Twelve Policy Priorities to Secure Bulk Electric Reliability

Authors

Table of Contents

- Executive Summary

- Introduction

- Generator Performance

- Recommendation 1: Expedite generator winterization

- Recommendation 2: Ensure natural gas fuel assurance

- Recommendation 3: Unleash flexible demand

- Recommendation 4: Finish generator interconnection reforms

- Recommendation 5: Safeguard against premature generation retirements

- Recommendation 6: Improve wholesale market design

- Recommendation 7: Enhance state resource planning

- Recommendation 8: Improve conventional transmission expansion

- Recommendation 9: Optimize the existing transmission system

- Recommendation 10: Establish institutional coordination

- Recommendation 11: Streamline federal permitting and siting

- Recommendation 12: Overhaul state permitting and siting

- Conclusion

Media Contact

For general and media inquiries and to book our experts, please contact: pr@rstreet.org

Remedying market failures for generator performance, liberating markets for resource investment, and improving institutional coordination will chart the path toward a reliable bulk power system. With targeted reforms and better coordination, policymakers can significantly reduce the risk of future reliability crises.

Executive Summary

The reliability outlook of the U.S. bulk power system is becoming strained. As energy demand surges for the first time in decades—driven by data centers, manufacturing, and electrification, longstanding weaknesses in the power system are becoming more acute. At the same time, policies outside of the control of electric reliability authorities are introducing new risks and delays, making it more difficult to expand and maintain the infrastructure needed to meet new levels of demand.

This paper identifies 12 targeted reforms that could help address these power grid reliability issues, evaluating each on two key criteria: (1) the degree to which the reform would improve grid reliability (“magnitude”) and (2) how quickly the reform could be implemented (“expedience”).

We determined that five of the 12 suggested reforms would have a high magnitude of impact on reliability: expediting generator winterization, ensuring natural gas fuel assurance, finishing generator interconnection, unleashing flexible demand, and overhauling state permitting and siting. The remaining seven reforms would be expected to have a medium magnitude of impact on reliability: streamlining federal permitting and siting, enhancing state resource planning, safeguarding against premature generation retirement, optimizing the existing transmission system, improving conventional transmission expansion, improving wholesale market design, and establishing institutional coordination. Of these, the most expedient reforms are generator winterization, natural gas fuel assurance, and premature generation retirement safeguards.

Importantly, the only reform category with both a high magnitude of impact on reliability and quick implementation are those related to fixing generator performance problems. Policymakers should be particularly focused on prioritizing reforms that improve generator winterization and resolve natural gas fuel supply deficiencies.

The remaining three high-impact reforms involve liberating market forces by unlocking flexible demand, expediting generator interconnection approvals, and streamlining permitting and siting. Flexible demand can help prevent most reliability events, such as brownouts or blackouts, by asking consumers to voluntarily reduce or shift power consumption away from low-value uses when the grid is stressed. It requires effective, competitive wholesale and retail electricity markets, as well as substantial coordination between federal and state authorities.

Generator interconnection and state permitting and siting are the primary culprits that prevent or delay new power plant development. The Federal Energy Regulatory Commission (FERC) and regional transmission operators (RTOs) began interconnection reforms and they should complete them in a manner that reduces barriers to competitive supply, especially with congressional encouragement. State permitting and siting laws number in the thousands and generally fail to consider regional grid reliability. States can prioritize their own interests with sensible reforms, and federal agencies should engage states on how such policies affect interstate reliability outcomes. Failure to improve state permitting and siting may warrant stronger federal backstop authority for power and supporting fuel infrastructure.

Besides generator performance improvements, other expedient reforms are safeguarding against economically premature generator retirements and optimizing the existing transmission system. Compensation from competitive markets, combined with existing reliability must-run (RMR) contracting procedures, generally prevent premature retirements. However, congressional action to refine RMR authority in situations where state policies risk interstate resource adequacy would be prudent. FERC, RTOs, states, and Congress should prioritize reforms that accelerate the economical adoption of grid-enhancing technologies, reconductoring, seams optimization, and other methods of expanding transmission capacity on existing lines.

Congress and federal agencies should also streamline federal permitting and siting practices, especially for “shovel-ready” projects. Statutory refinements, especially to the National Environmental Policy Act (NEPA), Endangered Species Act, and Clean Water Act, would codify practices and minimize unproductive variances between administration changes. Another priority reform is to improve conventional transmission expansion planning and cost allocation rules to capture long-term reliability benefits. This includes robust implementation of FERC Order 1920 and initiating interregional transmission reform.

Competitive power markets hold an inherent reliability advantage over fragmented cost-of-service utility planning. Nevertheless, market rules warrant refinement, and FERC and RTO stakeholders should continuously enhance wholesale market design to ensure vigorous resource investment and operational reliability incentives. States retaining cost-of-service generation should better align utility resource planning with regional conditions.

The most challenging task policymakers face is addressing reliability risks that stem from policies outside of electric reliability authorities’ control. Better federal interagency coordination, such as ensuring that reliability authorities’ concerns are remedied in environmental rulemakings, could help alleviate some of these issues. Given the growing conflicts between state policies and interstate electric reliability, a federalist reckoning seems inevitable. Congress could address both frontiers by establishing an institutional coordination framework and refining reliability authorities. Such a pursuit may be a valid priority of the newly formed National Energy Council.

Taken as a whole, this paper provides a roadmap for policymakers to identify and prioritize reforms based on magnitude of reliability impact and implementation expedience. Generally, remedying market failures for generator performance, liberating markets for resource investment, and improving institutional coordination will chart the path toward a reliable bulk power system. With targeted reforms and better coordination, policymakers can significantly reduce the risk of future reliability crises.

Introduction

Few services are as essential to modern civilization as reliable electric power. A single reliability event, such as a brownout or blackout, can cause over $100 billion in economic damages and hundreds of deaths. Society’s dependence on electricity is growing—and will continue to do so as we venture deeper into the digital age. In fact, the biggest constraint on U.S. artificial intelligence expansion and innovation may be our inability to meet the technology’s energy demands. Recent expert analysis confirms that the electric reliability outlook is deteriorating, which has justifiably attracted congressional and presidential attention.

Two converging trends now pose acute challenges to electric reliability. After decades of flat demand, power demand is growing—just as constraints on supply and delivery have reached historic highs. Importantly, most energy-supply-related constraints stem from governmental restrictions on new infrastructure projects, as well as narrow market failures in the electric and natural gas industries.

In particular, the unintended consequences of policies beyond the control of electric reliability authorities have reached an unprecedented level and there is no clear path to resolving this issue. In 2023, the North American Electric Reliability Corporation (NERC) identified energy policy as a key risk to grid reliability for the first time. Although executive agencies have the authority to address some threats to reliability, other solutions require congressional action—especially as reliability-relevant decisions become increasingly fragmented across jurisdictions.

Given this landscape, policymakers must better understand why reliability risks have risen and prioritize targeted reforms. They must also avoid counterproductive policies (i.e., reforms with a high cost and low reliability benefit). Such reforms often result from misunderstanding what constitutes reliability services—for example, mistaking baseload generation as a reliability service when it is actually an outdated operating mode. Instead, policymakers should ensure that essential reliability services, namely energy and balancing services, are produced and delivered in a way that can continuously meet demand.

It is also imperative that policymakers correctly diagnose the cause and severity of reliability threats. Most customer outages stem from distribution system problems, which are under state jurisdiction and tend to be localized. In contrast, bulk system failures can create widespread outages.

This analysis focuses solely on bulk electric system reliability, which requires precisely balancing power demand and supply across the high-voltage transmission system. Although intentional attacks—physical or cyber—are also a major concern, we exclude them from this paper because they mostly fall under a separate policy domain. This paper identifies policy remedies for the following core bulk reliability risk categories: generator performance, generation adequacy, transmission adequacy, and policy risk that originates outside of reliability authorities. Each section begins by providing essential context, and we then offer reform recommendations based on their expected magnitude of reliability impact and implementation speed.

Generator Performance

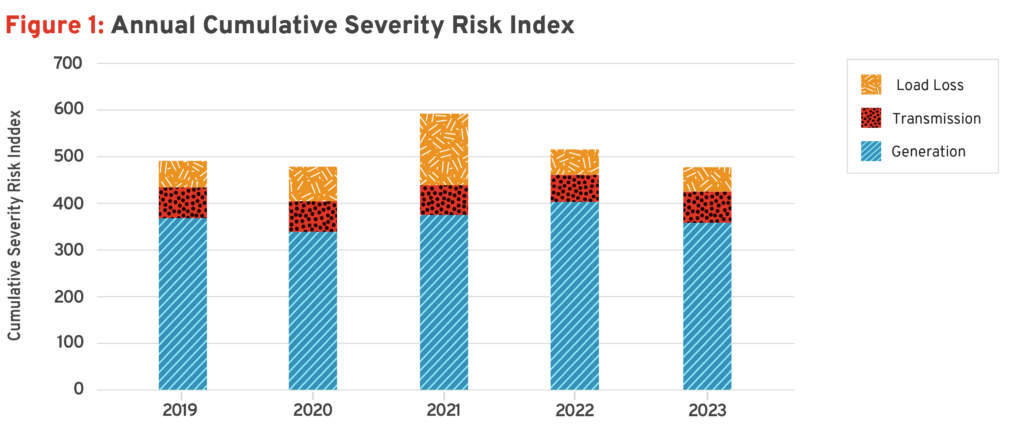

Historically, the bulk electric system has had ample resource capacity, and most reliability events have stemmed from power plant or transmission facility performance failures. For the past five years, the primary driver of bulk reliability risk has been generation loss; transmission loss has been a distant secondary risk. NERC’s severity risk index (SRI)—its main quantitative reliability measure—demonstrates that cumulative generation loss has far exceeded transmission and load loss combined in recent years (Figure 1).

Source: “2024 State of Reliability,” North American Electric Reliability Corporation, June 2024, p. 13. https://www.nerc.com/pa/RAPA/PA/Performance Analysis DL/NERC_SOR_2024_Technical_Assessment.pdf

Weather-related outages are also increasingly dominating reliability events. From 2019 to 2023, six of the top 10 reliability event days in the Western Interconnection were caused by extreme heat or wildfires, two by winter storms, one by high winds, and one was non-weather-related. Similarly, in the Eastern Interconnection, four event days were caused by winter weather, four by summer storms and hurricanes, and two by high temperatures and derecho. Furthermore, power systems are increasingly dependent on high weather–correlated generation sources, namely wind, solar, and natural gas–fired power plants. Taken together, this makes reducing generator outages during extreme weather arguably the top reliability priority.

Reliability Standards

To understand the rationale for establishing mandatory reliability standards, policymakers must first understand the incentives—or lack thereof—that compel power generators to perform reliably. Historically, power generation was treated as a natural monopoly, where a monopoly utility owned generation under cost-of-service regulation. And this historical approach continues to be a dominant form of generation ownership today. At best, this structure cancels out incentives to operate power plants reliably, as the owner does not profit from generation output. At worst, this structure motivates generator underperformance to justify greater capital expenditures that increase utility companies’ rate base. The perverse incentives of cost-of-service generation requires regulation to determine the prudence of investment and operational practices.

In contrast, competitive generators, which were introduced in the 1990s, have profit motives that align with reliability. This reliability-compatible structure immediately reduced generator outages. Moreover, competitive generators routinely make voluntary investments to ensure reliability, both in general and in high-demand periods. Such actions ensure that these generators are able to operate in challenging scenarios—and they also have the added benefit of allowing the generator owners to capture additional revenue when prices spike during scarcity conditions. Some of these companies even tie executive bonuses to plant performance during these spikes. Importantly, these types of incentives work well for expected events like summer heat waves, but they often fall short for very-low-probability events, also known as tail risk events.

To address these gaps in industry reliability incentives, Congress passed the U.S. Energy Policy Act of 2005, making compliance with reliability standards mandatory and enforceable. Generally, these standards are developed by NERC through an industry-stakeholder process and approved by the Federal Energy Regulatory Commission (FERC). However, they are not currently subject to a cost-benefit review, and setting standards by region and ownership model, versus taking a universal approach, would better account for differences in regional needs and generator performance incentives.

Importantly, terminology matters in setting effective generator standards. Efforts to distinguish “dispatchable” from “non-dispatchable” generation on the basis of fuel type has become popular, but it is inaccurate and dismisses key reliability initiatives designed to make all fuel classes dispatchable, even weather-dependent renewables. For example, integrating intermittent renewable generation creates technical challenges to grid stability, so FERC launched a rulemaking to establish reliability standards for inverter-based resources. Reliability initiatives like this can improve the dispatch of renewables.

Making renewable energy dispatchable is increasingly important and market-based reforms are often more economical to procure reliability services, like frequency response, than reliability standards. For instance, last decade the Midcontinent Independent System Operator (MISO) launched a successful “Dispatchable Intermittent Resource” program, which first converted uncontrollable, non-dispatchable wind resources into controllable, dispatchable resources that augmented system reliability. MISO later extended the program to solar. With or without standards, policymakers should work to ensure controllable output across entire generation portfolios to deliver the essential reliability services needed to meet demand at all times.

Tighter standards can help cost-effectively reduce generator outages from wildfires, storms, and hurricanes—but only to a point. The greatest improvement opportunity in this regard is reducing generator outages during cold weather events. For example, the pervasive generator outages seen during winter storms Uri and Elliott were primarily caused by electrical equipment failures and lack of natural gas access. These events resulted in hundreds of deaths and major economic damages, including widespread customer outages at times when the public were most sensitive to reliable energy supplies. Multiple initiatives have made incremental progress on cold weather readiness but have not yet resulted in major improvements.

Cold Weather Readiness

Because voluntary cold weather readiness efforts have come up short, FERC and NERC have begun to pursue mandatory standards. Recent bipartisan efforts from these groups have made progress across several areas, shown in Table 1. These include generation freeze protection, gas-electric coordination, grid operations, state coordination, and other topics requiring further study.

Table 1: FERC and NERC Cold Weather Preparedness

| Recommendation Category | Recommendation Topic | Status |

|---|---|---|

| Freeze protection | Cold weather reliability standards for electric generation | Completed |

| Cold weather reliability standards for natural gas facilities | More progress needed | |

| Gas-electric coordination | Identify actions: forums, work groups | Progressing as expected |

| Develop and implement actions | More progress needed | |

| Grid operations | Bidirectional power transfer studies | Progressing as expected |

| Load shed coordination and training | Completed | |

| Load forecasting and operational planning | Progressing as expected | |

| State level | Energy efficiency improvement incentives | Progressing as expected |

| Enhance emergency response centers | Progressing as expected | |

| Additional deployable demand response | Progressing as expected | |

| Further studies | ERCOT additional interconnection links | Progressing as expected |

| Blackstart cold weather reliability | Progressing as expected | |

| Mechanical/electrical caused outages | Progressing as expected | |

| Low frequency effects—generation | Progressing as expected | |

| Dynamic stability during Elliott event | Progressing as expected | |

| Natural gas reliability for grid support | Progressing as expected | |

| Critical natural gas infrastructure identification | More progress needed |

However, even areas deemed “complete” or “progressing as expected” could benefit from expedited implementation. For example, FERC considers generator freeze protection rules to be “complete,” but they only apply to power plants operating after Oct. 1, 2027. That leaves two more winters where the grid will still have a heightened risk of generator freezes, a leading cause of outages. Many solutions could be adopted sooner.

Some NERC stakeholders expressed concerns that the cost of complying with such requirements could trigger premature generator retirements. But these concerns could be manageable, especially if compliance were accelerated strategically. For cost-of-service utilities, the key to avoiding premature retirements is communicating the importance of winterization to state regulators who determine whether those costs are recoverable through rates. In competitive markets, those costs are reflected in capacity market bids, and generators can secure additional revenue through higher clearing prices, if needed.

Recommendation 1: Expedite generator winterization

FERC and state actors should expedite efforts to winterize the generation fleet.

Of note, Table 1 also highlights areas where FERC and NERC have identified the need for more progress: freeze protections for natural gas infrastructure, improved gas-electric coordination, and the identification of critical natural gas assets. FERC has been working on many of these issues for over a decade, including a notable gas-electric coordination order in 2015, with reforms requiring mandatory electric industry compliance and voluntary gas-sector compliance. A new development focus in outstanding gas-electric coordination reforms is improvement in the real-time electricity markets, where the vast majority of fuel-related generator outages arise.

Freeze protections for gas infrastructure raise fundamental questions about the efficacy of voluntary gas industry improvement. Severe cold has led to large disruptions in upstream natural gas production that coincide with peak gas demand, such as during Winter Storms Uri, Elliott, and Heather. Severe cold also induces midstream performance problems with pipelines and compressor station outages and, even when operational, midstream problems can restrict the flexibility of pipeline service. Importantly, some problems can be mitigated by gas storage, where power plants can pull from fuel inventories rather than depend on continuous primary production or pipeline service through constrained corridors. There are recent indications of improvement in gas industry cold weather readiness, but they are not revolutionary. Despite progress, some problems have persisted for decades regardless of industry and regulatory attention. Remedying this requires either compulsory gas industry reform or electric industry reforms that heavily discount the reliability of gas plants during severe cold.

Executive action alone is unlikely to accomplish improved gas industry performance, given statutory jurisdictional constraints. Specifically, mandatory reliability standards apply to the electric sector under the Federal Power Act but not to the natural gas sector, which falls under the Natural Gas Act. In 2023, after multiple reliability events and near misses—including a nearly catastrophic event in New York—the chairman of FERC and the chief executive officer of NERC jointly called for the creation of an authority to establish and enforce winter weatherization standards for the natural gas system.

A prompt congressional response is warranted, but policy intervention should be limited to remedying the conditions under which current gas service incentives are inadequate, as the natural gas industry is largely functionally competitive with established incentives to provide reliable service in most circumstances. Conditions where incentives are insufficient primarily arise during periods of high gas demand, namely winter storms. Cold weather preparation is expensive, and ubiquitous requirements risk imposing costs that exceed benefits in some cases. In contrast, strengthening market incentives for reliable service would encourage creative gas system performance improvements across upstream, midstream, and storage, (e.g. where the marginal revenue of the incentive exceeded the marginal cost of winterization). Even when generators can access fuel, cold weather constraints sometimes limit the flexibility of gas service, which reduces generators’ dispatch flexibility. Another issue often seen in gas markets during severe cold weather is high market power and opacity that can impede transparency and lead to market manipulation, which erodes reliable performance, especially along certain pipeline segments.

To address these problems, policymakers should consider the following reforms:

- Strengthen cold weather preparation incentives for natural gas services, such that producers, pipelines, and storage providers have sufficient revenue expectations to incur prudent costs to improve performance

- Improve the transparency of upstream, midstream, and downstream supply arrangements and ensure that non-disclosure requirements do not inhibit communication during extreme weather conditions

- Narrow the definition and improve the public accounting of force majeure events, such as filing requirements with descriptions, to reduce abuses. Eliminating specious force majeure events removes a pathway to physical withholding, a persistent form of market manipulation

- Address liquidity problems caused by gas industry participants not responding to electric-sector requests to obtain natural gas during critical periods, such as winter storms over holidays and weekends

- Further study on how to secure flexible pipeline service to accommodate increasingly large swings in gas usage for power plant dispatch ramping. This type and timing of demand is materially different from the more predictable and steady demand, such as home heating and industrial processes, that pipelines were initially built to handle

Rather than create a new regulatory body or extend NERC authority to the gas industry, Congress could direct FERC to oversee the adoption of gas standards facilitated by the North American Energy Standards Board (NAESB). NAESB—much like NERC before it received its official designation in 2005—establishes industry-driven, voluntary, business-practice standards to achieve more competitive and efficient natural gas and electricity markets. In 2023, NAESB issued recommendations on gas-electric industry harmonization vetted by both industries and endorsed by the independent grid monitors, which should expedite adoption. Furthermore, there is precedent for FERC implementation of NAESB gas-electric standards dating back to 2007.

Recommendation 2: Ensure natural gas fuel assurance

Congress, FERC, and—to a lesser degree—states should ensure natural gas fuel assurance, without creating a new regulatory authority, by remedying the conditions where reliable natural gas service incentives are inadequate.

Although the natural gas and electric industries disagree on some aspects of gas-electric industry harmonization, they express mutual concern about the inability to develop gas infrastructure. State laws, especially those related to pipeline permitting, markedly inhibit the development and retention of natural gas infrastructure. This negatively affects regional power grid reliability, especially in the Northeast and California, during severe cold weather. The interstate ramifications of these issues have prompted scrutiny by regional grid operators and federal authorities. Moreover, this reality presents an acute federalist challenge, as state-imposed gas infrastructure expansion barriers threaten grid reliability under federal oversight.

These gas infrastructure constraints that are most problematic during cold weather events also highlight the need to modify the regulatory system to allow price signals to work. When the demand-side of gas markets can respond to price signals with strategies like voluntarily shifting or reducing residential consumption during severe cold weather events, gas delivery can be maintained for critical uses like power generation. This is especially valuable in areas with heavy gas pipeline constraints, like New England, New York, the Mid-Atlantic, and California, where gas generation is not used to its full potential during severe cold events. Some commercial demand flexibility efforts have shown promise. Beyond that, coordinated state public utilities commission (PUC) and FERC reforms would help address regulatory barriers, as PUCs oversee local gas distribution companies and FERC oversees interstate pipelines. Importantly, enhancing ongoing FERC and state PUC collaboration is critical for gas-electric industry harmonization.

Generation Resource Adequacy

Improving generator performance is a reliability imperative, but it is equally important to ensure that adequate resources exist to meet demand. Unlike generator performance, resource adequacy (RA) lacks a national reliability standard. Instead, RA is determined by states and regional reliability entities.

Historically, RA presented little challenge. Both cost-of-service utility planning and competitive electric markets attracted and deployed adequate capacity investment. Competitive regional markets even demonstrated lower costs and better reliability because of scale advantages, coordination of resource retirements and expansions, and optimized siting processes. These market advantages will likely increase as the grid continues to incorporate unconventional resources, like energy storage and variable renewable generation, as markets integrate and signal the technology- and location-specific reliability value of such resources better than fragmented utility planning processes.

Still, both paradigms face mounting RA challenges. These largely stem from policies unrelated to RA constructs, such as capacity markets or utility resource planning. Most notably permitting and siting barriers and regional generator interconnection processes pose mounting RA challenges. Supply chain disruptions, such as those seen for gas turbines and solar components, have compounded the problem. Over the past five years or so, these barriers to entry have pushed power plant development timelines from a few years to a decade in some regions.

Leading developers have recently told investors that only currently planned generation projects (i.e., those already in interconnection queues) can be deployed by 2030. As of 2024, this reflects roughly 2,600 gigawatts (GW) of capacity, which is more than double the currently installed system capacity (roughly 1,190 GW). Although, at face value, this number may suggest a robust reliability outlook, it is misleading for two reasons. First, most of this capacity will not be built; only 14 percent of projects seeking interconnection from 2000 to 2018 were built by 2023. Second, the composition of new resources in these queues is fundamentally different than the legacy generation profile. Specifically, about 95 percent of queued capacity is solar, storage, or wind, with natural gas constituting just 3 percent.

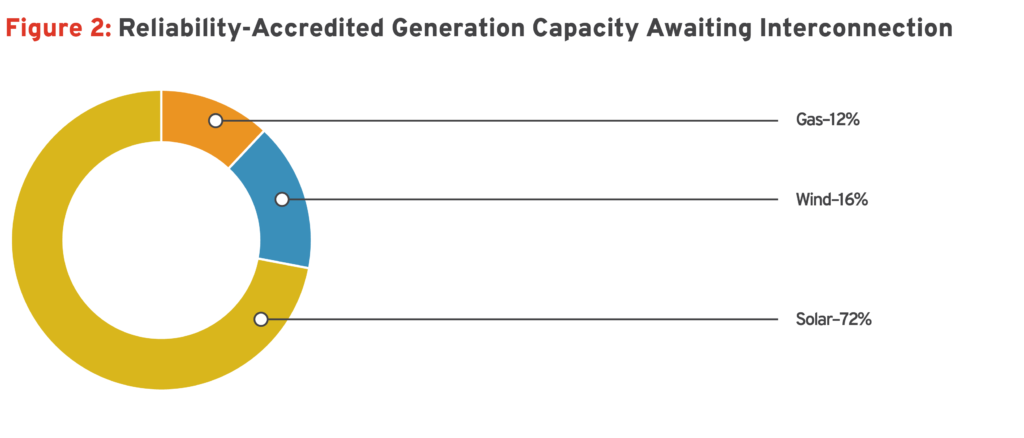

Because the bulk of queued projects will not be completed and those that will be completed will have notably lower accredited capacity (i.e., capacity under expected conditions) than nameplate capacity (i.e., capacity potential under optimal conditions), it is important to adjust the nameplate capacity values noted above to account for these factors. Common industry practice assigns a reliability value as a percentage of nameplate capacity to account for expected conditions. Representative accreditation values for this capacity-accreditation method are 26 percent for wind, 38.75 percent for solar, and 90 percent for conventional generation (based on regional analysis). By 2030, the existing fleet is estimated to produce about 925 GW of accredited capacity. When adjusted for accreditation and completion rates, the planned projects realistically capable of delivering new, reliable capacity by 2030 are estimated at 82 GW of accredited generation capacity from solar (59 GW), wind (13 GW), and natural gas (10 GW). This excludes storage. As shown in Figure 2, 88 percent of accredited new entry is from variable wind and solar generators, and 12 percent is from conventional natural-gas-fired generators.

Thus, new entry this decade constitutes roughly 9 percent of the capacity-accredited level of the existing generation fleet. This is drastically lower than the 218 percent of unaccredited capacity seeking interconnection (2,600 GW) relative to unaccredited existing capacity (1190 GW). This stark difference underscores the importance of accounting for completion rates and differences in capacity accreditation between the existing generation fleet, which is predominately conventional generation sources, and the variable-generation-heavy profile of new entry as shown in Figure 2. Of note, new entry numbers exclude three nuclear facilities capable of restarting by 2030, and uprates at existing predominantly natural gas plants.

Lawmakers and regulators should prioritize clearing pathways for “shovel-ready” projects that could address critical RA concerns this decade, especially in regions facing tight generation reserves and resurgent demand. They should also take further policy action to facilitate the deployment of currently unplanned projects in the 2030s. NERC’s latest assessment found that most of the North American bulk system faces mounting RA challenges over the next 10 years because of increasing demand, thermal generator retirements, and lagging new-generation completion rates, despite strong investment interest.

However, it is important to avoid overestimating RA risk by treating demand growth, resource retirements, and resource additions as independent factors, as NERC assessments typically do. Retirements and additions tend to be well coordinated in markets, because delays in new supply send RA price signals that lead generators to retain legacy plants that would otherwise be retired. In most regions, new demand requires various approvals to come online. If supply is insufficient, new demand approvals are delayed, effectively deferring demand growth to avoid a supply shortfall. Nevertheless, some RA risk remains, and suppressing demand growth poses major economic and possible security risks.

Flexible Demand

Flexible demand is one of the highest-impact yet most frequently overlooked strategies for improving RA. Recent research indicates that the grid’s ability to meet a surge in new demand depends heavily on how flexible load is. Most reliability events are shallow, meaning that only a small proportion of demand cannot be met by available supply. However, without flexible demand, even modest shortfalls can trigger widespread outages that can cause significant economic damage, loss-of-life, and public outcry.

Today, grid operators follow strict protocols when energy supply falls short. These protocols evenly curtail power across customers, usually through voltage reductions or rotating outages. This approach, based on engineering heuristics, treats all firm demand as equal, regardless of its value.

Current methods to encourage voluntary customer curtailment are minimal—often limited to public pleas for power conservation. But the less effective voluntary curtailment is, the more likely involuntary curtailment becomes. In effect, the current system uses a rigid, vertical demand curve for electricity, which artificially suppresses flexible demand. An economics-based approach would instead allocate electricity during scarcity according to individual consumers’ value of lost load (VOLL), or willingness to pay to avoid an outage. VOLL varies widely depending on factors such as customer type, outage duration, and specific end use. In this approach, the demand curve would be sloped.

Converting just a fraction of artificially inflexible demand to reflect true flexible demand preferences could avoid the majority of rotating outage events because most reliability events have only modest supply shortfalls. Even for deep reliability events, like Winter Storm Uri, VOLL-based demand curtailment would likely have avoided dozens of deaths and billions of dollars in damages. The wide variation in VOLL across consumers suggests that major social welfare improvements could be gained by allowing load-serving entities to offer different levels of reliability at different prices. Ironically, part of the problem stems from reliability standards themselves, which admirably aim to reduce the likelihood of supply shortfalls, but inadvertently inhibit the market-based solutions that could reduce the consequences of such shortfalls.

Experts and customer groups agree that unleashing flexible demand for customer-valued reliability should be a priority. Doing so would require revisions to NERC standards and complementary improvements to wholesale market design under FERC jurisdiction. It would also require tailoring retail competition strategies (which are under state purview) to allow customers to access smart meter data and to authorize suppliers to differentiate reliability services at different price points.

Overall, the policy imperative is to increase voluntary demand reduction for low-value energy consumption, which would decrease involuntary curtailments of higher-value uses. FERC should lead efforts to integrate flexible demand into wholesale markets, review reliability standards that block it, and work with states to support retail policy alignment. Congress could help by launching a national initiative to engage states on demand-side flexibility.

Recommendation 3: Unleash flexible demand

FERC and states should prioritize coordinated wholesale and retail reforms to unleash flexible demand.

Generator Interconnection

Generator interconnection (GI) delays are now the main RA concern within electric institutions’ control. The GI process—by which transmission system operators approve requests for new generation connections to the transmission system—is woefully outdated in most regions. NERC has identified GI backlogs as a growing reliability concern, with some regions facing more severe issues than others. One such region is the PJM Interconnection, which estimates that low rates of entry could lead to a capacity shortfall by 2027 and stresses the need for GI reform.

GI delays have increased dramatically over time. From 2000 to 2007, wait times were under two years. By 2023, they had increased to a median of five years. In addition, GI request processing times vary markedly by regional market, with the Electricity Reliability Council of Texas (ERCOT) far outperforming others. Although GI delays are likewise ostensibly low outside regional transmission operators (RTOs), this reflects less commercial volume interest because of barriers to competitive generation entry, not process efficiency. GI problems are a vestige of the integrated cost-of-service utility model in an era of fewer conventional power plant construction projects. They remain heavily dependent on incumbent utilities. Now, unconventional plants developed by independent power producers are flooding RTO markets and overwhelming legacy processes.

In 2023, FERC issued Order 2023 to enhance GI processes, but it did not remedy the primary problems. A coalition of consumer groups and the R Street Institute called for deeper reform, which FERC did not take action on. In April 2024, the Senate introduced legislation consistent with the coalition’s recommendations. FERC then held a GI workshop in September 2024 to identify outstanding issues but, again, took no action. Additional GI reforms have instead been brought forth to FERC for approval by individual RTOs. This has made ad hoc, regionally piecemeal approaches to GI reform the new status quo.

RTOs’ additional proposed GI reforms vary widely. Some, like the California Independent System Operator (CAISO), have pursued productive reforms to streamline the GI process and reduce barriers to all new generators. Other proposed reforms aimed at PJM suggest fast-tracking approvals for certain generator classes over others, which is an inefficient, discriminatory practice. It is worth noting that after adjusting for the reliability value of different technology types, the amount of new firm power awaiting PJM interconnection in 2023 was 55 percent solar, 31 percent natural gas, and 14 percent wind. Some reforms could even entrench incumbent transmission utilities further, perhaps undermining bedrock open access transmission policy, rather than holding utilities accountable to produce expeditious and accurate study assessments. One example is MISO’s Expedited Resource Addition Study, which is discriminatory and creates new barriers to competition generation development.

This highlights the importance of ensuring that additional GI reforms are high quality. Proposed reforms should reduce financial, informational, and procedural barriers to entry for all energy resources. The consumer coalition mentioned above outlined several helpful recommendations:

- Use accurate, consistent, and transparent GI study assumptions and assess low-cost alternatives

- Plan transmission network upgrades proactively and cost-efficiently

- Enable nondiscriminatory fast-tracking of the most commercial-ready GI requests, especially for energy resource interconnection service

- Expand informational tools and simplify deliverability requirements for network resource interconnection service

- Ensure best GI queue management practices like process automation

Numerous procedural vehicles could facilitate continued GI reform. FERC could issue a subsequent rulemaking, although this is unlikely. FERC could also implement the consumer coalition request of requiring greater reporting by grid operators of GI practices, hosting recurring forums on GI best practices, and issuing a policy statement to clarify reform objectives. Such actions would elevate the quality of RTO-specific GI proposals and ensure that FERC holds their approval to a higher standard. Finally, consumer group–backed congressional legislation requiring FERC to finish GI reform could accelerate outcomes, especially among laggard RTOs.

Recommendation 4: Finish generator interconnection reforms

FERC, regional stakeholders, and possibly Congress should prioritize finishing GI reforms as outlined by the consumer coalition.

Preventing Premature Retirements and Abuses

Another important RA-related reform is safeguarding against economically premature retirements. This is generally not a concern with competitive generators in RTOs, as the marketplace provides sufficient revenue to retain power plants that meet energy and capacity reliability criteria, as long as they are still economical. For example, PJM’s latest capacity auction signaled the retention of legacy power plants that were previously slated for retirement. However, markets do not compensate all reliability services, such as voltage support, so tools to address such gaps may be warranted.

The primary tool used to safeguard against premature retirements are reliability must-run contracts (RMRs) issued by RTOs. These contracts are agreements between an RTO and a resource owner to keep units in operation through a temporary cost-of-service contract. However, the effectiveness of RMRs is increasingly being challenged for several reasons:

- RMRs are triggered only by reliability criteria, not by RA concerns. This raises a bigger question around possibly needing to refine RMR criteria to include RA needs.

- RMRs for existing cost-of-service generators pose a unique challenge. Cost-of-service generators are indifferent to market signals, and the decision to retire is typically at the discretion of state regulators.

- Generators do not have to accept RMRs. They historically have done so because contract terms have generally been favorable, providing sufficient financial incentive for the resource owner to keep the unit operating. However, financial incentives are not always sufficient to overcome regulatory or legal requirements, or pressure from governmental bodies to shut the facility down (as seen in Illinois, California, the Mid Atlantic, and the Northeast). This issue may require refining RMR authority, such as clarifying that federal reliability authority supersedes conflicting state policy.

Furthermore, the overuse or misuse of RMRs poses market disruption risk by creating a barrier to exit. Specifically, RMRs are often biased toward investment in cost-of-service regulation and away from market-driven services. There is, unfortunately, a strong incentive for inappropriate RMR applications, as generators may seek to insulate themselves from competition by appearing to need an RMR, and RTOs are often willing to sacrifice market efficiency for reliability guarantees. To prevent RMR abuses and ensure that they support, rather than undermine, markets, we recommend the following best practices:

- Minimize the need for RMRs by ensuring that market design compensates locational reliability services (e.g., energy and reserve prices reflect scarcity, granular capacity zones)

- Apply clear, transparent criteria for issuing RMRs, including a defined reliability service need, a demonstration of uneconomical status, and a benefit-cost test

- Consider cost-effective alternatives to RMR agreements, such as alternative new generation

- Prevent plant owners from using cost-of-service RMRs and retirement threats to exercise market power by raising market prices without risking losses

- Provide a clear action plan to alleviate the need to retain a power plant that provides other market participants with a clear set of forward expectations, thereby improving regulatory predictability and helping to minimize investment distortions

An example of an effective RMR process is ERCOT’s approach. ERCOT employs a strict timeline to process generator deactivation requests, uses objective criteria to assess whether the system can meet reliability criteria without the generator, and solicits market participants’ input. ERCOT recommends an RMR contract only when the absence of the unit would violate specific reliability criteria.

Importantly, once an RMR is contemplated by ERCOT, they are obligated to seek cost-effective alternatives through an open and competitive solicitation process. Options considered as alternatives have included demand management programs, which accelerate the completion of current generation construction projects, and installing mobile generation. ERCOT may seek board approval for an RMR contract only after it has evaluated alternatives. A key part of ERCOT’s process is that once a unit is placed on an RMR contract, ERCOT is obligated to identify options that would obviate the need for the contract. Typically, these exit strategies involve the completion of transmission projects.

Congress and FERC can take various actions to improve RMR effectiveness in safeguarding reliability while minimizing RMR abuses and market distortions. Congressional attention may be necessary to reconcile authority questions, especially regarding compliance with conflicting state or non-FERC policy, such as EPA compliance. FERC should prioritize clarifying and tightening technical criteria, especially with respect to RA, and improving process implementation, building on ERCOT’s example.

Recommendation 5: Safeguard against premature generation retirements

Congress, FERC, and states should safeguard against economically premature generator retirements while avoiding the creation of exit barriers that distort markets.

Productive policy reform is even more important to deter counterproductive interventions to retain legacy power plants. In April 2025, President Trump signed an executive order using emergency authority to retain legacy plants. Although its effect depends on implementation, the design of the required actions “risks creating a one-way ratchet in which new capacity is merely additive rather than enabling competitive replacement—a recipe for artificially suppressing new supply that contradicts the administration’s objectives to unleash supply and lower energy costs.”

Wholesale Market Design

As the generation mix evolves, market design must increasingly adapt to ensure that reliability attributes are properly valued and procured. For example, not all balancing services will be in ample supply, which used to be the case as a byproduct of procuring conventional resources to meet peak demand. This may warrant discrete market procurement mechanisms for each essential reliability service, such as frequency response, which can be more economical than using uniform reliability standards.

In RTOs with capacity markets, capacity accreditation must be continuously refined to properly assign reliability value. Care must be taken when validating accreditation methodologies like Effective Load Carrying Capability, as some approaches age better than others. A key challenge is to accredit resources in a predictable, accurate manner for correlated generator outages across all fuel classes, including the risk of common mode failure. This is especially important now, as a greater proportion of the resource mix—such as renewables and natural gas—exhibits simultaneous performance sensitivities to weather conditions. Ex ante capacity accreditation (before resources are built) will always carry uncertainty, given that it is based on administrative estimates. This underscores the importance of leveraging ex post accreditation, based on real-world, operational data, to more accurately reflect reliability value.

In regions with forward capacity markets, accurate load forecasting is critical. After almost a decade of over-forecasting, and a recent period of under-forecasting (especially with respect to data centers and manufacturing demand), it appears that utilities are again over-counting with respect to prospective data center developments. Notably, energy futures markets do not support the level of load growth that utilities forecast, which is usually the basis of RTO load forecasts. This results in investors being unwilling to back new generation to the degree that would be expected from an increase in the demand curve used in capacity markets, as developers do not expect all forecasted demand to materialize. Investor hesitancy can create forward capacity supply-demand imbalances with higher-than-necessary capacity prices. It also leads to the false impression that markets cannot procure sufficient new generation. FERC, RTOs, and states must coordinate to improve load forecasting accuracy, especially with respect to new data center demand. Errors in retail utility forecasting typically get repeated in RTO forecasts and NERC assessments, giving a false impression of industry alignment.

The high degree of uncertainty around demand growth heightens the need for high-quality, well-designed spot markets, while allowing bilateral markets to drive forward resource contracting derived from spot market expectations. This ensures that market signals reflect what competitive market participants expect, and not administrative assumptions about the future. FERC, RTO stakeholders, and states should double down on efforts to improve price formation in energy and ancillary service market design. A potential policy objective would be to improve scarcity pricing so that the net cost of new entry becomes zero, which would eliminate the overreliance on capacity markets.

Markets should be designed to be proactive, not reactive, to avoid creating accidental barriers to entry for unconventional resources. This is of particular importance to energy storage, which is remarkably heterogeneous with varied hybrid configurations. Market design should also support flexible demand, given its aforementioned importance. Productive actions on this front include reducing transaction costs and information asymmetries, which deter demand-side participation, as well as securing pathways to demand integration in dispatch processes like scheduling consumption for flexible loads. A more ambitious pursuit would be to partially privatize RA. RA is currently treated as a common good, given outmoded technology assumptions. In other words, this would isolate the consequence of resource shortfalls to those responsible, rather than socialize consequences across all customers. This would better align customer-specific service reliability with consumers’ VOLL, which maximizes economic efficiency.

FERC is unlikely to conduct a rulemaking on any singular market design feature. But FERC can take actions, like issuing a policy statement, to delineate refined policy objectives that guide industry market design proposals and FERC’s review process. As retail and wholesale policies become more interconnected, FERC must proactively work with restructured states to align market rules and avoid conflicting policies.

Recommendation 6: Improve wholesale market design

FERC and regional stakeholders should continue to improve wholesale market design proactively, especially by enhancing spot market rules and refining load forecasting and capacity accreditation in areas employing capacity markets.

State Resource Planning

Despite the aforementioned challenges, competitive markets hold key reliability advantages over traditional utility resource planning. Competitive markets provide more accurate price signals and better reflect the time- and location-specific value of different types of generation resources. This benefit is especially important as the grid integrates more performance-correlated resources, which require specialized regional knowledge to assign accurate capacity accreditation and better coordinate entry and exit decisions across a broader regional footprint than siloed utility decisions.

It appears that fragmented utility planning is increasingly becoming an RA liability as the resource mix evolves, yet many stakeholders misdiagnose the problem. For example, when the capacity market of the Midcontinent Independent System Operator (MISO) fell short of its procurement target, some FERC commissioners blamed the wholesale market. However, MISO RA responsibility resides with states, who oversee cost-of-service utilities that supply the vast majority of the region’s generation. Thus, an accurate assessment identified fragmented utility resource planning under state jurisdiction as the core driver of MISO’s RA problem. In fact, NERC identifies MISO as the region facing the highest RA risk moving forward.

This problem is also evident in the Southwest Power Pool (SPP) and CAISO, which are the only other RTOs where RA is primarily left to state utility planning processes. In fact, FERC’s former lead reliability commissioner attributed the 2020 California blackouts to gaps in coordination between state and regional authorities. The same state/RTO alignment concern was a central theme at the SPP’s 2025 energy summit, and the SPP’s market monitor has become more focused on state utility planning. The fundamental challenge in MISO, SPP, and CAISO is that competitive wholesale markets cannot influence RA decisions when state retail policy remains under cost-of-service regulation.

Nevertheless, states retaining cost-of-service utilities are better off within RTOs. RTOs provide better data on the regional reliability value of different energy resources, which can help state regulators make more informed decisions. For example, MISO and its member states have started developing a survey to help coordinate utility planning across the region. In contrast, states that are outside of RTOs, especially those in parts of the West and Southeast, face even more fragmented planning. These areas overbuilt conventional capacity and have lower levels of newer resource participation, which delays reliability concerns but at a higher-than-necessary cost.

States should consider enacting several competitive reforms that would prioritize reliability at the lowest cost. Even partially competitive reforms, like allowing large consumers to participate in retail competition, would help align incentives for reliable generation and flexible demand behavior within the customer class showing the most demand growth. In addition, PUCs should align utility procurement practices with regional conditions. For example, one option would be to incorporate bilateral market tests in utility resource planning, which would mitigate the issue of utilities planning in siloes. At minimum, states should modify utility resource planning practices to consider capacity accreditation and the location of resources needed to meet regional RA needs, which is far more straightforward in RTOs.

Recommendation 7: Enhance state resource planning

State and regional stakeholders should ideally expand retail competition for large consumers, but at minimum must enhance utility resource planning to align with regional reliability conditions.

Transmission Resource Adequacy

A reliable bulk power system not only needs enough generation to meet demand, but it also needs to be able to deliver power where it is needed. Transmission constraints can hamper reliable power delivery even when the base level of systemwide generation is sufficient. Indicators suggest that transmission constraints are growing, as transmission congestion costs rose sharply between 2020 and 2022 in ERCOT, SPP, MISO, and PJM. These constraints exacerbate reliability risk in several ways:

- An import-constrained subregion may have to shed firm load even if the broader regional system has ample generation

- An import-constrained region may have to shed firm load even if neighboring regions have surplus generation

- A saturated transmission system triggers reliability problems associated with GI backlogs; with the exception of ERCOT, interconnection approvals require transmission network upgrades that are inefficiently resolved through one-off GI requests

Transmission expansion serves multiple policy purposes, but the primary historic driver has been reliability. A study of new transmission lines over 2010-2020 found that reliability was the primary project driver (51 percent), followed by the accommodation of generation (26 percent) and load growth (9 percent). It is notable that this period had expectations of flat demand, whereas the current outlook indicates substantial demand growth.

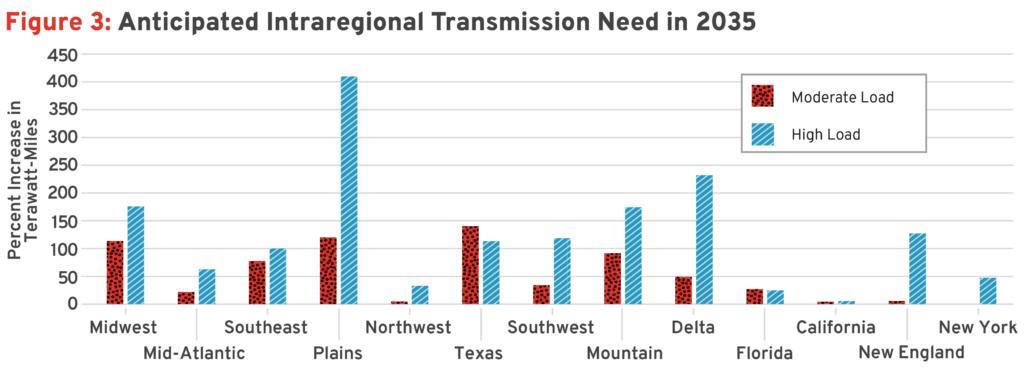

Transmission expansion is highly sensitive to demand growth assumptions. As shown in Figure 3, projected median regional transmission needs are expected to increase by 64 percent by 2035 under moderate load growth and by 128 percent with high load growth. Similarly, the projected median interregional transmission need is expected to increase by 114 percent with moderate load growth and by 412 percent with high load growth. To close this transmission need gap, even just for reliability purposes, policymakers must implement reforms that would improve the speed and quality of transmission expansion for new projects as well as facilitate enhancements to existing transmission lines.

Greenfield Transmission Expansion

The conventional expansion of the transmission system via new greenfield projects faces large entry delays, typically taking 5 to 20 years to develop. Permitting and siting reforms are important to reduce this delay and are addressed later in this paper. Better transmission planning and cost allocation policies are also essential.

Historically, flawed transmission incentives and regulation have resulted in an overbuild of local transmission lines at the expense of more cost-effective and reliable regional and interregional transmission lines. The larger-scale lines generally carry superior reliability benefits.

To improve regional transmission planning and cost allocation, FERC issued Order 1920 in 2024. After modifications, it secured bipartisan FERC support, notably from the current FERC Chairman, Mark Christie. This reform should improve reliability by making regional transmission planning a more proactive process with robust benefits accounting (existing practices are reactive and use incomplete benefits methodologies). The effectiveness of Order 1920 will largely depend on how regions implement it, as it gives regional entities considerable compliance discretion.

Importantly, Order 1920 does not fully harmonize economic and reliability planning criteria. This is a core flaw of transmission planning that has resulted in the false bifurcation of projects that are planned separately for economic or reliability purposes. All transmission projects serve both purposes, and planning for one need without considering the other is inefficient and drives up costs for customers. Ideally, the planning process would monetize reliability benefits, such that a comprehensive cost-benefit analysis would inform planning decisions.

Although Order 1920 addresses flaws in FERC’s first regional transmission rule, which was issued in 2011, FERC never issued a planning rule for interregional transmission. Given reliability benefits and economies of scale, the agency likely should have prioritized interregional transmission in the 2000s when fossil and nuclear generation dominated the resource mix. This regulatory void has resulted in practically no interregional transmission development. The last (118th) Congress proposed two types of interregional reforms—comprehensive planning and minimum transfer requirements—each of which were included in major pieces of legislation. Congress instead passed legislation requiring NERC to study the reliability effects of interregional transfer constraints in 2023.

NERC filed the study in November 2024 at FERC, which hosted a public comment period. A key takeaway from the study was that interregional transfer capability is insufficient, resulting in future expected energy deficiencies. NERC calculated that 35 GW of additional transfer capability would benefit reliability overall, but the transfer level for each interregional interface varied extensively. The greatest transfer capacity needs were by far in ERCOT, followed by the Southeast, New York, SPP, MISO, PJM, and other footprints. Importantly, the NERC study was not an economic assessment. Still, it makes a strong case for interregional reforms for reliability purposes.

Congress and FERC have three key policy avenues for pursuing prudent interregional transmission planning and cost allocation reform:

- Reduce regulatory barriers to merchant high voltage direct current (MHVDC) builds by competitive developers. This model lets counterparties voluntarily contract for transmission projects, akin to pipeline service, which avoids cost-allocation disputes. Competitive developers have already helped fill the interregional void. However, expansion faces pronounced regulatory barriers that FERC should remedy. Even with fixes, not all reliability and economic benefits can be productized, which leaves some need for mandatory planning policy.

- Adopt a mandatory interregional transmission framework. Any transmission needs not met by the competitive market can be addressed through comprehensive interregional planning. Experts and consumers contend that, done well, this would identify needs that maximize net economic benefits to consumers and reduce costs further by leveraging competitive bidding.

- Impose a minimum transfer requirement between regions. A backstop option is to require a transfer floor based on reliability criteria, ideally optimized using cost-benefit analysis. For example, most regions are unable to transfer over 10 percent of peak load, but analysis has found that 20 to 25 percent of peak load transfer capability may serve as a conservative reliability floor across regions. Importantly, a methodology-based approach would identify different transfer levels, depending on the economics and reliability conditions of specific interregional interfaces.

Recommendation 8: Improve conventional transmission expansion

FERC, regional, and state authorities should improve conventional transmission expansion at local, regional, and interregional levels. Congressional action would help facilitate improvements on an interregional scale.

Existing System Enhancements

Although new, conventional transmission projects are critical for long-term reliability, they will not provide congestion relief until the mid-2030s. To reduce congestion and improve reliability in the near term and at a lower cost, policymakers should focus on enhancing the existing transmission system. Reconductoring and grid-enhancing technologies (GETs) can save billions of dollars annually in congestion costs with exceptionally attractive returns for customers.

The problem is that low-cost transmission capacity enhancements run counter to the financial incentives of cost-of-service regulation. As a result, incumbent utilities are often reluctant to adopt such technologies and, instead, prefer higher–cost, conventional projects. Transmission consumers are incredulous over the chronic underutilization of technologies to enhance the existing system, making it a pillar of their reform agenda.

Recognizing the incumbent utility incentive problem, FERC issued Order 881, which required utilities to adopt a specific type of GET: adjusted transmission line ratings to reflect ambient temperature conditions. FERC appears to be favoring a technology-specific approach to the problem, including issuing a promising advanced notice of proposed rulemaking on another type of GET: adjusted line ratings for additional meteorological conditions like wind. FERC could move this into a formal notice of proposed rulemaking and explore additional GETs and reconductoring utility requirements. Congress could also play a role by requiring or urging FERC to prioritize cost-saving technologies that resolve congestion-related reliability problems expeditiously. Given that states also regulate transmission, this is another area ripe for federal-state collaboration to ensure that incumbent utilities implement efficient and effective solutions.

Another reform that could help remedy congestion and improve reliability is improved seams management. Interregional transmission facilities are managed inefficiently, with power flowing in the wrong direction roughly 40 percent of the time. Software solutions could resolve interregional transmission capability problems many years before new hardware, like new lines, could be built. Optimizing interties between regional systems could save billions of dollars per interface in under a decade and bolster reliability, especially by ensuring import-export flows reflect conditions in each regional system during severe weather events. FERC already has clear authority to pursue seams optimization and Congress should, at a minimum, nudge the organization to act.

Recommendation 9: Optimize the existing transmission system

Congress, FERC, RTOs, and states should prioritize reforms that accelerate the adoption of cost-effective transmission enhancements like GETs, seams optimization, and reconductoring to reduce congestion and improve reliability in the near-term.

External Policy

Expert analyses are beginning to reveal that many of the causes of generator outages, generation adequacy, and transmission adequacy stem from public policies outside of reliability authorities’ control. This theme was poignantly captured in a 2021 National Academies of Science report, which found it ever more challenging to determine who is in charge of ensuring power system integrity. This fragmentation of reliability responsibility undermines accountability mechanisms and amplifies risk.

To address this fragmentation, Congress and executive bodies must refine the institutional framework governing bulk power system reliability. The goal should be to ensure that reliability authorities’ concerns are factored into all relevant policy decisions, including those that originate outside of the energy sector. A stronger coordination framework could address disconnects between institutions at various levels, including:

- Clarify FERC and regional entity authorities in RA in cost-of-service states and determine whether reliability instruments like RMRs should override state policies that threaten RA

- Establish formal interagency processes, such as task forces, to align federal agencies on permitting, emissions compliance, and other relevant issues, especially in a format that endures changes in presidential administration

- Establish routine federal–state coordination on issues like gas-electric harmonization, flexible demand integration, state environmental compliance, and state–RTO synchronization; some topics would be particularly well suited for technical agency collaboration, such as ongoing FERC and PUC initiatives, whereas others like permitting and siting may require more direct legislative engagement

Recommendation 10: Establish institutional coordination

Congress should clarify federal reliability authorities and establish a coordination framework to ensure that bulk reliability risks identified by reliability authorities are adequately accounted for in all federal agencies’ rulemakings as well as relevant state policies. Executive agencies and states should actively participate in this framework, and initiate one on their own if Congress fails to act.

Congressional action is required to institutionalize a role for reliability authorities in other agencies’ rulemakings that affect grid reliability. An example of one such approach was the Energy Permitting Reform Act of 2024 (EPRA). EPRA contained a provision that would require FERC to direct NERC to assess reliability impacts of proposed federal regulations. The NERC assessment would be triggered whenever FERC, another federal agency, a transmission organization, or a state PUC determined that a proposed federal regulation posed reliability risk. A similar provision under the GRID Act would go further and require federal agencies to modify proposed regulations if FERC or NERC identified negative reliability impacts. If Congress does not take action of this kind, the executive branch should take steps to ensure that agencies routinely coordinate on grid reliability and make decisions based on codified reliability criteria, which could be memorialized in joint memoranda of understanding.

Permitting and Siting

Permitting and siting policies increasingly hamper generation and transmission development and retention. Federal permitting and siting is the lesser problem and generally shows positive momentum, but state permitting and siting is becoming increasingly more restrictive with regard to energy infrastructure.

Federal progress on permitting and siting improvements is evident with efforts like the Fiscal Responsibility Act of 2023, though more reforms are needed. Permitting under the National Environmental Policy Act (NEPA) takes nearly five years on average. Ironically, the projects affected are overwhelmingly clean energy related. The Endangered Species Act and Clean Water Act, section 401 permits, in particular, routinely pose major challenges to energy infrastructure development. Reforms that reduce duplicative reviews and litigation risk have an especially compelling reliability, environmental, and energy cost case. Bipartisan initiatives have identified a “Goldilocks Zone” for permitting reform, which may form the basis for further congressional permitting reform.

Recommendation 11: Streamline federal permitting and siting

Congress and federal agencies should continue to streamline federal permitting and siting laws, including NEPA, the Endangered Species Act, and Section 401 of the Clean Water Act.

State permitting and siting laws are arguably the largest categorical barriers to long-term power infrastructure and to supporting fuel infrastructure development. These barriers have recently risen to the level of presidential prioritization, with an April 2025 executive order dedicated to state energy concerns, noting that “[s]ome States delay review of permit applications to produce energy, creating de facto barriers to entry in the energy market.” These challenges have been most acute for the infrastructure projects that are in highest commercial demand: wind, solar, natural gas, and transmission. They also hamper geothermal, nuclear, and oil combustion for power supply. Such restrictive policies take numerous forms, ranging from explicit state moratoria to a deluge of local ordinances. This trend appears to increase with greater infrastructure development levels, implying an increasingly restrictive outlook.

Unlike the handful of discrete federal permitting and siting policies, state policies number in the thousands. Wind and solar have faced a more than 1,000 percent increase in the number of restrictive local ordinances over the past decade. Transmission development has become slow, piecemeal, and haphazard because of fragmented permitting and siting processes across states and local authorities. Generally, such laws and project-specific decisions do not account for regional reliability impacts.

Similarly, states that restrict gas infrastructure expansion, especially in the Northeast, generally do not account for the risk that such actions pose to regional RA. FERC and NERC leadership highlighted major reliability risks in New England, noting that considerations largely came down to gas system factors under states’ jurisdiction. Tighter restrictions on oil storage and combustion in the Northeast, which are often necessary to compensate for insufficient natural gas infrastructure, could induce a major reliability event.

States retaining or exacerbating restrictive energy infrastructure policies are creating a federalist conundrum. Stronger federal backstop siting authority for linear interstate infrastructure, namely transmission lines and pipelines, is more straightforward. This is consistent with some existing infrastructure precedent, keeps states in the driver’s seat, and incentivizes states to coordinate to ensure reliability needs are met. Potential federal backstop authority for new power generation approvals would be an entirely different frontier.

Federal agencies can at least use their convening power to delineate which state policies are compatible with regional electricity markets and reliability and which are not. For example, FERC hosted a 2020 technical conference on carbon pricing, where Chairman Neil Chatterjee explicitly sought to defuse state-federal tensions over state policies that undermined regional reliability. The record delineated how some state command-and-control climate change policies threatened reliability but carbon pricing did not. This was embraced by climate-minded state leaders as a path to reconcile state policies with the health of regional electricity systems.

States can serve their own interests and avoid federal conflicts over grid reliability by enacting permitting and siting reforms that:

- Tie permitting to specific harms, not ad hoc political influences

- Ensure that local governments have robust information on project benefits, including grid reliability

- Maintain fairness across incumbent and non-incumbent developers

- Create an appeal process to vindicate liberty, including public interest considerations like reliability effects, by enabling parties to challenge local decisions by elevating them to higher authorities for redress

Recommendation 12: Overhaul state permitting and siting

States should reform permitting and siting laws to tie permitting to specific harms and create an appeals process to vindicate liberty. Federal authorities and states should ensure that subnational authorities have information on project reliability benefits.

Federal Interagency Coordination

Improving federal interagency coordination is one of the lowest-hanging fruit for institutional harmonization. Policymakers can start by considering lessons from previous executive actions. For example, under President Biden, efforts across the Departments of Energy and Interior identified categorical exemptions under NEPA. This type of coordination could be especially helpful for expediting the completion of “shovel-ready” projects.

However, ad hoc executive branch approaches are not necessarily durable with changes in administrations, and they are frequently prone to political interference to promote certain resource classes over others. For example, NEPA actions by the Council on Environmental Quality under the Biden administration exacerbated infrastructure delays and contradicted previous NEPA efforts by the Trump administration that would have reduced barriers to all energy infrastructure development. Such regulatory uncertainty chills infrastructure investment that is planned on timeframes spanning several presidential terms. To minimize uncertainty and streamline approvals, future executive initiatives should use transparent, objective criteria to make expedited permitting and siting decisions. Ideally, Congress would remedy the underlying statutes to avoid conflicting executive leadership interpretations.

Few interagency coordination agendas have been as prone to disruption with administration change as power plant compliance with Environmental Protection Agency (EPA) rules. Such efforts harken back to compliance strategies with the Mercury and Air Toxics Rules, as well as more recent iterations of coal combustion residuals, water effluents, ozone, particulate matter, and greenhouse gas rules. In the past, ad hoc interagency coordination has led to creative solutions, like devising reliability “safety valve” compliance pathways.

The EPA’s 2024 power plant rule under section 111 of the Clean Air Act prompted concerns from reliability authorities, including FERC commissioners, NERC, and RTOs. Concerns over the proposed rule motivated a 2023 FERC technical conference that the EPA participated in. The EPA’s final rule appeared to account for some input from reliability authorities, such as considerable exemptions for natural gas plants. However, such factors were not based on explicit reliability criteria, but rather were subjected to the discretion of an agency with no electric reliability expertise. This creates an unpredictable investment climate, even if the current version of the rule is discontinued. For example, an ongoing chilling effect on natural gas investment persisted not only while the rule was in play; it continues to hang over the long-term investment cycle that extends beyond the agenda of the current administration. Such long-term erosion of investor confidence could translate into financing problems for natural gas plants, even with no new, imminent EPA rule.

Conclusion

Ensuring the reliability of the U.S. bulk electric power system is becoming increasingly complex—a challenge underscored by recent warnings from NERC and the National Academies of Science. Simply identifying the myriad root causes of reliability threats and appropriate fixes is a daunting task. This paper has identified 12 key drivers of reliability risk and offers targeted reforms based on their expected reliability impact and speed of implementation, which is summarized in Table 2.

The top priority is to improve generator performance—particularly failures related to fuel supply and winterization. Secondarily, market liberalization and the removal of regulatory barriers is the solution for generation RA. The greatest RA reform priorities, are deeper generator interconnection improvements, unlocking flexible demand, and expediting permitting and siting. Secondary priorities include improved state resource planning, safeguarding against premature retirements, transmission reforms, enhanced market design, and better interagency coordination.

Table 2: Bulk Electric Reliability Reform Recommendations

| Number | Recommendation | Reliability Value | Impact Expedience | Jurisdiction / Institutional Actor |

|---|---|---|---|---|

| 1 | Expedite generator winterization | High | Fast | FERC, state |