Potential Effects of the Inflation Reduction Act on Greenhouse Gas Emissions

Introduction

When the Build Back Better (BBB) legislation was first proposed, the R Street Institute (RSI) analyzed several of its major provisions to give insight as to its policy effectiveness. Now that the Inflation Reduction Act (IRA) has become law, RSI performed a similar but shortened analysis of its provisions. RSI finds that the IRA’s major provisions are similar to BBB and abate similar levels of greenhouse gas (GHG) emissions, at an estimated cost of $391 billion versus BBB’s $417 billion. Similar to BBB, some provisions remain highly inefficient. Overall, the IRA can be described as a large, high-cost energy bill with considerable emission abatement potential but also will entail that most energy subsidies will go to firms that would have built clean energy even without additional subsidy. Even with emission abatement from the IRA, it is unlikely that the 2030 emission targets laid out by President Joe Biden will be achieved.

Methodology

To perform the analyses below, RSI utilized the Congressional Budget Office’s (CBO) estimated budgetary effects of the IRA to determine the volume of new clean-energy related equipment and facilities coming online through the 2022-2031 budget window. For example, in the case of the extended energy investment 30 percent tax credit for new solar or other eligible clean energy facilities, we assume that the $2.1 billion of projected tax expenditure in 2023 corresponds to $7.1 billion of new built capacity, and that any new capacity is the same efficiency as existing eligible photovoltaic solar. At such an assumption, $2.1 billion of subsidy supports 5.3 gigawatts (GW) of new capacity, which would produce an additional 11.6 billion kilowatt hours (kWh) of clean energy generation.

From the CBO’s assumptions of subsidy, we derive estimates of the total deployment of new clean energy technology and compare this to the projected clean energy production in the Energy Information Administration’s (EIA) 2022 Annual Energy Outlook (AEO). This allows us to extrapolate the effect of the IRA. We also assume that all new clean energy technology claims the available subsidy.

One limitation, though, is that much of the spending in the IRA for climate change is for policies for which data is limited. As an example, the IRA spends over $2 billion on transmission facilities. As the impact of this spending can be highly variable depending on where it is distributed, we do not assume its effects. This analysis is instead constrained to the major and most predictable provisions of the IRA, such as the production tax credit (PTC), investment tax credit (ITC) and new clean vehicle tax credits which award subsidy based on a specified volume of technological market entry.

Additionally, we assume no barriers to technological uptake. A critique applicable to this analysis, as well as other estimates demonstrating the effect of the IRA and similar legislation, is the assumption that capital availability is the constraining factor in clean energy deployment. In truth, research shows clean energy adoption is increasingly constrained by factors like permitting for electric transmission or low-carbon energy, or behavioral preferences for conventional cars over electric vehicles (EVs).

Electric Power Sector

We expect the most impactful IRA provisions to be subsidies for clean electricity, specifically the PTC and the ITC. The PTC offers a 1.5 cent subsidy for each kWh of clean electricity produced under its criteria, and the ITC provides a 30 percent subsidy for the costs of constructing new clean electricity facilities. The subsidies are mutually exclusive; filers must choose one. The IRA also reforms both subsidies into technology neutral iterations later in the decade. Additionally, there is a tax credit for nuclear energy production, which is applicable to existing facilities, and a credit for residential clean energy. Together these subsidies sum to $179 billion. This analysis did not assess provisions for energy efficiency, transmission or permitting.

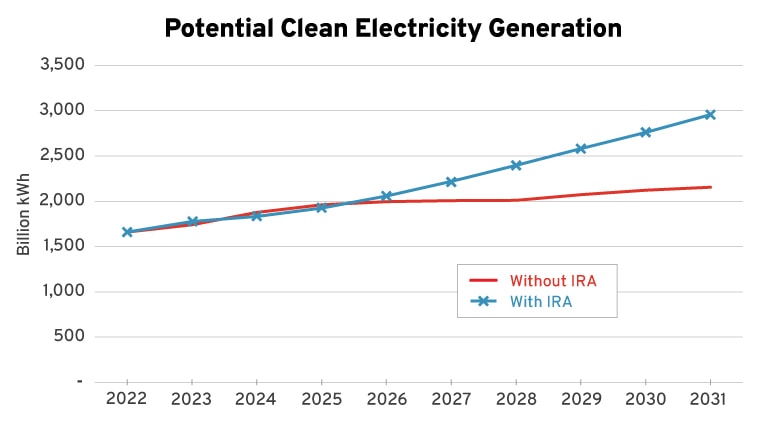

We find that when assuming no regulatory constraints, the additional subsidy leads to an overall 37 percent increase in clean electricity generation over the baseline in the year 2031, with 3.0 trillion kWh of clean electricity in 2031 relative to the baseline of 2.2 trillion kWh (which includes nuclear and hydroelectric resources).

Source: R Street estimates based on CBO cost estimates and EIA AEO 2022.

The PTC is responsible for the largest share of increased generation, accounting for 67 percent of the increase. The ITC is the runner up, accounting for 26 percent of the increase. The nuclear tax credit and residential tax credits make the least difference, accounting for 6 percent and 2 percent of the change, respectively. Overall, 67 percent of the clean energy supported by IRA subsidies is expected to occur even without the IRA.

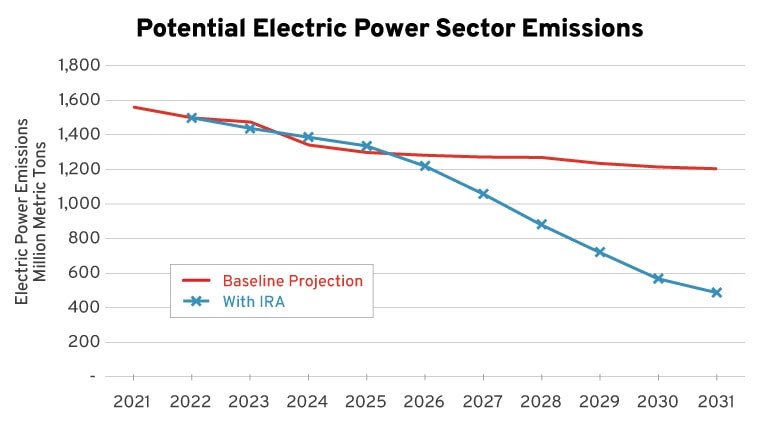

Source: R Street estimates based on CBO cost estimates and EIA AEO 2022.

The GHG emission impact of the electricity subsidies when assuming no barriers to market entry could be considerable owing to the high emission intensity of coal-fired electricity generation. We estimate that by 2031 coal generation could shift from 661 billion kWh to zero, and natural gas electricity generation could be 47 billion kWh lower than the EIA’s baseline projection. By 2031, electric power generation carbon dioxide emissions are 716 million metric tons (MMmt) annually lower than the reference case, at 488 MMmt under the IRA as opposed to 1,204 MMmt without the IRA.

The caveat, though, is these estimates assume no barriers to market entry for new clean electricity, and that all new generation replaces coal power. Research from Lawrence Berkeley National Lab has found that grid interconnection queue timelines have increased from an average of two years to four, and the problem is worsening. There is currently 930 GW of zero-emission electricity generation seeking transmission access, a volume that is nearly as large as the nation’s existing electric generating capacity (1,144 GW). Permitting and transmission constraints may dampen the effect of the subsidies. Simply, these estimates of emission abatement are likely overly optimistic since they ignore real-world barriers to market entry.

Additionally, this analysis and others typically assume a perfect substitutability between renewable energy generation and coal. In truth, electricity markets can become saturated with renewables during their peak times of generation but may be unable to displace fossil resources outside of their peak generating hours without energy storage. The incidence of “curtailment” of renewable energy generation resources is increasing, meaning the marginal benefit of additional renewable resources has diminishing returns.

In a practical sense, electricity demand at any moment is satisfied by the total generating capacity that consumers can access, and there is no added value from having capacity beyond that. Consumers either have electricity or they do not, and they do not benefit from having twice as much electricity. Likewise, generating capacity scarcity during off-peak hours for renewable generation may put upward pressure on demand for fossil fuels. In short, the market is more heterogeneous than RSI and other studies would imply. From a policy perspective, even though these subsidies appear effective on paper, that is an illusory effect of modeling assumptions, when in truth the falling cost of renewable energy without additional subsidy and the projected high market demand coupled with non-capital-related deployment constraints diminish the benefit of additional renewable energy subsidy.

We also assessed the impact of the modified value of the Carbon Oxide Sequestration Credit (45Q), which now pays up to $85 per metric ton of carbon dioxide (CO2) sequestered via carbon capture technology (up from $50 per ton) and up to $180 per ton for abatement via direct air capture technology. The tax credit is expected to cost an additional $3.2 billion through 2031. However, the increased spending on this provision is largely reflected by the increased subsidy value, rather than any expected additional volume of carbon sequestration. While we believe the increased value of the subsidy will increase carbon sequestration, we do not yet know to what degree, and it is not expected to be a large factor in emissions in the near term.

Transportation Sector

To address transportation emissions, the IRA has several forms of subsidy. The largest of these subsidies include $13.2 billion for clean hydrogen, $7.5 billion for new EVs and alternative fuel vehicles, and a $5.6 billion extension of renewable liquid fuels subsidies. Additionally, there is a technology-neutral clean fuel production credit that lasts from 2025-2028, replacing earlier fuel subsidies in the bill such as the sustainable aviation fuel credit. There are also subsidies for used EVs, commercial clean vehicles, alternative fuel type refueling properties, second generation biofuels and grants for reducing air pollution at ports.

We isolate our analysis to the provisions that we expect to have the largest impact over the budget window: subsidies for clean hydrogen; subsidies for biofuels, sustainable aviation fuels and clean fuels; and new EVs. We do not assess the benefit of subsidizing used EVs, since we assume that any acceleration of EV adoption caused by used EV demand would also result in increased uptake of the new EV subsidy, and we do not assess the benefits of subsidizing commercial clean vehicles because of limited data on their projected market uptake.

Electric Vehicles

At a value of $7,500 per vehicle, the modified new EV tax credit could support an additional 1 million EVs entering the market through 2031. However, the EIA projects that there will be 5.8 million EVs sold over the same period, and 9 million vehicles total of the eligible type (EV, plug-in hybrid EV and fuel cell vehicles). This would indicate that most new EVs will be ineligible for receiving the subsidy, and likely that most subsidy claimants would have purchased an EV anyway. We expect the tax credit to have almost no impact on EV market uptake, which is already projected to reach 18.5 percent of total new light duty vehicle sales by 2031.

Clean Hydrogen and Clean Fuels

The tax credits for clean hydrogen and clean fuels are based on their emission improvement over conventional fuels. In assuming that all credits go to zero emission fuels and replace gasoline or their equivalents, we note that the tax credits would, at their peak, support 2.7 billion gallons of biodiesel (roughly equal to total production capacity), and about 1.2 billion gallons of clean fuel. In assuming that this increased production results in permanent, added capacity for fuel production, by 2031, clean fuels and biodiesel would reduce emissions by 31 MMmt annually and clean hydrogen by 52.1 MMmt annually. Though hydrogen will have non-transportation related applications, this analysis simply categorizes it under transportation for simplicity.

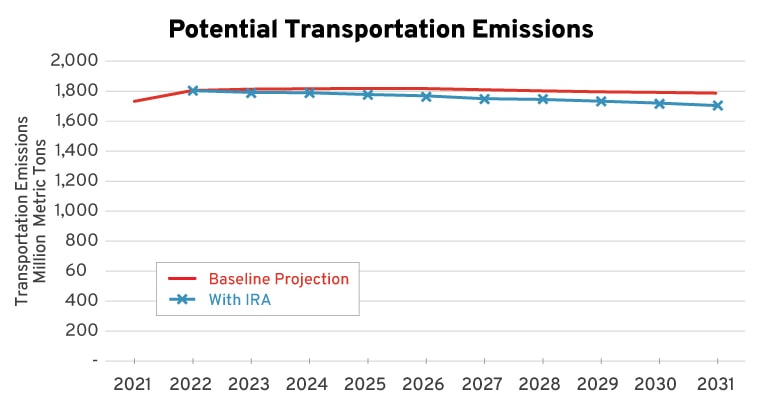

Overall, energy-related CO2 emissions in the transportation sector in 2031 are 5 percent lower than the reference case.

Source: R Street estimates based on CBO cost estimates and EIA AEO 2022.

Although the subsidies have little effect on emission mitigation over the budgetary window, the transition to a clean fuel tax credit is a positive policy development. There are a variety of competing opportunities for clean fuel types, such as renewable diesel, e-fuels and advanced biofuels. A fuel credit based on emission mitigation properly incentivizes innovation for fuel abatement. The more economically efficient policy would be the implementation of a carbon tax, which would deliver incentives for both innovation and reduced consumption while raising revenue that could be utilized to lower other taxes.

Unassessed Provisions

The provisions assessed in this analysis account for $213.4 billion of the IRA’s $391 billion in energy and environmental-related spending. These unassessed provisions are largely grants or smaller, issue-specific programs that are not expected to have significant climate benefits in isolation. In the cumulative analysis, it is likely that these programs will have some emission benefit, but we expect these programs to be less efficient on average than the ones assessed above. This is not to diminish their importance, as these programs may be essential in fostering innovation and nascent markets, but merely to explain that we do not expect them to alter the expected emission outcomes assessed significantly.

Overall Change in Emissions

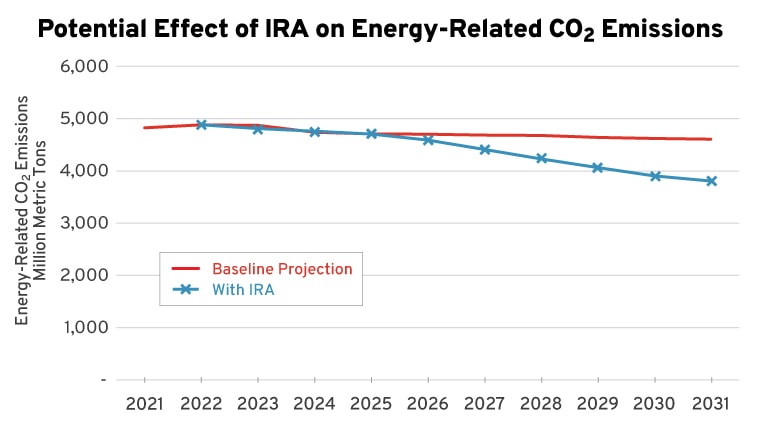

By 2031, energy-related CO2 emissions are projected to be 3,808 MMmt annually, down from the projected 4,607 MMmt, with 95 percent of the benefit coming from changes in the electric power sector.

Source: R Street estimates based on CBO cost estimates and EIA AEO 2022.

In terms of stated political climate objectives, particularly President Biden’s hoped-for 50 percent emission reduction from 2005 levels by 2030, the IRA is expected to be insufficient. Projected 2030 emissions in the reference case are 23 percent below 2005 levels, and with the IRA are potentially 35 percent below 2005 levels. We estimate optimistically that with no energy deployment constraints the IRA could reduce emissions in 2030 by approximately 12 percent of 2005 levels, or about half of the amount needed to reach President Biden’s climate target.

We note that our optimistic estimated emission abatement potential is consistent with the Rhodium Group analysis of the IRA, which estimated the law would lower emission levels to 30-40 percent below 2005 levels. However, both estimates are well below Princeton University’s REPEAT Project, which estimated the IRA could reduce emissions to 42 percent below 2005 levels. This is owing to Princeton’s broad assumption of reduced transportation emissions caused by the reformed subsidy, where they assume that all EV related infrastructure subsidies have a contributive effect on reducing EV costs. The reformed structure of EV subsidy under the IRA, though, narrows the scope of eligibility for subsidy and is reducing investment in EVs, so the assertion that relatively minor changes to subsidy structure and modestly increased investment make such a large difference in EV adoption is uncertain.

Economic Considerations

The CBO has estimated the effect of the IRA on inflation to be between -0.1 and +0.1 percent, or a mean of effectively no effect. The CBO notes that the reductive effects on inflation from higher taxes are offset by the worsened inflation caused from increased spending. The CBO did not produce a concrete estimate on the IRA’s effect on gross domestic product (GDP) but noted that higher taxes on corporations will reduce their incentives to invest and produce in the United States, and other policies will reduce the incentive for workers to join the labor force. The positive effect of reduced deficits was not assessed by the CBO.

From an environmental economics perspective, the IRA should not be expected to have an overall positive effect on the economy. While the environmental provisions will stimulate increased investment in the subsidized sectors, the benefit from such will be offset by reduced investment in others. Similarly, the tight labor market with an unemployment rate of 3.7 percent coupled with high inflation means that any increase in jobs in subsidized sectors will likely mean equitable reductions in the workforce elsewhere in the economy. There will be some monetized benefits from reduced pollution, which we would expect to come largely from reduced coal consumption, but these benefits are supposed to be captured under National Ambient Air Quality Standards even without legislation such as the IRA.

There are capturable climate benefits, but it should be noted that the cost in achieving them via subsidy is likely greater than the benefit. A simplistic abatement cost comparing the total value of the subsidy to the estimated change in emissions yields a $71.7 per ton abatement cost for the IRA’s electricity subsidies, and a $65.8 per ton cost for its transportation subsidies. Both of these values are above the currently estimated $51 per ton global benefit or $7 per ton of domestic benefit. Our estimate of abatement cost is likely far lower than will be economically realized, as it does not account for the heightened economic impacts of subsidy from the deadweight loss of additional taxes, and it presumes perfect substitution of fossil resources. Nevertheless, we state these figures here to point out that climate benefits alone should not be expected to yield economic improvements under the IRA.

The overall effect of the IRA on environment and energy is to steer money from other sectors of the economy to energy investments via corporate taxes. The largest shares of the subsidies will go to efforts that would have occurred without the IRA, indicating that a more efficient subsidy structure could have captured similar benefits at a reduced economic impact to Americans.

As an example, several carbon pricing proposals are estimated to have been able to reduce energy related CO2 emissions to between 3.6 billion and 2.4 billion metric tons in 2030, whereas we estimate the IRA to bring energy related CO2 emissions to 3.9 billion in 2030. Using carbon price revenues to reduce either corporate income taxes or payroll taxes are expected to have positive effects on GDP. While the IRA delivers some environmental benefits, it does so in a highly economically inefficient manner compared to competing policy opportunities that could have been pursued under budget reconciliation.

Conclusion

The IRA may significantly reduce emissions from coal owing to the large volume of subsidy directed for low-carbon electricity generation. Realization of this benefit, though, could be constrained by continued permitting delays or lack of energy storage to satisfy demand during renewable generation’s off-peak hours. The IRA’s effects on transportation are modest, with most of the benefits coming from increased subsidies for alternative fuels. For both electricity and transportation, reforms to subsidy structure to embrace technological neutrality are positive developments that will improve the efficiency of the subsidies by rewarding emission abatement over technological preference.

Overall, though, the IRA achieves these outcomes in an economically inefficient manner. Despite its name, it is not expected to yield any improvement on inflation. The environmental outcomes it achieves will be captured at a higher cost than competing policy opportunities, such as a revenue-neutral carbon price. A lesson from the IRA for policymakers will be at what cost they achieve their policy outcomes, as a preference for subsidy over market-based policies exhausts Congress’s limited resources to address current and future policy challenges.