Practices,” 2018. https://sites.hks.harvard.edu/fs/whogan/7_Best_Practices%20(Hogan)_RCH_03_10_18MIH_rev_final_072518.pdf.

[20] “Board Directs PJM, Stakeholders on Reserve Pricing,”

PJM, Dec. 6, 2018. http://insidelines.pjm.com/board-directs-pjm-stakeholders-on-reserve-pricing.

[21] “Global Energy & CO2 Status Report,” International

Energy Agency, accessed Jan. 31, 2019. https://www.iea.org/geco/emissions.

[22] “Natural Gas Infrastructure Constraints,” ISO-New England,

accessed Jan. 31, 2019. https://www.iso-ne.com/about/regional-electricity-outlook/grid-in-transition-opportunities-and-challenges/natural-gas-infrastructure-constraints.

[23] “Governors’ Statement on Regional Cooperation on

Energy Infrastructure,” New England States Committee on Electricity, April 23,

2015. http://nescoe.com/resource-center/govs-stmt-apr2015.

[24] Examples include Northern Pass to bring Quebec

hydropower to Massachusetts and the Grain Belt Express to bring wind from

Kansas to the MISO market.

[25] Tom Lutey, “Montana, Wyoming join battle over

Washington coal port,” Billings Gazette May

11, 2018. https://billingsgazette.com/news/state-and-regional/montana/montana-wyoming-join-battle-over-washington-coal-port/article_a09eaa35-4538-5b1c-8174-510e70de95e0.html.

[26] James W. Coleman, “Pipelines and Power-lines: Building

the Energy Transport Future,” Ohio State

Law Journal 79 (forthcoming 2019),

p. 43. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3172652

[1] Public Utility Regulatory Policies Act of 1978, 92

Stat. 3157, (codified at 16 USC § 824a-3).

[2] 18 CFR § 292.304.