Southern Value of Strengthening Competition on the Midcontinent Grid

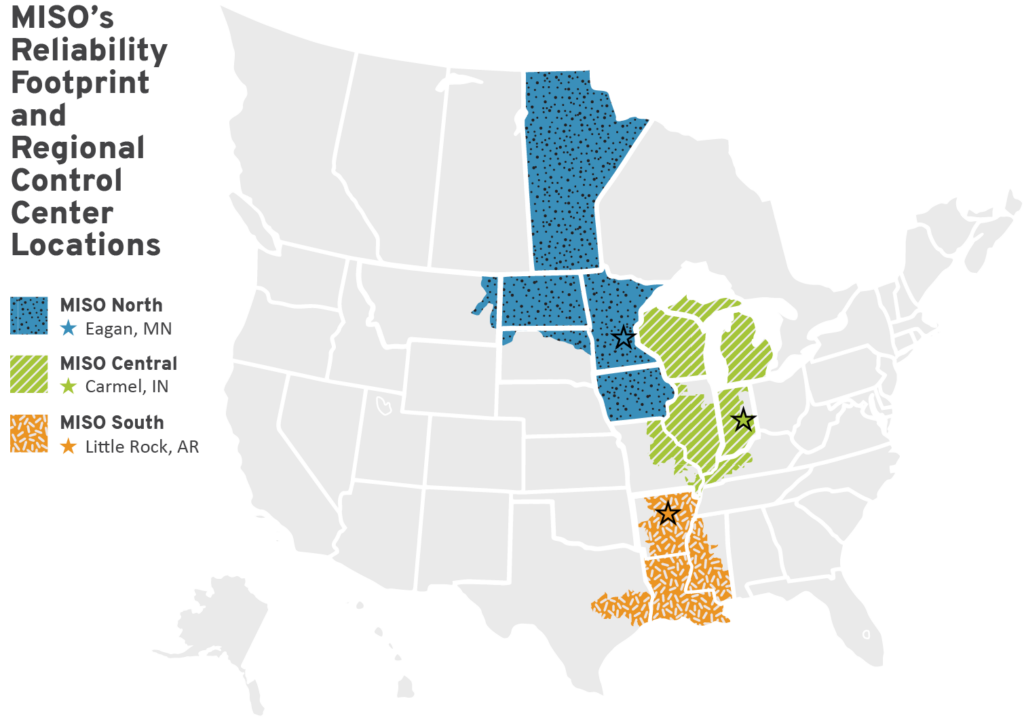

The Midcontinent Independent System Operator (MISO) is the air traffic controller of the grid. It is responsible for operating and planning the transmission system reliably, cost-effectively and transparently to meet the needs of 15 Midwest and southern states (and the Canadian province Manitoba). To do this, MISO administers organized wholesale electricity markets and manages transmission flows. Membership is voluntary, and to demonstrate its value, MISO conducts a value proposition assessment.

MISO is divided into three parts: North, Central and South. Power flows between the parts and is planned together. However, actual investments are increasingly done independently by region, which raises a number of concerns. MISO is in the midst of its Long Range Transmission Planning (LRTP) initiative, which is an effort to identify areas in need of new transmission to connect new generation being built inside MISO as well as to facilitate better power flows and exchanges with its neighbors.

Increasingly, new generation additions, especially wind power, come from MISO North. New transmission projects enable transfer of this electricity but carry additional costs. These new transmission costs have sparked disputes about the value of MISO from stakeholders in MISO South. This makes a review of MISO’s value proposition worthwhile, especially in context of the net benefits that accrue to its southern region.

MISO South Concerns

MISO South has a very narrow connection with MISO Central. In practice, this means that MISO South plans and operates within its region with limited assistance from the rest of MISO. Rather than strengthening those connections, some MISO South stakeholders seek to keep those connections weak, to the detriment of reliability, resilience and cost savings.

Generally, MISO South regulators are concerned about paying for infrastructure in MISO North or Central based on the perception that it does not benefit their region. Instead, they want their own set of benefits and cost recovery mechanisms. This perspective ignores shared benefits and costs from the integrated system; MISO South is not an island. To date, the MISO South regulators have not proposed what MISO South-specific benefits they want MISO to use in evaluating transmission costs and benefits.

Critiquing the MISO Value Proposition

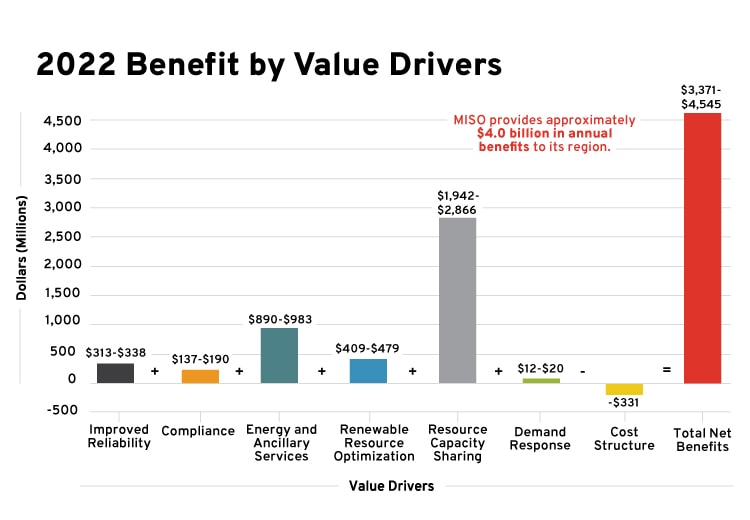

MISO’s value proposition analysis found roughly $4 billion in net benefits to members with a benefit to cost ratio of 12:1. This ratio may more than double by 2040 with changes in the resource mix. In particular, MISO helps optimize renewables and capacity sharing of resources to reduce the need to build additional assets. Despite these benefits, certain MISO South stakeholders, including state regulators, question the value to the region.

Though not broken down by region, the analysis contains quantitative benefit and cost categories worth deeper examination. Some added context can help interpret the salience of aggregate categories for MISO South. Stakeholders should factor in several qualitative considerations as well.

Improved Reliability is calculated by determining a decreased amount of outages multiplied by cost of outages—roughly $10K/megawatt hour (MWh). Treating MISO homogeneously overstates the value in MISO South, while understating it in MISO North. The small transfer capacity between the two areas restricts reliability benefits, which would be larger with investments that bolster transfer capacity. MISO South, as the smaller of the MISO regions, inherently has either higher risks of outages or higher costs for the same level of reliability.

By relying solely on transmission and generation inside the MISO South region, MISO South is significantly increasing its risks of outages and higher costs, creating a more fragile system. Due to weak connections, available generation from MISO North is costlier to deliver electricity to MISO South. If MISO South, instead, had stronger connections to MISO Central, it would be easier and more cost-effective for electricity to be delivered to MISO South. This would also allow MISO South to rely on the rest of MISO for electricity during weather events or other situations. Instead, major limitations on imports from outside regions cause MISO South to over-rely on its internal resources.

If there is a widespread outage, such as due to a hurricane, MISO South may not have the necessary resources to bring the system back on line and makes its system more fragile. A report by the American Council on Renewable Energy found that if there were stronger ties between MISO North and MISO South, the region would have saved $85 million per gigawatt (GW) of transmission capacity during Winter Storm Uri in 2021. Price differences between MISO North and MISO South were extreme throughout the event, routinely hitting $500/MWh.

Resource Capacity Sharing is the largest component of MISO calculated value and is directly tied to the resilience and reliability of the electricity system. The savings directly arise from the diversity of demand patterns across the region, resulting in 16-22 GW of estimated reduced installed capacity, while providing the same level of reliability. In other words, by being in MISO, MISO utilities do not need to procure as much capacity, which lowers their planning reserve margin, saving customers money for resources that do not need to be built or procured. By being able to share resources and services, such as capacity, MISO members benefit by avoiding construction of new peaker plants to meet local need when, instead, MISO utilities can leverage the overall system capacity resources.

Interregional coordination helps to reduce and manage congestion or stranded MWs, while dispatching the most cost-effective generation when it is available. It also helps converge prices on both sides of a regional border for increased market efficiency. Furthermore, interregional coordination is critical when generation or transmission becomes unavailable due to an unexpected outage or a weather-related event like Winter Storms Uri in 2021 or Elliot in 2022. This benefit category would increase further with productive reforms like intertie optimization, which can save tens of millions of dollars per year.

Renewable Resource Optimization addresses better integration of renewable energy by ensuring that resources are located more efficiently. This means that new wind resources are built with the overall system in mind, rather than meeting only the interests of the local utility or jurisdiction. This minimizes the risk of overbuilding resources in certain areas, which would increase costs and make it more difficult to integrate and schedule power flows across MISO. Large amounts of renewable resources are best managed across a wide region that can both consume excess amounts of production and also provide services when renewable production declines.

Energy and Ancillary Services savings are the second largest component of savings, even assuming limited transfers between MISO South and MISO North. There is a significant opportunity for MISO South to participate in these products to the benefit of MISO and MISO South customers. For example, the Gulf Coast is home to large amounts of industrial demand, such as oil refineries, that operate 24 hours a day. Improving access to MISO might mean those customers became significant consumers of overnight wind energy.

Demand Response (DR) accounts for under 1 percent of MISO’s total benefit. However, the potential value proposition of DR is far higher. This is a clear example of a benefit category that could grow precipitously with better MISO rules and, most importantly, competitive retail reforms. Nationally, DR is effective in regional transmission organizations (RTOs) with competitive retail suppliers but miniscule in monopoly utility footprints like MISO states, irrespective of RTO status. MISO and state regulators could at least set the stage by lowering barriers to distributed resource participation. Unfortunately, MISO itself seems to be limiting DR participation as its value is projected to remain the same between 2022 and 2040.

Cost Structure is measured as MISO’s administrative cost. This excludes the full participant cost of being in MISO. RTOs involve complex decisions and many stakeholder meetings, and technical and legal expertise for state regulators and other stakeholders is expensive. A holistic analysis would incorporate such costs but would not transform the cost outlook; participant costs may total up to tens of millions annually compared to hundreds of millions for MISO’s administrative cost.

There are qualitative benefits to consider beyond interregional coordination. MISO provides price and information transparency. This allows buyers, sellers and state regulators the opportunity to make better decisions regarding resource additions. Transmission congestion transparency helps inform decisions on how best to reduce congestion costs. For example, MISO’s independent market monitor used this to identify how one grid-enhancing technology (GET) could save over $100 million, which spurred regulatory reform to adopt the technology.

Qualitative costs appear insignificant. Generally, southern stakeholders sometimes express reservations about giving up state autonomy over resource decisions. However, in MISO, states are responsible for resource adequacy. In reality, MISO membership helps state regulators do their job better, such as accessing information to improve utility asset management and planning coordination, rather than relying solely on fragmented local utility planning.

Takeaways

MISO’s value proposition analysis has room for improvement. Its methodology could be refined, assumptions could be better and analyses made more granular, especially at the regional level. Some quantitative benefits may be moderately over- or undercounted, while qualitative benefits and some modest costs are unaccounted. However, even acknowledging its shortcomings, the analysis provides sufficient evidence that all customers receive overwhelming benefits in excess of costs today. Further, MISO’s net benefits are growing with the evolving resource mix.

The policy priority for states is to enrich MISO’s value proposition. A common thread across several benefits categories is that the transfer limitations between MISO South and North constrain benefits, especially to MISO South. Simply put, MISO South stakeholders’ efforts to keep their playground to themselves harms the region and its customers. It stymies cost savings and increases the risks of routine and long-duration outages. Employing regional transmission development using robust cost-benefit analysis with competitive bidding is a staple of the transmission consumer agenda nationally. This sets a north star for MISO’s LRTP and will allow customers to benefit from additional value streams.

Additional MISO and state reforms would further enrich customer net benefits from MISO. Priorities include enabling demand flexibility and distributed resource aggregation, supporting GETs, intertie optimization and expanding competitive supply. Many state large customer groups seek direct access to MISO’s markets; enabling this would lower costs and boost demand flexibility. Altogether, strengthening wholesale and retail competition will enhance net benefits across the MISO footprint.