Increasing Consistency and Transparency in Considering Benefits and Costs in the Clean Air Act Rulemaking Process

On June 11, 2020, the U.S. Environmental Protection Agency (EPA) published a notice of proposed rulemaking (NOPR) to increase the consistency and transparency in considering benefits and costs in the Clean Air Act (CAA) rulemaking process.[1] To achieve these objectives, the NOPR proposes three main requirements:

- Codify the preparation of benefit-cost analysis (BCA) for all future significant proposed and final regulations under the CAA.

- Develop BCA in accordance with best practices from the economic, engineering, physical and biological sciences.

- Increase transparency in the presentation of the benefits resulting from significant CAA regulations.

The proposal also solicits comment on additional considerations. In particular, this includes how the EPA would consider BCA results in future rulemaking under specific CAA provisions, and how the EPA should weigh BCA results in CAA decisions.

COMMENTS OF THE R STREET INSTITUTE

I. Summary

The R Street Institute fully embraces the objectives of this rulemaking and focuses its comments on areas to strengthen the proposal consistent with those objectives. In particular, R Street provides:

- An emphasis on inclusion but with refined treatment of co-benefits.

- An emphasis on capturing the regulatory rebound effect.

- A framework to determine the thoroughness of evaluating expanded regulatory alternatives.

- Elaboration on how the EPA can use BCA to guide more evidence-based CAA regulatory decisions.

R Street applauds the NOPR for taking a novel approach to examining co-benefits in BCA and the uses of BCA in regulatory decision-making under the CAA. This focus is very valuable, as co-benefits often decide whether regulatory actions pass or fail a BCA. A recent study of all economically significant CAA rules issued by the EPA from 1997-2016 revealed that co-benefits comprised 45 percent of total benefits on average and that 47 percent of rules had benefits of the targeted pollutant exceeding costs.[2] Unsurprisingly, the study found that “co-benefits have been pivotal to the quantified net benefit calculation in the majority of cases.”[3]

That said, R Street underscores the need to stay within the confines of the law to achieve a durable policy improvement. The CAA imposes strict limitations on the use of BCA for many applications. This includes the inability to factor costs into decisions under the National Ambient Air Quality Standards (NAAQS) and limitations on applying BCA to regulatory alternatives across multiple provisions of the CAA. The EPA must also stay within the confines of guidance from the Office of Management and Budget (OMB), which addresses co-benefits (and co-costs) as well as applying BCA to various regulatory alternatives.[4] Ultimately, the CAA will require reform to enable proper BCA application to drive regulatory decisions.

II. Preparation of Benefit-Cost Analyses for Significant Regulations

The NOPR proposes to codify the mandate that the EPA prepare a BCA for all future significant CAA regulations in the proposal and final stages[5] This is prudent, with the possible exception of cases where the final rule does not materially differ from the proposal. At the same time, updating the BCA to reflect minor changes would incur lower costs that may still be less than the benefits, even if relatively small.

The EPA should endeavor to codify BCA updates for any significant regulatory action, including reinterpretations. For example, the EPA often wishes to reconsider many rules after years of litigation delays or in light of new evidence. Some of this evidence, such as with scientific evidence, can materially change the benefits calculation. Some of it, such as shifts in industry composition, can materially change costs. For example, the EPA did not update costs and benefits estimates from 2012 when it promulgated the reconsidered basis for the Mercury and Air Toxics Standards for Power Plants (MATS) in 2020.[6] BCA experts warned that this overlooked new research about health consequences and relied on outdated compliance cost projections.[7] It also put the rule at greater legal risk.[8]

III. Best Practices for the Development of Benefit-Cost Analysis

R Street agrees with the NOPR on the need to improve transparency and rectify flawed analytic assumptions in BCA. The NOPR flags double-counting of benefits as one such concerning result. Recent research indicates some claimed mechanisms of double-counting are either inaccurate or addressed by the EPA following its own guidelines on BCA baselines assuming full compliance with existing rules.[9] The NOPR recognizes the baseline problem and appropriately seeks to address it to codify consistency and best practices.

The more problematic mechanism for over/double counting is the regulatory rebound effect, which refers to the shift in compliance behavior tied to a policy targeting a co-pollutant—or, in other words, a new policy that indirectly reduces emissions covered under a pre-existing policy can result in a change in the pre-existing policy.[10] This is not explicitly mentioned in the NOPR.

For the original MATS rule, the rebound effect caused the BCA to overstate the co-benefits of fine particulate matter (PM2.5), which is already regulated under NAAQS and was the primary benefit driver of the rule.[11] In particular, reductions in PM2.5 from MATS would allow states in NAAQS attainment to relax regulations on other PM2.5 sources. This would offset the effect of MATS on PM2.5 as other areas could reduce standards stringency on new sources.[12]

Better accounting for the rebound effect in the baseline is a difficult exercise as it relates to changes in regulatory—not merely conventional economic—behavior. However, the EPA should endeavor to address this for PM2.5 in particular, as it dominates BCA results for many CAA rules and, in fact, constitutes two of three categories that drive the vast majority of total benefits of various regulations the last two decades.[13] The EPA could look to fold this and other co-benefits estimates into an emphasis on better partial equilibrium analysis that holds some advantages over a general equilibrium technique.

The EPA should also seek to codify institutional improvements to continuously improve and expeditiously incorporate best data and methodological improvements. For example, this could apply to the use of risk-adjustments in lieu of linear concentration-response assumptions for emissions that display non-linear (i.e., threshold) effects between ambient concentrations and environmental and public health impacts.[14] This will require institutionalizing conduits for internal and external expertise, such as the External Environmental Economics Advisory Committee that formed after the dissolution of the internal advisory committee on the EPA’s science advisory board.[15]

IV. Requirement for Additional Presentations of BCA Results in Rulemakings

The NOPR’s primary value is derived from the distinction of direct benefits from co-benefits and its relevance to regulatory decision-making. R Street thoroughly agrees with distinguishing benefits derived from the target pollutant under the specific statutory provision from the co-benefits incidentally resulting from a regulatory action. The NOPR’s proposal to present the overall BCA results alongside an additional presentation of benefits that pertain to the specific objective of the CAA provision is sound. R Street encourages the EPA to include associated costs as well, and to apply consistent BCA metrics across both presentations (e.g., net benefits, benefit-cost ratios).

In light of some commenters suggesting that the EPA should exclude co-benefits from BCA, R Street notes that it is critical that the agency retain co-benefits in the total evaluation. Research indicates that narrowing the scope of regulatory impact assessment to exclude co-benefits can lead to “policy errors and welfare losses” not to mention legal vulnerabilities.[16] Proper BCA regulatory analysis accounts for all quantifiable costs and benefits, including those intended and unintended by the regulatory action.[17] Although co-benefits calculations should come under increased scrutiny, they should not be categorically excluded. Recent EPA decisions to exclude co-benefits from BCA have left experts concerned about the credibility of the agency and may have increased legal risk unnecessarily.[18]

R Street therefore encourages the EPA to maintain the NOPR’s premise that “BCA requires a comparison of total social benefits and total social costs.”[19] Although the NOPR underscores separate accounting of co-benefits, the same application should apply to costs. Altogether, this information is essential to avoid double-counting costs and benefits and to inform regulatory decision-making, especially between alternative mechanisms under the CAA.

R Street also suggests presentation conditions for co-benefits evaluation to help the EPA weigh regulatory alternatives. These would help amplify the key objective of the NOPR that disaggregating benefits into targeted and ancillary categories of the statutory provision’s objective would help the agency explore whether more economically efficient or lawful ways of obtaining ancillary benefits are available.[20] This is consistent with contemporary BCA research, as many experts have expressed concern over inappropriate claims of co-benefits and unbalanced analyses.[21] The peer-reviewed literature indicates that some co-benefits are better regulated through separate policy or statutory provisions intended for them directly.[22] Conducting BCA to evaluate across this range of regulatory alternatives would expand the complexity and analytic requirements of regulatory BCA considerably, quite possibly well beyond reasonable comprehension. Thus, applying some guiding principles can ensure that BCA is done in an institutionally-relevant context and puts the scarce resources of the EPA and stakeholders to their best use.

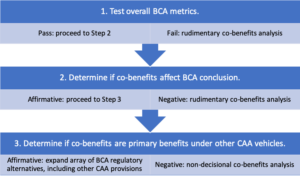

As noted in OMB Circular A-4, the “number and choice of alternatives selected for detailed analysis is a matter of judgment. There must be some balance between thoroughness and the practical limits on your analytical capacity.”[23] One method to determine whether detailed BCA across extensive regulatory alternatives is warranted is to use a sequential BCA threshold test, depicted below.

TABLE 1: BCA THRESHOLD TEST TO GUIDE CO-BENEFITS ANALYSIS IN CAA REGULATORY DECISIONS

As the EPA develops the analysis to support the NOPR’s first requirement—a summary of overall BCA results, it could inject the BCA threshold test to determine if detailed co-benefits evaluation— potentially across multiple CAA provisions—is warranted.[24] Furthermore, the nature and rigor of implementation of the NOPR’s second requirement, which disaggregates co-benefits, could be conditioned upon several parameters in the test. For example:

- If either overall BCA metrics fail or, if they pass but co-benefits are not a deciding factor, then a rudimentary co-benefits analysis may suffice to suit informational purposes, as co-benefits would be less salient (if not immaterial) to the regulatory decision. In cases where direct BCA metrics fail but overall BCA metrics pass (i.e., co-benefits dependent BCA conclusion), further analysis of regulatory alternatives may be warranted.

- If co-benefits covered elsewhere under the CAA determine whether overall BCA metrics pass or fail, then an expanded array of BCA regulatory alternatives—including those provision(s) of the CAA that co-benefits are treated as the primary objective—may inform the regulatory decision.

- If these co-benefits do not fall under the CAA, then their consideration would be non-decisional for the EPA. However, the informational value of evaluating them may inform other policymaking and regulatory decisions outside of EPA’s authority. In this case, a higher-quality co-benefits analysis may prove fruitful but require EPA coordination with external parties (or perhaps across EPA offices if the co-benefits fall under other environmental statutes).

The threshold test has an advantage in simplicity and decisiveness. However, it has major limitations. Even if a direct BCA passed, it would remain possible that more exhaustive BCA analysis across CAA provisions may reveal a preferable set of alternative regulatory actions. More nuanced metrics may address the concerns but prove more challenging to implement. For example, the ratio of co-benefits to direct benefits may indicate that other regulatory alternative(s) would achieve better BCA results.

The threshold test may also place too much decisional emphasis on BCA analysis. Although R Street heavily emphasizes the use of BCA to drive evidence-based regulatory decision-making, it is not an infallible tool (e.g., it overvalues readily quantifiable benefits and costs relative to under-quantified ones) nor is it an exhaustive one, as it does not necessarily encompass all elements a regulator should factor into decisions.

The presentation of co-benefits analysis should be crafted in a manner to maximize its utility in regulatory decision-making. That is, it must maximize the ability to weigh regulatory alternatives, subject to resource constraints. The presentation of co-benefits should also provide for additional considerations noted herein.

V. Additional Considerations and Requests for Comment

R Street applauds the EPA for seeking comment on how to consider BCA results in CAA regulatory decisions. There is a large gap between how BCA should be used in air pollution regulation and what the law allows. If the EPA acts in a manner that stretches its statutory discretion, it must be cognizant of the sacrifice in elevating legal risk. As noted by the American Action Forum, the NOPR would codify the BCA process and aim to give “BCA principles a life beyond this administration.”[25] R Street would like to see this legacy endure.

Despite the age of the CAA, the role of BCA in decision-making retains some legal ambiguities. For example, it took until as recently as 2015 for clarity on the Hazardous Air Pollutants (HAP) provision, when the narrow majority of the U.S. Supreme Court ruled in Michigan v. EPA that the agency must consider cost before deciding whether a regulation is “appropriate and necessary,” whereas the dissent said it does not.[26] That is to say, court opinion on BCA for HAPs is still evolving. However, as noted in the NOPR, the EPA cannot factor costs into decisions under the NAAQS. The EPA must also stay within the confines of Executive Order 12866 and OMB guidance, which addresses co-benefits (and co-costs) as well as applying BCA to various regulatory alternatives.[27] In particular, OMB Circular A-4 has guided federal regulatory analysis over the last three presidential administrations and is critical to accomplishing the NOPR’s objectives.

R Street underscores the need to adhere to the law to achieve durable policy improvement. Considering the legal variation in how BCA can be applied across CAA provisions, the final rule should not try to apply a uniform decisional requirement tied to BCA. But, it can provide more accurate and consistent evaluations that influence decisions via improved BCA results. For example, better treatment of prospective changes and rebound effects from NAAQS will help prevent double-counting of costs and benefits for rules under HAPs.

The EPA can provide a record to justify a variety of actions it otherwise could not by employing a framework, such as the BCA threshold test, to determine when and how to pursue more robust evaluation of co-benefits and co-costs across numerous regulatory alternatives. The agency could also add increased procedural scrutiny for any existing and proposed rules with poor direct/targeted BCA metrics. For example, if a proposed rule had poor direct BCA metrics but positive overall ones, the EPA could institutionalize a protocol for additional evaluation of co-benefits and rebound effects. In theory, this could provide the grounds for coordinating rulemakings, such as adjusting criteria pollutant levels under NAAQS in lieu of economically inferior rules under HAPs justified primarily by their co-benefits.

This is consistent with recent research by the former OMB official who led EPA regulatory oversight when Circular A-4 was released. Specifically, the researchers advised that regulators should consider regulating co-benefits directly when they yield higher net benefits than another statutory provision.[28] Some applications of this may test the legal constraints of regulatory impact assessments, which tend to be confined to a narrower range of regulatory alternatives, and may need to wait until reauthorization of the CAA to remedy.[29]

Nevertheless, even for NAAQS, it is critical for the EPA to pursue robust BCA. The value of informing the public on the costs and benefits of regulations—irrespective of whether they influence regulatory decisions—is vital information for affected private stakeholders and improves research quality. It can also influence the quality and role of BCA in regulatory decisions under other provisions of the CAA that permit BCA considerations.

Quality BCA creates value for policymakers as well. For example, even without BCA considerations, the NAAQS program has created net benefits for society that, in the past, did not compel policymakers’ attention for statutory reform. Moving forward, quality prospective BCA will illuminate the thresholds and degree of diminishing and potentially strongly negative net benefits of abatement for some criteria pollutants. It is especially important to proactively inform Congress and its research institutions, including the U.S. Government Accountability Office and Congressional Research Service, to keep Congress apprised of statutory constraints that require regulatory actions trending toward net welfare loss to society.[30] Senior leadership in the EPA’s Office of Air Quality Planning and Standards has been aware of this potential trend under at least the last three presidential administrations, with some advocating for a “surgical strike” by Congress on the CAA to condition new regulations upon expected improvement in social welfare.[31]

VI. Conclusion

The R Street Institute fully embraces the objectives of this rulemaking and focuses its comments on areas to strengthen the proposal consistent with those objectives. In particular, R Street provides:

- An emphasis on inclusion but refined treatment of co-benefits;

- An emphasis on capturing the regulatory rebound effect;

- A framework to determine the thoroughness of evaluating expanded regulatory alternatives;

- Elaboration on how the EPA can use BCA to guide more evidence-based CAA regulatory decisions.

R Street applauds the NOPR for taking a novel approach to examining co-benefits in BCA and exploring better uses of BCA in regulatory decision-making under the CAA. R Street underscores the need to stay within the confines of the law to achieve a durable policy improvement. Ultimately, the CAA will require reform to enable proper BCA application to drive regulatory decisions.

Respectfully submitted,

Devin Hartman

Director, Energy and Environmental Policy

dhartman@rstreet.org

R Street Institute

1212 New York Ave., NW #900

Washington, DC 20005

Aug. 3, 2020

[1] Environmental Protection Agency, “Increasing Consistency and Transparency in Considering Benefits and Costs in the Clean Air Act Rulemaking Process,” Notice of Proposed Rulemaking (NOPR), Federal Register, Vol. 85, No. 113 June 11, 2020, pp. 35612-627. https://www.govinfo.gov/content/pkg/FR-2020-06-11/pdf/2020-12535.pdf.

[2] Joseph Aldy et al., “Co-Benefits and Regulatory Impact Analysis: Theory and Evidence from Federal Air Quality Regulations,” Environmental and Energy Policy and the Economy Conference, 2020, p. 11. http://conference.nber.org/conf_papers/f136946.pdf.

[3] Ibid., p. 1.

[4] Office of Management and Budget, “Circular A-4: Regulatory Analysis,” Executive Office of the President, Sept. 17, 2003. https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/circulars/A4/a-4.pdf.

[5] NOPR, p. 35617. https://www.govinfo.gov/content/pkg/FR-2020-06-11/pdf/2020-12535.pdf.

[6] Environmental Protection Agency, “Mercury and Air Toxics Standards for Power Plants Electronic Reporting Revisions,” July 17, 2020. https://www.epa.gov/sites/production/files/2020-07/documents/frn_mats_e-reporting_finl-rule.pdf.

[7] Joseph Aldy et al., “Deep flaws in a mercury regulatory analysis,” Science 368 (2020), pp. 347-48. https://science.sciencemag.org/content/368/6488/247.full.

[8] See various industrial sector trade association comments on the rule.

[9] “Co-Benefits and Regulatory Impact Analysis,” p. 22. http://conference.nber.org/conf_papers/f136946.pdf.

[10] See, e.g., Meredith Fowlie, “Declining Power Plant Emissions, Co-benefits, and Regulatory Rebound,” American Social Science Association Meeting, 2020. https://www.aeaweb.org/conference/webcasts/2020.

[11] Devin Hartman, “Comments of the Electricity Consumers Resource Council,” Feb. 7, 2019, p. 2. https://elcon.org/wp-content/uploads/ELCON-MATS-Comments-FINAL.pdf.

[12] Ibid, p. 2.

[13] See, e.g., Susan E. Dudley, “Perpetuating Puffery: An Analysis of the Composition of OMB’s Reported Benefits of Regulation,” Business Economics 47 (2012), pp. 165–76. https://link.springer.com/article/10.1057/be.2012.14.

[14] Susan E. Dudley, “OMB’s Reported Benefits of Regulation: Too Good to Be True?,” Regulation (Summer 2013), p. 28. https://regulatorystudies.columbian.gwu.edu/sites/g/files/zaxdzs1866/f/downloads/Dudley_OMB_BC_Regulation-v36n2-4.pdf.

[15] See: https://www.e-eeac.org.

[16] John D. Graham et al., “Co-Benefits, Countervailing Risks, and Cost-Benefit Analysis,” Harvard Center for Analysis Risk Assessment, Economic Evaluation, and Decisions Workshop, Sept. 26‐27, 2019, p. 1. https://cdn1.sph.harvard.edu/wp-content/uploads/sites/1273/2019/09/Graham-Wiener-Robinson-2019.pdf.

[17] See, e.g., Ibid., p. 32.

[18] See, e.g., Comments of Matthew Kotchen, “Has Good Benefit-Cost Analysis Been Swept under the MATS?”, Resources Radio, April 15, 2020, (26:00). https://www.rff.org/news/press-releases/new-episode-resources-radio-has-good-benefit-cost-analysis-been-swept-under-mats-mary-evans-and-matthew-kotchen.

[19] NOPR, p. 35622. https://www.govinfo.gov/content/pkg/FR-2020-06-11/pdf/2020-12535.pdf.

[20] Ibid.

[21] See, e.g., Ana Maria Zarate Moreno, “Escaping the ‘Smoke and Mirrors’ in Benefit Cost Analysis,” George Washington University, July 1, 2015. https://regulatorystudies.columbian.gwu.edu/escaping-smoke-and-mirrors-benefit-cost-analysis; “Perpetuating Puffery: An Analysis of the Composition of OMB’s Reported Benefits of Regulation.” https://link.springer.com/article/10.1057%2Fbe.2012.14.

[22] See, e.g., Susan Dudley et al., “Consumer’s Guide to Regulatory Impact Analysis: Ten Tips for Being an Informed Policymaker,” Journal of Benefit‐ Cost Analysis 8:2 (2017), pp. 187–204. https://www.cambridge.org/core/journals/journal-of-benefit-cost-analysis/article/consumers-guide-to-regulatory-impact-analysis-ten-tips-for-being-an-informed-policymaker/FAF984595B822A70495621AEA7EF7DEB; Adam Gustafson, “Testimony before the Subcommittee on Oversight & Investigations of the House Committee on Energy and Commerce,” Hearing on Undermining Mercury Protections: EPA Endangers Human Health and Environment, 116th Congress, May 21, 2019. https://energycommerce.house.gov/committee‐activity/hearings/hearing‐on‐undermining‐mercury‐ protections‐epa‐endangers‐human‐health.

[23] OMB, 2003, p. 7. https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/circulars/A4/a-4.pdf.

[24] NOPR, p. 35622. https://www.govinfo.gov/content/pkg/FR-2020-06-11/pdf/2020-12535.pdf.

[25] Dan Bosch, “EPA Proposes Benefit-Cost Analysis Rule,” American Action Forum, June 5, 2020. https://www.americanactionforum.org/insight/epa-proposes-benefit-cost-analysis-rule.

[26] Michigan et al. v. Environmental Protection Agency et al., U.S. Supreme Court, June 29, 2015, p. 2. https://www.supremecourt.gov/opinions/14pdf/14-46_bqmc.pdf.

[27] OMB, 2003. https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/circulars/A4/a-4.pdf.

[28] Graham et al. https://cdn1.sph.harvard.edu/wp-content/uploads/sites/1273/2019/09/Graham-Wiener-Robinson-2019.pdf.

[29] Based on personal communication with a leading BCA expert.

[30] For example, the U.S. Government Accountability Office has recently been actively evaluating the abatement benefits of carbon dioxide. See: https://www.gao.gov/assets/710/707776.pdf.

[31] This is based on private conversations with former EPA officials.