Where’s the grid resilience fire? (hint: it’s not retiring power plants)

On Friday, President Trump ordered the Energy Department to stop the closure of coal and nuclear plants in the name of national security. An accompanying memo outlined a plan to bail out the plants using the Department’s emergency powers under a Cold War-era law that permits it to nationalize parts of the power sector. Not only is this horrendous economic policy, but this Security State takeover has nothing to do with national security and everything to do with political optics.

The memo admits that the grid is reliable, but that reliability in the “conventional sense is not sufficient,” adding that the grid must be resilient and secure. Grid resilience has certainly become the topic du jour, and a flood of work on the topic has surfaced in the past year. But the administration’s rationale directly contradicts this body of evidence and its intervention has made economists’ fears come true.

On Wednesday, Resources for the Future and the R Street Institute co-hosted an expert workshop on an economic framing of grid resilience. Although held under Chatham House rules, the general conclusions (without attribution) stood in stark contrast to the administration’s framing of resilience (note: a more complete summary will be available later).

“Where’s the fire?” was a common refrain from experts referring to the retirement of legacy power plants, who noted that the bulk power system is already reliable and resilient. Given the political situation, several workshop participants appreciated the emphasis on power generation, but stressed the need for next steps to focus on where there may actually be a fire. Specifically, the transmission and distribution (T&D) systems are, by far, the most vulnerable elements of the electricity supply chain.

If any form of generation is inherently more resilient for end-use service, it would be distributed generation because it’s sited behind the T&D system. For example, economists at the Brattle Group found that siting energy storage behind the T&D system mitigates customer outages more effectively than connecting it to the bulk system. Numerous natural disasters – including the recent one in Puerto Rico – have demonstrated that most threats to customer resilience incapacitate T&D systems far longer than central power plants (with the exception of nuclear, e.g., Japan). So, we must be careful that metrics and policies for electric resilience use customer outages as the measuring point because measuring bulk generation resilience alone often does not accurately indicate customer outages.

This customer-centric view of grid resilience is the central theme of an excellent paper recently released by Rob Gramlich, Michael Goggin and Alison Silverstein. Recall that Silverstein was the technical lead on the Energy Department’s 2017 study on grid reliability and afterward, called legacy power plant retirements a sign of market competition working as intended.

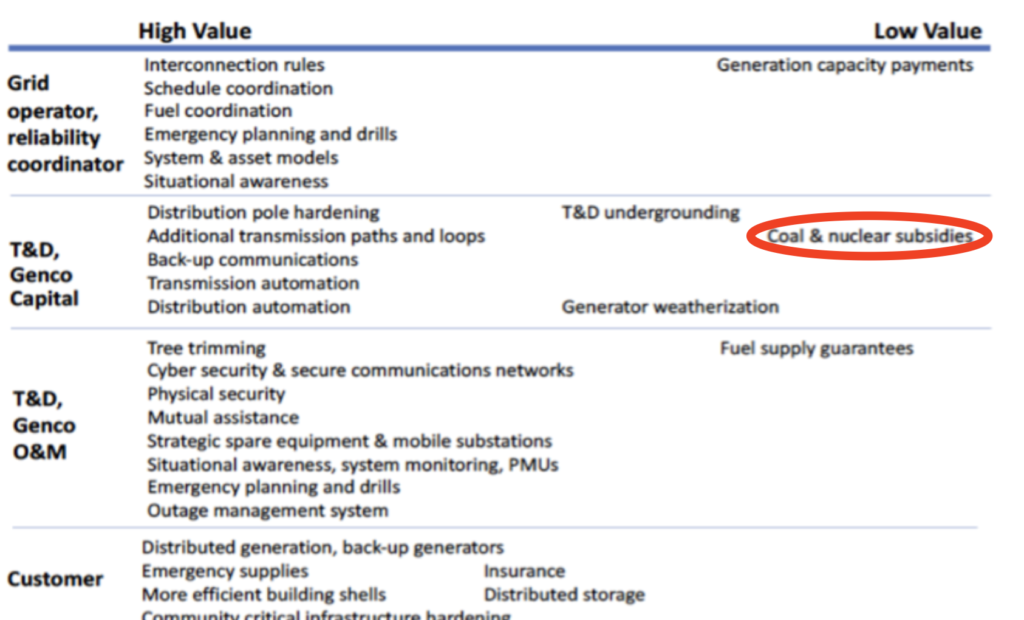

The paper highlighted that over 90% of service outages occur from distribution-level problems and, since distribution falls under state jurisdiction, grid resilience therefore falls primarily on state governments. The study also examined the relative values of measures to improve grid resilience, finding that coal and nuclear subsidies have very low value, while over two dozen measures have far higher value (see chart below). Read another way, if grid resilience is actually a matter of national security, the Trump administration is asleep at the wheel.

SOURCE: Alison Silverstein et al., “A Customer-focused Framework for Electric System Resilience,” May 2018, p. 6. https://gridprogress.files.wordpress.com/2018/05/customer-focused-resilience-final-050118.pdf.

So why the obsession with retiring coal and nuclear plants? Put simply, they have stronger lobbies than consumer groups, who should be leading the grid reliability and resilience narrative and who adamantly oppose coal and nuclear bailouts. In particular, the coal industry has the ear of the Trump administration. On this account, Republican Rep. Pete Olson (Texas) – a straight-shooter that’s been willing to stand by market competition and consumers – hit the nail on the head when he noted that: “Rick Perry knows about the chain of command and his commander-in-chief has made some promises on the campaign trail.” He continued that “Secretary Perry is being the good cabinet member he is. I imagine he said, ‘Try another way,’ but he’s been over ruled.”

While the case to bail out coal and nuclear plants doesn’t pass the laugh test, abusing a defense statute to meet a campaign promise is no laughing matter. To be clear, doing so uses emergency authority in the false name of national security for the actual purpose of enacting civilian industrial policy. This is an appalling approach to governance. As the Heritage foundation has accurately described in an excellent op-ed, policymakers should “beware of bailouts masquerading as national security investments” because they undercut the real purposes of the Defense Production Act.

Ordering the purchase of electricity from politically preferred resources on this scale is the most draconian intervention in energy markets in at least several decades. This will likely prove far more costly with less legal support than the original Clean Power Plan. Even worse, it undermines our rule of law and circumvents the institutions responsible for making electricity policy.

The United States is fortunate to have a variety of robust institutions to evaluate grid reliability and resilience. This includes the North American Electric Reliability Corporation and regional grid operators who are tasked with operating their electric systems reliably and resiliently. Grid operators have consistently found no evidence for the need to systematically bail out classes of unprofitable power plants. They do, however, warn of major market damage from the administration’s drastic and unnecessary intervention. Furthermore, the Federal Energy Regulatory Commission already has a pending proceeding on grid resilience and this is the proper channel to pursue reforms. But the administration has shown no interest in economically-sound reforms, especially through a regulator that unanimously rejected the Energy Department’s first bailout attempt.

In addition to calling for direct electricity purchases from specific coal and nuclear plants, the Energy Department memo also revealed plans to establish a “Strategic Electric Generation Reserve.” Considering that every regional grid already has reserve standards that have been closely monitored for decades, this would be duplicative with minimal, if any, added benefit. In fact, with the exception of Texas, these regions actually have excessive reserves to the point that the marginal costs far outweigh the benefits. Instead of rectifying the existing uneconomic surplus, a new (political) reserve would impose major unwarranted costs on electric customers or taxpayers, depending on the funding scheme.

In totality, there is no question that effectively nationalizing once-competitive coal and nuclear plants provides little-to-no benefit to consumers or national security. There is also no question that the costs of doing so will be immense. Two key questions remain. One is whether this move will directly cost consumers tens or hundreds of billions in unnecessary costs. The second is whether competitive markets can survive in the interim, and how long it will take the country to rebuild its market institutions to restore investor confidence. The indirect costs of stifling incentives for innovation and new entry are incalculable and, frankly, are the most critical component to a future energy system that advances our economic, environmental and security interests.

It is difficult to hyperbolize the severity of this action. Large industrial consumers have gone so far to say that “the cost consequences of this planned [Energy Department] action will devastate U.S. manufacturing.” Nationalizing fledgling industries under the false pretense of national security is symptomatic of developing countries with unstable democracies. Accordingly, on Friday, the United States took an enormous step backward as a global energy leader.