FR-6111-A-01 Reconsideration of HUD’s Implementation of the Fair Housing Act’s Disparate Impact Standard

Regulations Division

Office of the General Counsel

Washington, DC 20410

Dear Sir/Madam:

Re.: FR-6111-A-01 Reconsideration of HUD’s Implementation of the Fair Housing Act’s Disparate Impact Standard

Thank you for the opportunity to comment on this advanced notice of proposed rulemaking, which we believe has the potential to significantly improve the existing standard. The authors of this comment each have many years of experience in housing finance, both as operating executives and as students of housing finance systems and their policy issues.

Our comments are in particular directed to your Question #6: “Are there revisions to the Disparate Impact Rule that could add to the clarity, reduce uncertainty, decrease regulatory burden, or otherwise assist regulated entities and other members of the public in determining what is lawful?”

The short answer to this question is Yes. We recommend one major, fundamental change which would great enhance clarity and understanding, while greatly reducing uncertainty, in the concepts and operation of the rule: This is to add to the analysis of HMDA data the default rates on mortgages, organized by the same demographic categories as used in HMDA reporting.

Discussion

Applying one’s credit standards in a non-discriminatory way, regardless of demographic group, is exactly what every lender should be doing. Is it evidence of discrimination if a lender applies exactly the same set of credit underwriting standards to all credit applicants, but this results in different demographic groups having different credit approval-credit decline ratios? And is this result evidence of discrimination?

There is a straightforward, data-based way to tell. It is to add the default rates on the mortgages for each group, and compare them to the approval-decline ratios by group, adjusting for ex ante credit risk factors.

If a demographic group A has a lower credit approval rate and therefore a higher credit decline rate than another group B, the revised rule should require comparing their default rates.

There are three possible outcomes:

- If group A has the same default rate as group B, then the underwriting procedure was effective and the different approval-decline ratios were appropriate and fair, since they resulted in the same default outcome. Controlling and predicting defaults is the whole point of credit underwriting. Here there is no evidence of disparate impact.

- If the default rate for group A is higher than for group B, that shows that in spite of the fact that group A had lower credit approval and higher decline rates, it was nonetheless being given easier credit standards. The process was evidently biased in its favor, not against it, even if this was not intended. Again, there is no evidence of disparate impact.

- If on the other hand, group A’s default rate is lower than that of group B, that shows that group A is experiencing a higher credit standard, even if this is not intended. This may be evidence of disparate impact.

As Nobel laureate in economics Gary Becker wrote, “The theory of discrimination contains the paradox that the rate of default on loans approved for blacks and Hispanics by discriminatory banks should be lower, not higher, than those on mortgage loans to whites.”

In short, if the default rate of group A is equivalent or higher than that of group B, then the claim of disparate impact disappears.

Some discussions of the disparate impact issue have analyzed different demographic groups by household income or other credit factors, but while these factors may be indicators of future default rates, they are not the experienced reality. Any sufficient analysis must add the reality of the actual default rates.

In sum, we need the facts of default rates to address this issue objectively. We recommend that HUD’s revised rule should require them to be provided as an essential part of the analysis of any possible disparate impact issue.

The default data by HMDA category is not now readily available from typical mortgage servicing records, but research at the AEI Center on Housing Markets and Finance has shown that the required matching of HMDA to relevant risk and performance data is practicable, as well as theoretically required in order to, as a factual matter, determine any disparate impact.

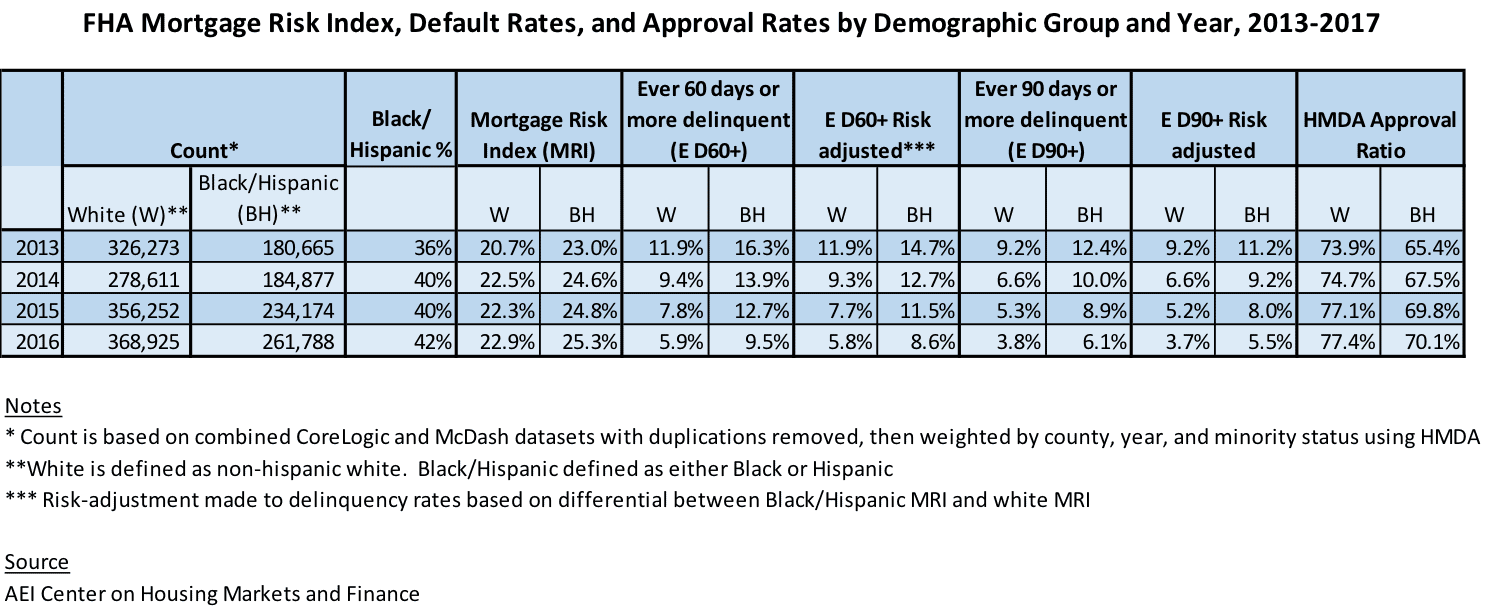

For example, the experience of FHA loans for the years 2013 to 2017, comparing credit approval ratios to default rates by demographic group is shown in Attachment A. In all cases, although the credit approval ratios for minorities are lower, their default rates are higher, as are their risk-adjusted default rates, indicating no disparate impact in the aggregate.

We look forward to sharing with you with the further data the Center is developing to help advance the appropriate policy considerations.

It would be a pleasure to discuss this recommendation further with you at your convenience, should you so desire.

Thank you again for the chance to participate in this timely reconsideration.

Yours respectfully,

Alex J. Pollock Edward J. Pinto

Distinguished Senior Fellow Co-director

R Street Institute AEI Center on Housing Markets and Finance

[email protected] [email protected]

202-900-8260 240-423-2848

Attachment: FHA Mortgage Risk Index, Default Rates, and Approval Rates by Demographic Group and Year, 2013-2017

Attachment