Florida Insurance Disaster Averted

In March 2023, both chambers of the Florida Legislature passed comprehensive, consequential tort reform bills. House Bill 837, a companion bill to Senate Bill 236, took direct aim at a welter of runaway lawsuit abuses that conspired to make Florida homeowners insurance unreasonably expensive and well-nigh unavailable from Floridian insurance companies teetering on the brink of collapse. If tort reform measures were not passed, the June 1, 2023 reinsurance renewal cycle could have found Florida’s insurers having to pay significantly more for reinsurance or unable to obtain reinsurance. This would have caused homeowners’ insurance premiums to reach nosebleed levels, posing an existential threat to Florida insurance company impairments—and potentially resulting in more insurers leaving the state.

The bold measures contained in HB 837 did not pass without opposition. Florida Justice Association President Curry Pajcic, representing the powerful Florida plaintiff bar, issued a call to arms: “Florida is under attack. HB 837/SB 236 are a direct assault on the rights of every Floridian by insurance companies and corporate elites who think they can dictate which rights should be preserved and which can be tossed aside.” In this piece, we unpack the issues that led to the passage of the bold tort reform measures contained in the Florida legislation. We do this by identifying symptoms of Florida’s insurance crisis and causes, as well as by describing the measures taken to get Florida’s troubled insurance market off life support.

Symptoms

Symptoms of Florida’s flawed insurance market include a string of recent Florida insurance company failures; financial difficulties; Florida insurers leaving the Sunshine State; elevated premium cost; rating agency turmoil; challenges obtaining reinsurance; and a bloated insurer of last resort becoming the only insurer. Additionally, the average homeowners’ insurance policy in Florida cost $4,231 in 2022—close to three times the national average of $1,544.

Company Failures

Following Hurricane Michael in 2018, three years without landfalling hurricanes was ended by Hurricane Ian in 2022. Yet in this period, there were seven Florida insurer insolvencies. Considering that Hurricane Andrew, which caused $31 billion (inflation-adjusted) in insured losses in 1992, caused seven Florida insurers to topple three decades ago, it is reasonable to worry about how insurers will handle the inevitable return of hurricanes to the storm-exposed peninsula and panhandle.

Property and casual (P&C) insurance company failures are rare events. Insurers typically have fortress balance sheets, with assets exceeding annual revenue by several factors to generate investment income, offsetting underwriting losses. For example, in 2010, following the recession, there were 157 bank failures, and only eight P&C insurance company failures. The number of insurance company failures in that year was no higher than the long-term average, but the number of bank failures was 20 times higher than the long-term average. In the entire P&C industry, which contains approximately 2,900 U.S.-domiciled insurers, the number of annual impairments is approximately one-fifth of 1 percent, or 0.2 percent of the total population of insurers. There were only five impairments of U.S. P&C insurers in 2019, four in 2018 and seven in 2017. The fact that there are now several Florida insurers failing each year at a time when the state has been spared from landfalling hurricanes is a cause for alarm.

When Middleweights Fall

Another troubling feature of the current string of Florida insurer failures is that two of the fallen are among the five publicly traded Florida insurers: FedNat Insurance Company (FedNat) and United Property and Casualty Insurance Company (UPC). Both are sizeable insurers, with FedNat writing $584 million in 2021 net premium and UPC writing $590 million. In FedNat’s 2021 10-k form, released on April 25, 2022, FedNat, which reported $183 million in 2021 premium, reported “[t]he Company has recently concluded that there is substantial doubt regarding its ability to continue as a going concern under Generally Accepted Accounting Principles.”

While most of FedNat’s business is in Florida, it had the misfortune of writing homeowner’s insurance in Texas and Louisiana as well, states battered by storms in 2021 (winter storm Uri and Hurricane Ida). The FedNat Group holding company includes three insurers: FedNat Insurance Company, Monarch National and Maison Insurance Company. Florida accounted for 71.1 percent of FedNat’s premium, followed by Texas with 13.0 percent, Louisiana at 7.2 percent, South Carolina at 6.5 percent and Alabama at 1.6 percent.

Withdrawals

Several property insurers whose Florida results have been battered by excessive claims are voting with their feet, deciding that continuing in the Florida market is throwing good money after bad. Lexington Insurance Company, part of the American International Group, announced in March 2022 that it was ceasing to write Florida business.

A number of other insurers also announced that they were no longer writing Florida business include United Property and Casualty, Florida Farm Bureau, TypTap, United, People’s Trust, Universal, Heritage, Progressive, Safeport and Wilshire. A notable addition to this list is Bankers. Bankers, based in St. Petersburg, announced it was pulling out of Florida’s home insurance market because it felt state lawmakers did not do enough during the home insurance special session to combat fraud and litigation.

Insurer of Last Resort Now Insurer of First Resort

Citizens Property Insurance Company (Citizens), the state-run “insurer of last resort” has become the “insurer of first resort,” or the insurer of only resort for Floridians unable to find coverage in the private insurance market. Since 2018, the number of Citizens’ policies tripled. At the Bermuda Risk Summit on March 7, 2023, Citizens announced that their policy count reached 1.2 million, and that they expect the policy count to exceed its prior high of 1.5 million in 2011.

Florida-only Insurers Hanging on by a Thread

Review of the 2022 financial results of selected Florida insurers reveals a dramatic deterioration from 2021. The loss ratio numbers in the chart below present the ratio of losses to premiums. The average direct incurred loss ratio in 2022 was 121.8 percent, up from 54.6 percent in 2021. The 121.8 percent figure means that for every dollar in premium received, insurers paid out $1.22 in claims. If one adds an expense ratio of approximately 30 percent to the loss ratio (the expense ratio numbers are not available until late April), the results are cause for concern.

Source: S&P Capital IQ Pro. https://www.capitaliq.spglobal.com/web/client?auth=inherit#office/screener

The small Florida takeout insurers are not the only ones with strained finances. Even Castle Key, the Florida-focused Allstate insurer, is under pressure. Insurance rating agency AM Best placed Castle Key Group’s B+ financial strength rating and “bbb-” long-term issuer credit rating under review with negative implications, citing challenging market conditions in Florida. Best pointed to its decision as driven by a “material deterioration” in the Allstate-owned company’s surplus position, due to “challenging personal property insurance conditions in Florida,” including higher loss severity, catastrophe-related losses and increased reinsurance cost.

Rating Agency Shuffle

Above and beyond the near dozen Florida insurers that failed in recent years, several more are hanging on by a thread. In July 2022, insurance company rating agency Demotech announced that it would downgrade the financial strength rating of 17 Florida insurance companies because of concerns with the level of their surplus and liquidity. Demotech has been the only insurer rating agency for the small Florida-only insurers that were set up beginning in the 1990s as “depopulation” or takeout companies. They are called depopulation companies because they were supposed to “depopulate” the state-run insurer Citizens in an effort to shift insurance to the private market and attract more private market insurers.

It is critical for an insurer to have a high financial strength rating because it is required for borrowers whose loans are through Fannie Mae or Freddie Mac. Fannie Mae and Freddie Mac require homeowners to have a policy with an A-minus rated company. Homeowners with insurance policies from insurers with a rating below A- are forced to find new insurers, potentially at higher costs, or face the risk of defaulting on their mortgages.

Demotech notified the 17 insurers that their financial strength rating will soon be downgraded from “A Exceptional” to “S Substantial” or “M Moderate.” Mortgage lenders do not recognize Demotech’s “S” rating. In addition to leaving homeowners in the lurch, downgrades are often preludes to company insolvency.

Demotech’s July announcement that it could downgrade 17 insurers prompted a Florida legislative panel in September to allocate $1.5 million for consultants to seek an alternative rating agency to Demotech. This led to a new rating agency, Kroll Bond Rating Agency, or KBRA, assigned to be the rating agency for eight Florida insurers.

Reinsurance Availability and Cost

Florida insurers are heavily reinsurance-dependent. Without adequate reinsurance Florida’s insurers cannot operate. To illustrate, in 2022, the Florida-focused Weston Property and Casualty Insurance Company was unable to fully place its reinsurance program and was unable to fund its continued losses. Under the liquidation order, all Weston’s Florida policies were canceled.

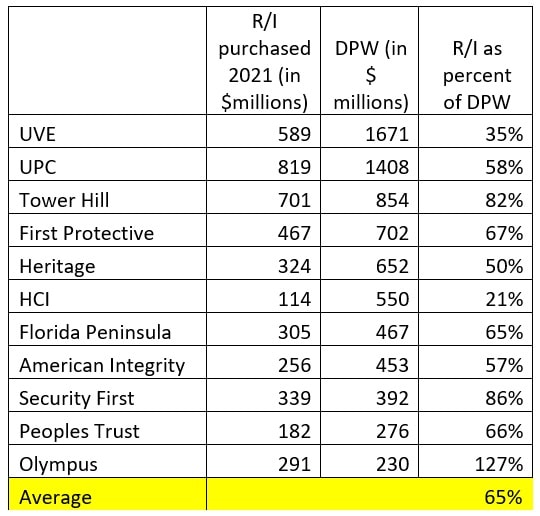

The Florida takeout insurers purchase large tranches of reinsurance layers so as not to have their capital dangerously exposed to a large catastrophe event. As shown in the table below, on average Florida-only insurers reinsure 65 percent of their business. Whereas it is prudent for small reinsurers to purchase large amounts of reinsurance, it may also render them dependent on reinsurers making coverage available at a reasonable cost.

The main reinsurance treaty renewal date for Florida property catastrophe business is June 1. This typically involves Bermuda and Lloyd’s reinsurers. It is too early to tell what the June 1, 2023 reinsurance renewals will bring, but it would be imprudent to expect rates to renew as expiring. This means that reinsurance may be costlier for Florida insurers, and the increased cost would be passed on to policyholders in the form of premium increases.

Florida Insurers’ Reinsurance Purchase

The amount of reinsurance coverage purchased by Florida insurers has increased an average of 15 percent from 2019. However, the cost of that reinsurance has increased by 54 percent from 2019.

Reinsurance companies also experienced difficulty in securing reinsurance to protect their own risk portfolios. Reinsurers buy retrocessional reinsurance, commonly called “retro,” from other capital providers to protect their balance sheets in the event of severe losses. In the Jan. 1, 2023 European reinsurance renewal, there was less retrocessional capacity available for reinsurers to buy. In 2023, several of the traditional providers of retro are pulling out of the market or are reducing how much capacity they offer in the market. What is more, the cost of retro at the Jan. 1, 2023 renewals rose by an estimated 50 percent. More expensive retro means more expensive reinsurance cover, which in turn means higher costs for insurance buyers.

Causes of the Florida Crisis

Florida’s 8,436 miles of coastline and exposure to severe weather exceed those of most other states, but its peninsula and panhandle coast are not the reason for the state’s insurance crisis. The root cause of Florida’s insurance crisis is an exceptionally high level of litigation against homeowners’ insurance companies. Florida has 6.1 percent of the nation’s homes and homeowners’ insurance policies, but it contains 76.0 percent of the country’s homeowners’ insurance litigation. When claims are litigated, they cost more, as the data below shows. Gov. Ron DeSantis (R-Fla.) characterized his state as a “cottage industry of litigation.”

Source: https://www.floir.com/siteDocuments/CommerceCommitteeDataRequest.pdf.

Not only does Florida have a shockingly elevated level of homeowners’ insurance with awards in the low-to-mid five figures, but it has a disturbingly high level of large lawsuits as well. In a study of “nuclear” verdicts, which exceed $10 million, Florida was found to have more than any other state from 2010 to 2019. That same study also found that Florida had the most nuclear verdicts per capita.

Florida and Tort Reform

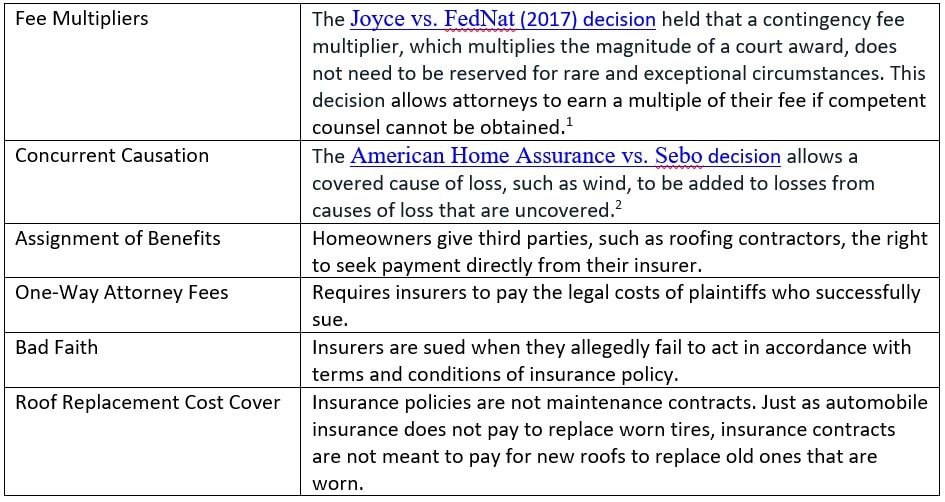

The excessive homeowners’ insurance litigation in Florida takes many forms. It takes advantage of court cases and provisions in Florida insurance statute, as described below.

The Many Faces of Florida Lawsuit Abuse

Florida Tort Reform, Finally

Since 2019, there have been four legislative tort reform measures introduced in Florida to stem the continuation of lawsuit abuse in the state. The first was in 2019, when Florida passed legislation curbing excessive litigation associated with the use of assignment of benefits (AOBs).

The second was in 2021, when the Florida Legislature passed SB 76, which restructures litigation rules for disputed insurance claims. In 2022, SB 2-D and SB 2-A provided further litigation reforms by limiting the assignment of attorney’s fees to third parties in property insurance cases, and disincentivizing frivolous claims. The 2022 reforms also eliminated one-way attorney fees on property claims, and reduced the period after a loss event to file a claim from two years to one year.

The most comprehensive tort reform measure was the March 2023 tort reform bill, which went further than HB 837/SB 236. The March bill closes the door on whatever was left unresolved in the 2022 bills. It eliminates AOB, one-way attorney fees and attorney fee multipliers; raises the bar on bad faith; and reduces the statute of limitations for filing claims.

Conclusion

Organizations have been educating policymakers and everyday Floridians on the precarious state of Florida’s property insurance situation for a number of years. For example, Americans for Prosperity’s legacy policy agenda, Five for Florida, which launched a decade ago, included calls to make reforms that would reduce the number of property insurance policies held by Citizens. Policymakers in the Sunshine State have known for years that if a 50- or 100-year storm were to hit Florida’s shores while Citizens’ policy underwriting was at an all-time high, it would have devastating consequences for the state budget. Public safety, public education, infrastructure and so much more would be at stake. This tort reform was one of the most critical elements necessary to pave the way for a stronger private property insurance market. This in turn is incredibly important to limiting the need for policy underwriting from Citizens. While there are certainly questions of policy remaining when it comes to state property insurance regulations and Citizens Insurance itself, these key reforms represent a watershed moment in addressing Florida’s property insurance woes.

R Street has been arguing for fixes to Florida’s troubled property insurance markets since its foundation in 2012. In the past two years, as the market grew increasingly unstable, R Street produced numerous articles and testified at both special legislative sessions in 2022, advocating for tort reform measures. The solutions proposed were exactly the ones that were enacted into law in 2022 and in the sweeping 2023 tort reform bill, designed to bring stability and stimulate the return of insurers to the market. At a panel at the Bermuda Risk Summit in March 2023 Citizens CFO Jennifer Montero responded to a question about new entrants possibly returning to Florida with “the capital is there – they were waiting on legislative reforms.” The reforms have been introduced—they are law. Finally, there is the legal framework in place to reduce the claim-related litigation, bringing more stability into Florida’s property insurance market. Assuming the plaintiff bar does not find creative ways around the reforms, HB 837/SB 236 will reduce insurance cost, allow more choice from more insurers and improve the stability of Florida’s property insurance market.