Potential Benefits and Costs from Phasing out Oil and Gas Production on Public Land

As part of a flurry of executive actions, President Joe Biden has formally directed the Secretary of the Interior to pause all new oil and natural gas leases on public lands, pending the completion of a “reconsideration of Federal oil and gas permitting and leasing practices.” An optimistic reading of the policy would indicate, perhaps, an attempt to tackle finally the longstanding mismatch between the low royalty rates of oil and gas extraction on public land and the higher typical rates charged by private landowners. Alternatively, a cynical view would be that this is part of an effort to end fossil fuel extraction from public land altogether—a stated priority of the National Resources Defense Council, whose former president and CEO now manages the administration’s domestic climate policy efforts.

Executive actions such as moratoria are not subject to the same sort of benefit cost analysis and oversight as other policy initiatives, which leads to a question of just what climate benefits will be achieved by the oil and gas moratorium, and at what cost it comes. This analysis looks to prior assessments from the U.S. Energy Information Administration (EIA) on the impacts of constraints on oil and gas supply. Broadly, this analysis finds:

- Emissions reductions could be between 0 and 123 million metric tons by 2030 assuming a full phaseout of oil and gas production from public land with no substitution from private land;

- Upstream emissions from increasing production from foreign suppliers dampen global emission benefits, increasing foreign emissions by 49 million metric tons from Russian supplies replacing U.S. liquefied natural gas (LNG) exports;

- Economic impacts could be substantial from a phaseout of oil and gas production from public land, with an impact of between $0 and $251 billion annually by 2030, which would entail economic damage of over $2,000 per abated ton of greenhouse gas emission, making it among the most cost-ineffective emission abatement policies to date; and

- Low royalty rates create an implicit oil and gas subsidy of $1.4 billion, and the administration should move quickly to implement new royalty rates consistent with private land market value, since a moratorium risks more economic harm than benefit.

At the end of the day, policies which constrain supplies will put upward pressure on prices and increase costs, and absent any changes to demand, the domestic emission cuts may be offset by upstream increases elsewhere. As a result, executive actions targeted at oil and gas production from public land are, not surprisingly, a very high-cost emission abatement method with low climate benefit potential.

The State of Oil and Gas Development on Public Land

The federal government owns approximately 28 percent of land in the United States and is also responsible for offshore waters. The control of this land is largely a relic of land purchases the United States made many years ago, such as the Louisiana purchase, and the lack of any efficient means to fairly parcel the land. Most of this land is in the Western United States. For natural resources on these lands, the federal government typically leases access to developers. Leases are auctioned, and royalties are paid for resources extracted, making the land a revenue source. A fossil fuel lease lasts up to 10 years, and extraction requires a permit that must be renewed every two years.

Oil extraction from federal land in 2019 was 2.66 million barrels per day, or about 22 percent of total U.S. oil production. Natural gas extraction from federal land was 4.3 trillion cubic feet in 2019, or about 13 percent of total U.S. dry gas production. Revenues from oil and gas extraction in 2019 were $8.4 billion. Unfortunately, 2020 calendar year data is not yet available, but fiscal year data shows modest declines in production, and a roughly 37 percent decline in revenues, as a result of depressed demand and prices during the pandemic.

The effects of the moratorium on leases are, at this juncture, difficult to estimate because it is not yet known what would satisfy the administration’s upcoming standards for new leases. It is possible that the requirements of such leases could be little different from existing ones. But the outright moratorium before revision suggests that new lease requirements may substantially increase the difficulty of extracting oil and gas from federal lands, perhaps to the point that production is significantly reduced.

Ideally, when the administration has provided details on the full extent of what policy will be required to lift a moratorium, it will be possible to perform robust analysis that estimates the full benefits and costs of the policy changes. However, since the policy action has come from an executive order, its effects will be put into motion immediately and without analytical review. In the absence of any potential for immediate econometric analysis, this piece attempts to provide upper-bound impact estimates that can offer ballpark figures to inform policy analysis.

For insight as to the effect of the moratorium, we note that an indefinite moratorium would result in an eventual phaseout of oil and gas resources from federal leases by 2030. Further, the decline in available resources would be comparable to the low oil and gas supply scenario estimated by the EIA as part of its Annual Energy Outlook (AEO). As a note, offshore leases may not fully expire until 2032, since lease programs occur every five years (2022, 2027, etc.), but for simplicity this analysis assumes full phaseout of oil and gas production from federal leases by 2030.

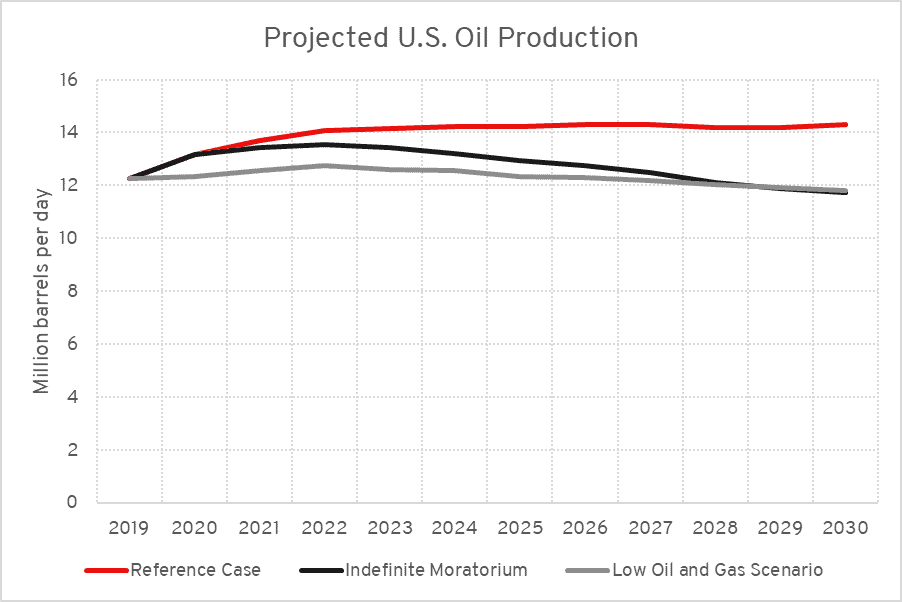

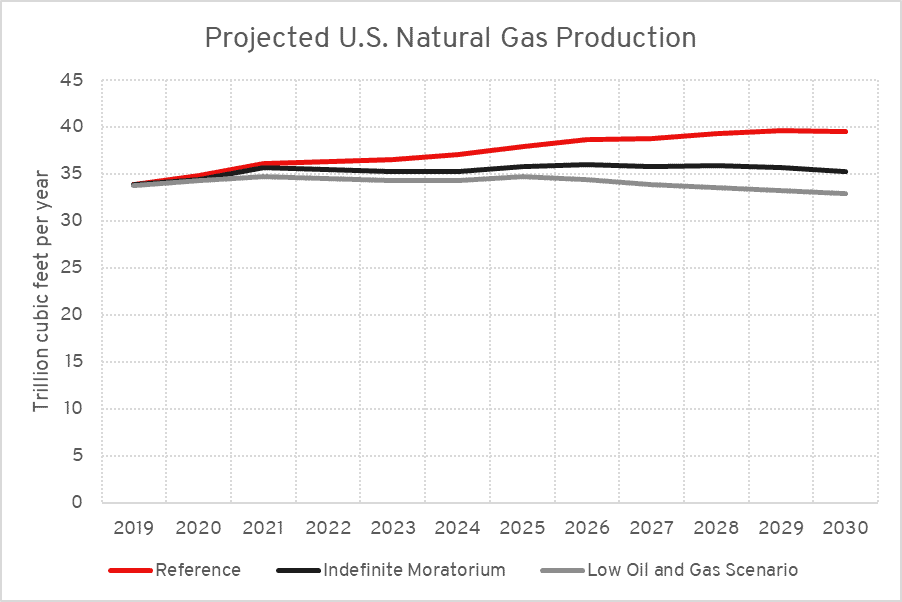

The graphs below show production changes for the reference case, low oil and gas supply scenario, and an indefinite moratorium that ends oil and gas extraction from federal land by 2030. To be clear, 2020 through 2030 are projected years, since the 2020 AEO does not include 2020 data.

Sources: AEO 2020, STEO (January 2021), ONRR

The data above compares the effect of an indefinite moratorium on oil and gas production from public land relative to the EIA’s low oil and gas scenario. A few caveats should be noted, though. The EIA’s estimates assume reduced supply of fossil resources from all lands, regardless of if they are public or private, but the Biden administration’s policies only impact public lands. Producers on private land may pick up slack from those on public land, and this would have the dual effect of both minimizing any emissions reduction as well as minimizing any economic impact. For the purposes of this analysis, though, it is assumed that reductions in production from publicly owned land results in a static supply reduction.

In comparing the EIA’s low oil and gas supply case with phased out oil and gas production from public lands by 2030, the indefinite moratorium has a supply change in between the reference case and the low oil and gas supply case. The EIA’s low oil and gas supply case estimates a 6.6 trillion cubic feet per year reduction in natural gas supply and 2.5 million barrels per day reduction in oil supply, whereas an end to oil and gas production on public land would reduce natural gas supply by 4.3 trillion cubic feet per year and oil supply by 2.66 million barrels per day. In comparing these cases, an indefinite moratorium has 107 percent of the EIA’s estimated reduction in oil supply, and 65 percent of the EIA’s estimated reduction in natural gas supply in 2030.

A fair insight is that the EIA’s low oil and gas supply case offers an upper-bound estimate of both cost and emissions benefit, and the economic impact and emissions benefit of an indefinite moratorium would lie somewhere between the reference case (a starting point of zero) and the estimated impacts from the low oil and gas supply case. In the comparisons below, this analysis illustrates what the impact from the EIA’s low oil and gas supply case would be, and how proximate such estimates may be to an indefinite moratorium on oil and gas production from public land.

Greenhouse Gas Emissions Impacts

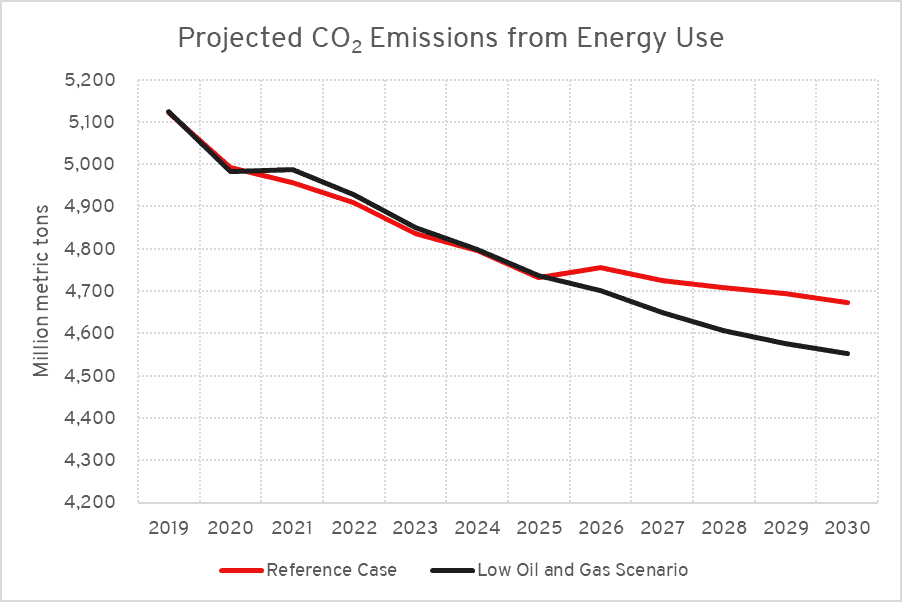

The EIA’s estimated emission reductions under the low oil and gas supply case are 123 million metric tons of CO2 from energy use by year 2030, or roughly 2 percent of the United States’ 2005 peak greenhouse gas emissions.

Source: AEO 2020 (axis does not begin at zero)

For reference, natural-gas-related CO2 emission reductions in 2019 were 525 million metric tons (from replacing coal with gas), and renewable-energy-related CO2 emission reductions were 330 million metric tons, meaning the moratorium would have only a relatively small greenhouse gas benefit compared to what has been occurring due to fuel-switching.

It should be noted, though, that focusing on domestic emissions may be misleading, because the EIA estimates that diminished natural gas production in the United States would, not surprisingly, reduce natural gas exports. Most of these gas exports are either displacing coal abroad or other natural gas competitors. In the EIA’s low oil and gas scenario, LNG exports are 1.2 trillion cubic feet lower per year in 2030 than the reference case.

To understand what reduced natural gas exports could mean for global emissions, one can look to Europe, the United States’ largest LNG customer. In 2019 Europe imported 607 billion cubic feet (17.2 billion cubic meters) of U.S. LNG, and has 1.2 trillion cubic feet worth of offtake agreements (representing the expected future export volume of LNG to Europe). The United States’ primary competitor for natural gas supply in Europe is Russia. The life cycle emissions (carbon dioxide equivalent) of Russian natural gas exports to Europe are currently 41 percent higher than U.S. LNG to Europe, on account of the extremely long pipelines required to transport the gas from Russian gas fields to Europe (which requires considerable energy to transport).

If the United States were unable to export LNG to Europe as expected, and if that 1.2 trillion cubic feet of demand was supplied by Russia instead, the upstream emissions increase in Russia would be 49 million metric tons per year (7732 Btu/kWh, 168 million MWh potential from 35 billion cubic meters, and life cycle emissions of 1,016 kgCO2/MWh versus 719 kgCO2/MWh). This means that if natural gas production in the United States is reduced when it would have otherwise replaced coal or higher emitting competitors then increased foreign emissions could diminish benefits from domestic emission reduction.

The displacement effects of emissions are not unique to fossil fuel production, and indeed agriculture is the classic example of an industry where reduced U.S. production can result in pollution and habitat destruction abroad as foreign producers fill the gaps. To at least some extent, reduced oil and gas production domestically will spur increased production abroad, meaning policymakers should not expect reduction in domestic oil and gas production to yield much if any global emissions benefit.

Economic Implications

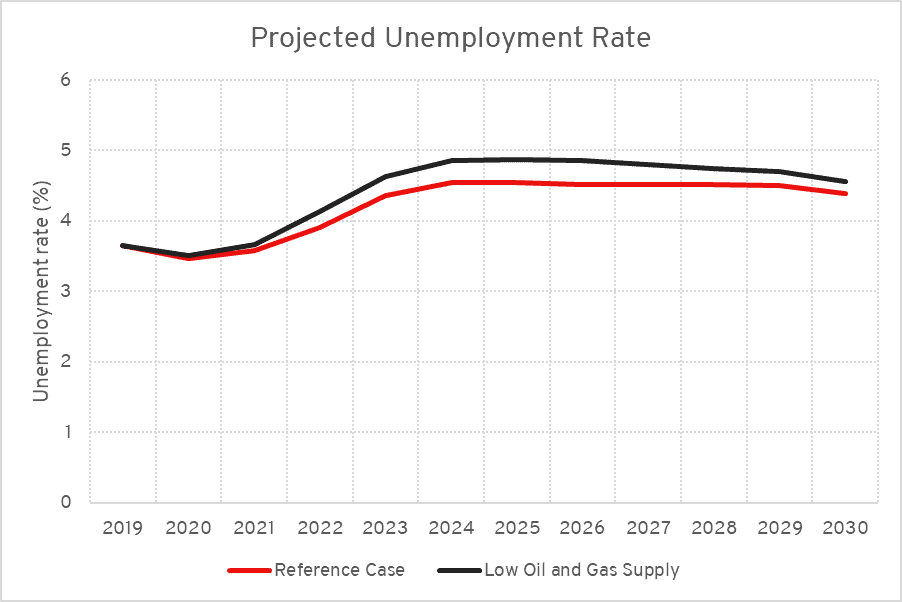

Similar to its emissions estimate, the EIA also estimated the economic implications of a low oil and gas supply on the United States. Not surprisingly, energy expenditures increase, on account of constrained supplies. In the EIA’s estimate, real GDP is $251 billion below the reference scenario (2012 dollars by 2030), and the unemployment rate is 0.17 percent higher. As would be expected, constrained energy supplies are anticipated to be bad for the economy.

Source: AEO 2020

The EIA’s estimate, similar to the emissions impacts, likely represents an upper-bound economic cost that an indefinite moratorium could have. Alternatively, the EIA’s estimates could be more optimistic than would occur, because the EIA is assuming at least some replacement of oil and gas with coal—something unlikely to occur alongside policies that stymie oil and gas, given coal’s significantly more carbon intensive footprint.

But the EIA’s estimates are certainly in the ballpark of the effect a phaseout of fossil fuel production from federal land would have. For oil alone, the EIA estimates about a 2.5 million barrel per day drop in production, and an increase of 2.3 million barrels per day of increased imports, or just shy of a billion barrels a year for both. At an estimated $50 per barrel (in line with EIA’s latest estimates), the United States would forgo $47 billion worth of production, and import $42 billion more oil, which would have a combined GDP impact of $89 billion. Foregone natural gas production from federal land would amount to $43 billion (at $10 per thousand cubic feet, or $22 billion at $5 per thousand cubic feet), though production would still be high enough that the United States would remain a net exporter. Indeed, a phaseout of oil and gas extraction from federal land could have economic costs that exceed $100 billion in GDP annually by 2030 before even considering the interactive effects of increased energy prices.

Regardless of the precise magnitude of the emission and economic impacts of the policy, the marginal effects offer the most insight as to the impact of an indefinite moratorium. The relevant takeaway is that in the EIA’s low oil and gas supply case it expects $2,041 of economic damage for each metric ton of domestic emissions abated in the year 2030. This would make policies designed to constrain oil and gas production absent any shift in their demand among the costliest methods of abating emissions; nearly fivefold the abatement cost of the Cash for Clunkers program. This estimate does not incorporate the expected foreign emissions increase, which would push the per-ton abatement costs even higher.

There is also a revenue implication from an indefinite moratorium. The average revenue over the past decade from oil and gas on federal land has been $8.3 billion annually. Assuming a decline of 10 percent per year, consistent with an eventual phaseout of federal oil and gas development, lost revenues would be $45.7 billion from 2021 through 2030. This amount would have to be recouped in some other fashion, such as a tax increase or spending decrease to offset the revenue loss. Those policies would also entail their own economic costs. There is also an environmental question as to whether there could be more environmental benefit to be gleaned from using oil and gas revenues from public lands to fund clean energy research and development, rather than diminishing available oil and gas supply.

The EIA also estimates in its low oil and gas resource scenario that electricity prices would rise by 4 percent, and motor gasoline prices by about 1 percent. These rises are, all things considered, quite modest, but it should be noted that increased coal consumption and oil imports are responsible for the moderation of cost increase. Further, because energy costs are typically regressive, the average cost increases may not reflect the full economic impact to low-income Americans, who would bear more of the burden of increased energy costs.

Foreign Policy Impact

Energy sales exist in a global market, and constraints on supply in the United States induce foreign suppliers to increase their production. It is a troublingly pervasive myth that policies that exclusively target private-sector energy companies will stimulate a sea change in global energy consumption. The truth is that it is estimated more than 75 percent of crude oil production globally is controlled by governments. Some countries, such as Russia, Iran and Venezuela, leverage the energy resources they control to elicit foreign policy concessions from their rivals. Early alternative energy efforts in the United States, including the formation of the Department of Energy, were mostly focused on weakening the ability of foreign governments to use what used to be referred to as “the oil weapon.”

Reduced energy production in the United States has the double effect of raising prices and increasing revenues for foreign suppliers that may fill the breach. It is outside the scope of this analysis to estimate exactly what sources would replace oil and gas from federal lands, but the relatively modest expected increase in oil price could mean substantial revenues for foreign rivals. For example, Russia exported 2 billion barrels of oil in 2019 (270 million metric tons). A $4 increase in the price of oil by 2030 (as estimated in the EIA’s low oil and gas supply case) would increase Russia’s revenues by $8 billion, or enough to procure 184 of its Su-57 5th generation stealth air superiority aircraft (estimated unit cost of $42 million each).

Conventionally, energy security policies have focused on minimizing demand for foreign-produced energy. A moratorium on federal leases for oil and gas extraction has the opposite effect and increases demand for foreign energy supplies. Plainly, policies that restrict energy development in the United States will be a boon to oil-exporting nations.

The Policy Pathway

The key issue to be remedied via policy relating to oil and gas leases on federal land is the imbalance of oil and gas royalty rates between public and private extraction. One analysis estimated that conventional private royalty rates range between 12 and 25 percent, but royalty rates for federal lands is 12.5 percent—unchanged since 1920. Rates for offshore resources are 18.75 percent. Absent government, all extraction would occur on private land, and competition would determine the appropriate royalty rate, but the reality is that significant amounts of oil production occur on federal land and politicians are responsible for setting a royalty rate.

A rate that is too low is an implicit subsidy and creates a preference for oil extraction from federal land at the expense of taxpayers (who lose revenue), and private landowners (who either lose leases or must lower their rates to be below market). A rate that is too high is also problematic. If royalty rates are above the market norm for federal land, fewer leases would occur than would otherwise be optimal, diminishing revenues to the government (and must be made up for by other taxpayers), and constraining energy supplies (which puts upward pressure on prices). A simple recommendation that has been offered before is to simply make all royalty rates 18.75 percent across the board, which would put federal leases in rough parity with private ones.

In 2019, royalty revenues from oil and gas extraction from federal onshore land was $2.7 billion. An increase from 12.5 percent to 18.75 percent would increase that revenue to $4 billion (assuming no change in production), an overall increase of $1.4 billion (rounded).

The policy of complete moratoria on leases, though, could be considered overkill. If the Biden administration acts quickly to restore the potential for oil and gas leasing while raising royalty rates to eliminate the implicit oil and gas subsidy, economic impacts may be generally unchanged (or even improved, on account of elimination of a subsidy). Further, royalty revenue could be modestly improved providing oil and gas production does not decline too much in response. On the other hand, if the moratoria are dragged out as part of a move to end oil and gas production from federal land altogether, the economic impacts from constrained energy supplies will quickly begin outweighing the benefits of eliminating the subsidies.

The optimal policy path forward is for the Biden administration to increase royalty rates quickly, which would eliminate the implicit oil and gas subsidy, and reopen leasing consideration.

Conclusion

The estimates above represent the upper end of the potential impact from an indefinite moratorium on oil and gas extraction from federal lands, or similar policies that constrain energy supplies to such extents. The total impacts may be less than what is presented in the EIA’s low oil and gas resource scenario, but importantly they will not be zero either. The insight to be gained from the EIA is that constraints on energy supply that could exceed 20 percent of production for oil and 10 percent for gas have significant economic implications—including regressive effects—but deliver little emissions benefit. The Biden administration would be wise to expedite its revisions to leasing policies as soon as possible, lest the move merely end up being a wealth transfer from Americans to foreign energy suppliers.

Image credit: Thaiview