Strengthening Electric Reliability Through Markets in the Midwest

Every year, the Midwest electricity grid operator conducts an auction to secure enough resource capacity to meet its reliability target for the year ahead. But this year was different. For the first time, the auction did not procure enough resources to hit the regional target, and prices jumped nearly 50-fold. The grid operator’s chief operating officer issued a sobering statement that the shortfall meant an increased risk of temporary, controlled outages. This reignited debate on the reliability and cost of the energy transition in the Midwest, especially as the region faces conventional fossil plant retirements replaced by unconventional resources like renewables.

The initial blame fell on the markets administered by the grid operator, known as the Midcontinent Independent System Operator (MISO). The independent market monitor (IMM) for MISO immediately jumped on one market rule: The demand curve for capacity resources is vertical, rather than sloped in the way you see it in an economic textbook. This results in a “knife-edge effect” in which small surpluses produce near-zero prices, and small shortages push prices to the price cap.

The effect explains the boom-or-bust of the region’s historical auction prices, whereas comparable auctions in the East use sloped curves that yield greater price stability and predictability. Solidifying price expectations in this way improves reliability by lowering investment risk for competitive suppliers, which comprise the bulk of market participants in Eastern markets. But this is not the case in the Midwest. Rather, MISO has the distinction of being the only grid operator that conducts a capacity auction composed primarily of monopoly utilities, not competitive suppliers.

MISO’s Unique Institutional Arrangement

With MISO, the obligation to bring sufficient capacity to meet the region’s collective needs falls on companies that serve end customers, known as load-serving entities. They have three options to satisfy their capacity obligation: submit their own plan, buy contracts in the bilateral market or participate in MISO’s capacity auction. The vast majority of load-serving entities are monopoly utilities, which make decisions to build or retire power plants irrespective of market prices. In the last three auctions, utilities have used their own supply or arrangements to predetermine 92-96 percent of MISO capacity resources, leaving market forces to decide the remainder.

Utilities decide to build or retire power plants based on their motive to expand their rate base or the value of their properties on which they earn a regulated return. State regulators scrutinize and approve these decisions through utility-specific resource planning exercises. Thus, the state of “resource adequacy” in MISO hinges mostly on fragmented state processes, not MISO’s own markets.

Acknowledging this, MISO instituted a state resource survey to gauge anticipated capacity levels. The survey projected a slight capacity surplus this year, which clearly proved incorrect. The shortfall in the most recent auction was 1.2 gigawatts (GWs), or 1 percent of its reliability target. This shortfall places the annual risk of MISO needing to implement temporary controlled load sheds at 18 percent, which is higher than the target of 10 percent. This is a substantial but not catastrophic increase.

The greater reliability concerns are the long-term trendline, the reasons the survey was inaccurate and what the survey does not reflect. For example, the latest state survey projects a capacity deficit of 2.6 GW in 2023—more than twice the 2022 shortfall—with the number potentially growing markedly by 2027.

The long-term reliability assessment of MISO, conducted in 2021, anticipated that the first capacity shortfall would occur in 2024. This assessment revealed 10.5 GW of expected coal and 2.4 GW of natural gas-fired power plant retirements from 2021 to 2024. Although a surge of new unconventional capacity is coming online, MISO accredits capacity for these resources at a fraction of conventional resources to account for the weather dependencies related to their availability. State processes do not consistently reflect this, which contributes to the phenomenon of installed capacity increasing in the Midwest while accredited capacity declines.

Keep in mind that this still only accounts for installed capacity, not the operating capabilities of such capacity. Operating a grid reliably requires not only adequate bulk resources but also a suite of essential reliability services that include frequency response, voltage support, and balancing and ramping. Grid operators like MISO need flexible resources that can rapidly adjust their output to account for unexpected contingencies and variability in supply, which is growing markedly with greater wind and solar integration. In recent years, most of MISO’s emergency reliability operating events occurred because of sudden shifts in short-term supply-demand balance and were exacerbated by poor availability of flexible resources, despite having ample installed capacity.

Historically, state utility resource planning procured the suite of reliability services as a byproduct of planning for peak demand conditions met by conventional resources. Those days are over. The resource mix of the future requires that state planning processes evolve to reflect their share of MISO’s planning needs across an array of discrete reliability services.

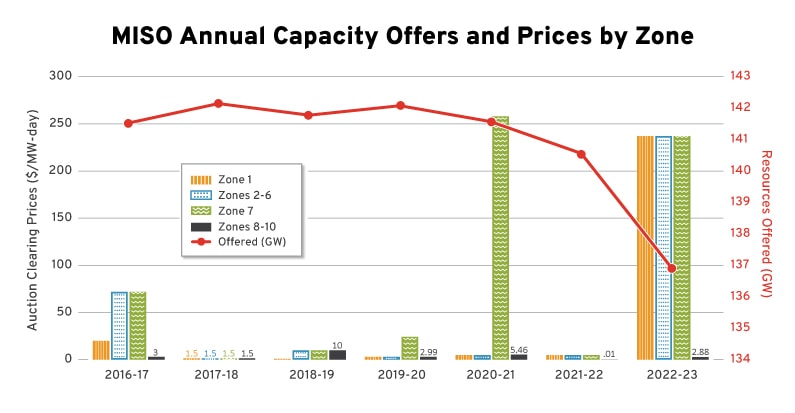

Source: data derived from various MISO capacity auction result reports from 2016-17 to 2022-23.

*Note: simple averaged used for Zones 8-10 for the 2020-21 auction.

This year’s auction not only revealed a continued decline in the total level of resources offered into the market but also major discrepancies by location. This can create additional reliability concerns, as the transmission system has constraints on the ability to transfer power, which is why MISO’s market uses capacity zones intended to reflect such constraints. Capacity prices diverge geographically if a transfer limit prevents further exports from areas with surplus or imports into areas with shortfalls. Monopoly utility planning typically does not factor in the reliability value of a resource’s location, whereas competitive suppliers internalize the locational value through an extension of the strength of price signals.

Monopolies create planning problems and performance woes. Similar to how monopolies do not make investment decisions based on market price signals, they are agnostic to price signals when it comes to operating their facilities. Environmental groups and MISO’s IMM have found a performance difference in how monopoly utilities and competitive suppliers manage thermal plants, and the IMM noted that this “underscores the fact that regulatory incentives can weaken the natural discipline of the competitive markets.” This has produced a pattern of cost-increasing uneconomic thermal power plant operations, suppressing the economical operations of renewables and creating artificial resource inflexibility that hampers reliable grid operations.

The Path Forward

MISO’s conditions cement a key takeaway in the energy transition: Institutions must be revised to account for the complexities of imperfect substitutes. In 2021, MISO conducted a renewable integration impact assessment, which found that 30 percent renewables integration would require significant changes to transmission, operating and planning practices; 30-50 percent would require transformative thinking; and over 50 percent would require additional coordinated action. MISO’s generation mix was 13 percent wind and solar in 2020 with a potential outlook of 20 percent by 2030, and it is already struggling with changes in its generation fleet. Speaking to the 2022 shortfall, the MISO IMM observed that the “reality is the investment in renewables is happening independent of the decision to retire resources.” This underscores the urgency of needed reforms to state and regional institutions.

A reform strategy to strengthen reliability and lower costs should have three main parts:

- State legislatures should enact competitive reforms. The most reliable and cost-effective option would be to restructure utilities so that the monopoly function is wires only and generation and retail services are left to market forces. Granted, this means that states would cede control over resource decisions to the regional marketplace. If autonomy is worth the cost premium, a workable alternative is for states to conduct their own all-resource competitive procurement with parameters aligned with MISO’s regional reliability requirements, which is already sought by MISO state consumer groups from Minnesota to Louisiana. A more efficient alternative to scattered, state-run procurements may be to let market forces in MISO work in a manner that would accommodate the influence states seek. One idea would be to redefine capacity zones by state boundary and let state policy preferences influence their zone’s procurement parameters, which might thread the restructuring-state autonomy needle.

- State regulators should align utility procurement and asset management practices with regional conditions. States could revisit a 2015 proposal to incorporate “market tests” in utility resource planning using regional bilateral market information, which could mitigate the cost premium and reliability coordination risk of monopoly utilities planning in siloes. At a bare minimum, states would need to modify their utility resource planning practices to align with the level, types and location of capacity resources needed for regional resource adequacy in conjunction with enhancements to the MISO-state survey to coordinate state planning. They should prioritize developing deep demand response to mitigate reliability consequences, which would increase voluntary load curtailments and decrease involuntary curtailments to prevent MISO emergencies. State regulators could seek transparency mechanisms on unit-specific operations in MISO markets that would better inform cost-recovery proceedings to address uneconomic utility operations.

- MISO and its stakeholders, including states, should collaborate to enhance market design. The premise of market design is to align the economic incentives of market participants with the efficient and reliable performance of the electric system. This is difficult to accomplish with price-agnostic monopolies, unlike competitive suppliers whose profit motive aligns with reliability and cost discipline. Nevertheless, a sloped demand curve would make sense to guide smoother investments for the sliver of the marketplace in which competition exists. But its benefits should not be oversold; monopoly dominance would result in a residual market that would be small and illiquid and that would have problems irrespective of the shape of its demand curve. Creating a multi-year, voluntary forward market—either bilateral or by altering MISO’s auction—would help signal competitive forces to compensate for utility deficiencies and give states a better basis for market-testing utility proposals. Other possible market design improvements include robust regional and state reforms that would enable distributed energy resource participation, accurate capacity resource accreditation and refined implementation of MISO’s new short-term reserve product. Midwest stakeholders and federal regulators should heed requests from demand response aggregators like Voltus and providers like industrial customers who have little access to provide services in MISO’s market.

Maintaining reliability and lowering costs without impeding the energy transition in MISO depends foremost on state policy reform. This highlights a critical lesson that organized wholesale electricity markets alone are not the policy end game, but rather market-compatible state policy is imperative. States need to recognize that the monopoly utility model is an economic and reliability liability—both with a regional transmission organization and especially without one. Ultimately, it is hard to see the monopoly model as workable with high levels of renewables and storage, and states would be wise to start the market migration sooner than later.

States should reconsider their complacency with monopoly utilities and advance competitive mechanisms for the procurement, ownership and operation of resources. In the short term, state regulators and MISO need to harmonize their planning and operations practices; MISO’s Reliability Imperative initiative offers numerous incremental improvements. For now, let’s get the narrative straight: MISO’s markets can improve, but the core reliability dilemma is a state monopoly problem.