Five Charts Show the Grim Financial Condition of the U.S. Postal Service

Last year, the U.S. Postal Service (USPS) ran a deficit of $3.9 billion. Unfortunately, losses are the rule rather than the exception for the agency.

All this red ink has flowed despite USPS’s aggressive move into the parcel delivery business. These five charts depict the immensity of USPS’s financial challenges.

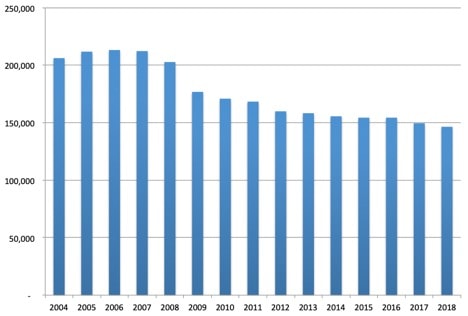

Chart 1. Mail Volume Is Down and Not Coming Back (Billions of pieces)

Source: The R Street Institute from USPS annual report data.

The Postal Service was designed to be a self-funding agency. From the early 1970s through the turn of the century, the agency frequently broke even. Rising mail volume and a monopoly on high-margin letter delivery brought in tens of billions of dollars annually.

Then the Great Recession of 2008 struck, and corporations—which send the vast majority of all mail—pulled back. Many of them were already transitioning from paper mail to electronic correspondence, and the financial crisis increased their incentive to bail from mail.

Mail volume dropped more than a quarter, and has not rebounded. This is a crisis for an agency whose business model all but ensures that its costs will rise annually. (E.g., USPS must deliver to more addresses every year.)

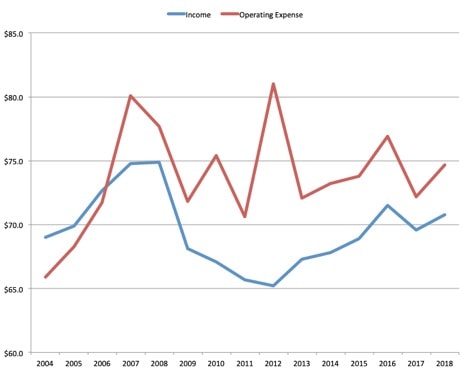

Chart 2. USPS’s Costs Regularly Outstrip Its Revenues ($Billions)

Source: The R Street Institute from USPS annual report data.

It is very difficult to stay in business when costs exceed revenues. This is exactly what has been happening to the Postal Service for years.

USPS reports that it expects costs to continue to rise: “Compensation and benefits expenses are planned to increase by $1.1 billion in FY2019, due to wage increases by $0.6 billion resulting from contractual general increases and cost-of-living adjustments.” The agency also expects its transportation and retiree health benefits expenses to increase by $1 billion.

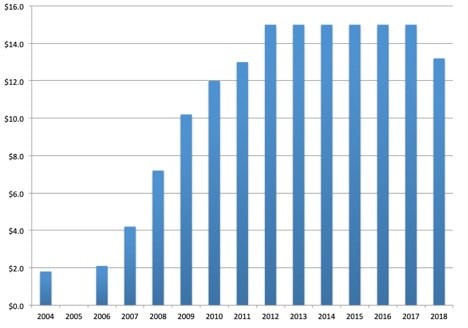

Chart 3. USPS’s Credit Line Is Nearly Tapped ($Billions)

Source: The R Street Institute from USPS annual report data.

USPS is a massive enterprise. According to its FY2018 Annual Report to Congress, it operates “34,700 Post Offices and [has] 58,000 retail partners and other access points, more than 232,000 delivery vehicles, and 8,500 pieces of automated processing equipment. On a typical day, our 634,000 employees physically deliver 493 million mail pieces to 159 million delivery points.”

Running an enterprise of this scale necessitates borrowing money to invest in new equipment and technologies. The Postal Service, unfortunately, has been at or near its credit limit for years, and much of that borrowing went to cover ongoing operating costs. USPS can’t borrow on the open market, so it has had to limit its infrastructure investments. Its delivery fleet, for example, was mostly manufactured between 1987 and 2001, and is prone to breakdowns and expensive repairs.

Chart 4. USPS’s Total Debt Is Immense ($Billions)

Source: Government Accountability Office, Continuing Financial Challenges and the Need for Postal Reform, GAO-16-651T.

The Postal Service has a total debt of around $120 billion, according to the Government Accountability Office (GAO). That is an immense sum, particularly for an organization that shows little capacity to generate the revenues required to fund itself. The Postal Service presently does have $10 billion in cash, so it certainly can minimally service its debt. But it has in recent years failed to pay towards its retiree health benefits obligations.

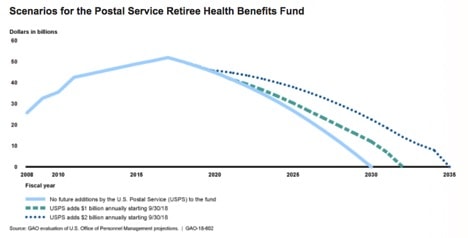

Chart 5. USPS’s Retiree Health Benefits Will Go Bankrupt

Source: Government Accountability Office, “Unsustainable Finances Need to Be Addressed,” GAO-18-602.

Retired postal workers participate in federal pension programs and receive health benefits. USPS’s pension obligations remain about $21 billion short of full funding. The agency’s retiree health benefits are in a far more concerning condition. The GAO estimates USPS’s fund for paying retirees will be emptied sometime between 2030 and 2036.

There is little evidence that the Postal Service can turn its finances around on its own. The agency has reduced its staff count, mostly by not replacing retirees, and has trimmed the number of post offices. Only Congress can rescue the agency.

The Trump administration put forth its own plan for saving the agency, but the response from Capitol Hill has been less than enthusiastic. Postal reform is very hard because some stakeholder is inevitably forced to give something up—mailers are loath to swallow large price increases, while postal workers will not accept compensation cuts. Meanwhile, customers, particularly in rural areas, grouse about service reductions.

Whether the 116th Congress will take up postal reform is far from clear. The burden will fall on the House’s Oversight and Government Reform Committee and the Senate’s Homeland Security Committee. What is certain, however, is that absent a fundamental refashioning of the Postal Service, U.S. taxpayers will have to bail the agency out one day. And no legislator or president wants that to occur on his watch.