Bad Electricity Math at The Wall Street Journal

Journalists are known for many things, but quantitative analysis is not typically among them. Still, it was discouraging to see The Wall Street Journal’s news section putting out what in the words of one expert “gets an F-grade for making big causal statements with 5th-grade math.”

In a recent article, WSJ reporters Scott Patterson and Tom McGinty claim that “deregulated Texas residential consumers paid $28 billion more for their power since 2004 than they would have paid at the rates charged to the customers of the state’s traditional utilities, according to the Journal’s analysis of data from the federal Energy Information Agency.” In a subsequent article, the same authors found that “U.S. consumers who signed up with retail energy companies that emerged from deregulation paid $19.2 billion more than they would have if they’d stuck with incumbent utilities from 2010 through 2019.”

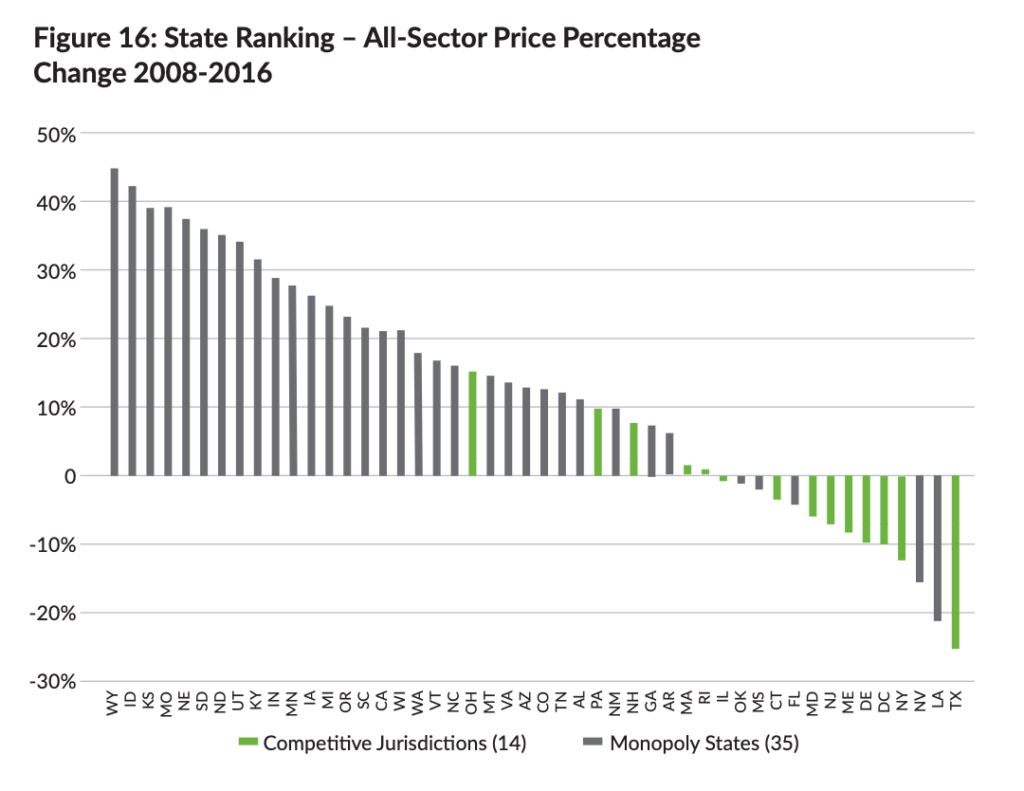

These striking findings are at odds with the peer-reviewed research on the subject, which has found competition has reduced electric rates in Texas. Electric rates in competitive states have generally fallen in recent years, while rates in monopoly utility states tended to increase or remain flat.

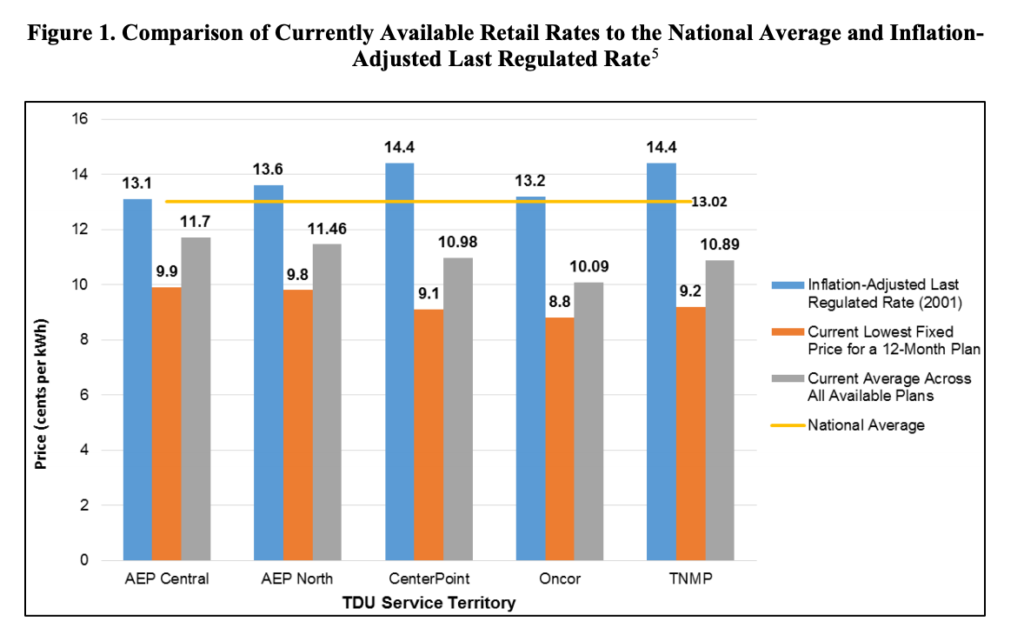

Texas in particular has seen significant declines. The Public Utility Commission of Texas noted in a 2019 report, “As Figure 1 below demonstrates, rates in the [Texas] competitive market have decreased by 31% since the transition to the competitive market. Rates in the competitive market also remain lower than the national average.” And at the risk of preaching to what should be the choir, the idea that competition would increase prices rather than lower them seems at odds with the way the world works.

So what gives? The initial article explains their methodology as follows: “EIA data shows how much electricity each utility or retail provider sold to residents in a given year and how much customers paid for it. The Journal calculated separate annual statewide rates for utilities and retailers by adding up all of the revenue each type of provider received and dividing it by the kilowatt-hours of electricity it sold.”

While this approach sounds straightforward, it is seriously flawed in several respects. First, the U.S. Energy Information Administration (EIA) data itself is incomplete, and doesn’t account for added charges on customers’ bills, which often constitute half or more of the total bill. More importantly, the Journal analysis implicitly assumes that prior to the introduction of competition in 2001, electric rates were the same in the parts of the state that entered competition and those that did not. This is not true. As an analysis by Rice University’s Baker Institute shows, areas of Texas that do not allow competition today—such as municipal utilities in Austin and San Antonio—had lower rates on average in 2001 than other parts of the state. Between then and now, rates in the non-competitive areas have increased slightly, while rates in the competitive zone, after an initial increase due to high natural gas prices, have fallen overall.

It’s also worth noting that there are benefits to electricity competition that go beyond prices. Competitive retail supply permits greater diversity in products and services than one is likely to get with a single utility option, such as green energy options or multi-year rate stability. Surveys show that consumers favor energy choice by a 10 to one margin and are more satisfied when served by competitive suppliers.

Figuring out what prices in competitive areas would have been without competition is a difficult question, and worthy of further study. But The Wall Street Journal analysis is not a helpful way of addressing the question.

Image credit: Lumppini