Jerry Theodorou Statement for the Record, Hearing on ‘The Factors Influencing the High Cost of Insurance for Customers’

November 1, 2023

The Honorable Warren Davidson

Chair

Subcommittee on Housing & Insurance

Committee on Financial Services

U.S. House of Representatives

Washington, D.C. 20515

The Honorable Emanuel Cleaver, II

Ranking Member

Subcommittee on Housing & Insurance

Committee on Financial Services

U.S. House of Representatives

Washington, D.C. 20515

Dear Chairman Davidson, Ranking Member Cleaver and members of the subcommittee:

Thank you for holding Thursday’s hearing, titled “The Factors Influencing the High Cost of Insurance for Consumers.” My name is Jerry Theodorou. I am the director of the R Street Institute’s (R Street) Finance, Insurance and Trade program. I have worked as an analyst of the property and casualty insurance industry for the past 15 years, in my current position at R Street and previously at Conning, a Connecticut-based asset management and insurance research firm. My research, publications, public presentations and congressional testimonies focus on the impact of market forces and external drivers on policyholders, insurers, the economy, and on sound public policy involving insurance.

Insurance Ratemaking and Rising Rates for Personal Insurance

The cost of insurance for consumers (and for commercial insurance buyers) is calculated in a process called ratemaking. Ratemaking is a quantitative calculation function performed by insurance company actuarial and underwriting staff. An insurance rate is expressed as a dollar (or cents) amount per unit of exposure. For example, property insurance rates are in dollars (or cents) per hundred dollars of insured value. Thus, a homeowners’ policy for a home with $300,000 replacement cost value at a $0.35 rate yields a premium of $1,050. The elements that enter into ratemaking are expected losses (loss costs), agent/broker commission, insurance company expenses, and a margin for profit. Expected losses in turn draw on past loss experience (known as “experience underwriting”) but also take into account changes that may have made future losses different from past losses (known as “exposure underwriting”).

Rates for consumer insurance, which includes private passenger automobile insurance, homeowners’, renters’ insurance and farmowners’ insurance, have risen in recent years, as has insurance cost for insurance buyers. There are several factors responsible for insurance companies raising their personal insurance rates. The main drivers of rate increases for personal insurance include:

- Inflation in construction materials. When there is a covered loss for physical damage to a home that involves the insurance company paying repair/reconstruction costs, higher costs of construction materials drive up the value of the claim and exert upward pressure on rates so that insurers can keep up with higher loss costs while making a reasonable return. The Fed’s data on construction materials show cost of construction materials has increased by 39 percent from August 2020 to August 2023. This was the sharpest spike ever in construction materials cost going back to 1947.[1]

- Inflation in construction labor costs. Construction labor costs have also risen. The average hourly earnings of construction workers rose by 13.9 percent from August 2020 to August 2023.[2]

- Loss costs exceeding CPI. Both construction material costs as well as labor costs outstripped general inflation (the Consumer Price Index) by approximately 10 percent since 2020.[3]

- Auto repair cost inflation. The cost of motor vehicle repair and maintenance rose by 16.2 percent from August 2020 to August 2023.[4]

- Used car cost inflation. The cost of used cars and trucks spiked by 44 percent from May 2020 to May 2023.[5]

- New car cost inflation. The cost of new cars rose by 22.4 percent from June 2020 to June 2023.[6]

- Higher catastrophe losses. Insurance loss payments for natural catastrophes were higher in 2022, and are higher through October 2023, than the long-term average.[7] In the first six months of 2023, insured losses were 18 percent higher than the decadal average, and 39 percent above the 21st century average.

- Higher reinsurance cost. Insurers buy reinsurance to protect their balance sheets. The cost of reinsurance protection has risen as a consequence of reinsurers being tagged for recent catastrophe losses.[8]

- Social inflation. Both homeowners insurance and personal auto insurance provide third party liability coverage. As I detailed in a 2021 R Street policy analysis titled “The Scourge of Social Inflation,” there have been higher courtroom awards in civil litigation that have caused higher losses, impacting the liability portion of personal lines policies.[9]

Financial Position of Insurance Industry

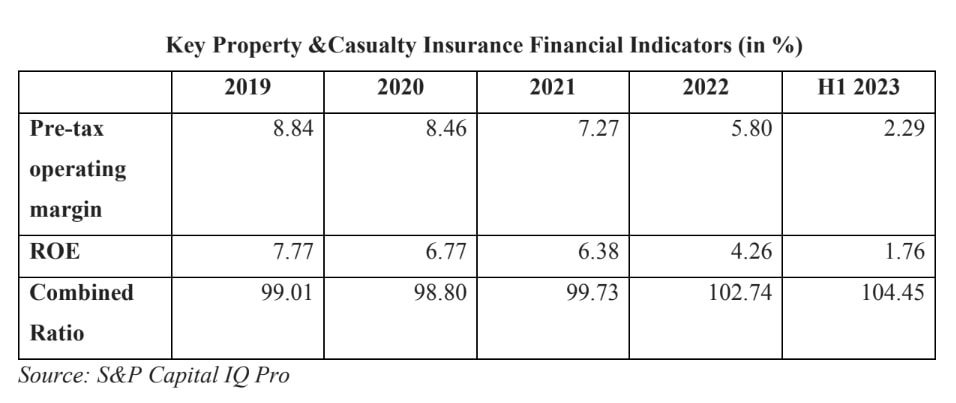

The financial results of the property and casualty insurance industry have deteriorated in recent years as a result of the loss drivers. The numbers below show that the property and casualty insurance industry’s profit margin and return on equity (ROE) are low. The combined ratio is a measure of underwriting profitability before the impact of investment income. In 2022 and into 2023, for every dollar of premium collected, insurers paid out $1.03 or $1.04 and five mills. The contribution of investment income pulled the results only modestly into the black.

As shown by the numbers above, the property and casualty industry has been reporting worsening results in recent years. The results are poorer for personal insurance than commercial insurance. In the second quarter of 2023, the combined ratio for personal lines insurance was 114.9 percent.[10] Insurers have significantly lower profit margins than companies in other economic sectors. The long-term pre-tax operating margin for S&P 500 companies is 11.4 percent.[11] In response to the rising loss costs, rates at insurers for loss-affected lines has risen. In mid 2023 personal automobile insurance rates rose by 17.8 percent in August YOY.[12]

When Insurance Cost Gets Cheaper

Just as insurance rates and insurance cost rise in accordance with rising losses, insurance rates and insurance cost decline when losses are lower than expected. If the objective is to reduce rates and cost, the risk should be reduced. A good example of insurance rate reductions can be seen in today’s market for workers’ compensation insurance.

In recent years, the impact of employers investing more in safety training and work hazard reduction, combined with work from home practices, has driven workers’ compensation claim frequency down for all but two of the past 20 years, according to the National Council on Compensation Insurance (NCCI).[13]

In contrast with rising rates for other insurance products, such as personal lines products of homeowners’ insurance and private passenger auto insurance, workers’ compensation rates are steadily decreasing. And the decrease has been sharp. Rates for workers’ compensation insurance have been declining approximately 4% every year since 2016.[14]

The active economy and a tight labor market are also reflected in the exposure base, in the form of aggregate payroll, far exceeding growth in workers’ compensation premiums. Whereas the 2022 average weekly payroll for all employees rose by 57 percent, workers’ compensation premiums rose by only 19.5 percent.[15]

The lesson to be learned from the progressive decline in workers’ compensation premium is, if you want to reduce the rate, reduce the risk.

To bring down the cost of homeowners’ insurance, homeowners can take measures to protect their property and prevent losses. A report by RMS, the risk-modeling arm of credit rating agency Moody’s, focusing on Florida, found that following building codes and land use policies restricting coastal building result in significant reduction in average annual loss.[16] Code measures include heightened emphasis on impact-resistant windows, reinforced doors, stronger roof coverings and connections between hurricane straps and clips. Such measures not only reduce hurricane damage loss, but also pay for themselves many times over. A United Nations report, consistent with findings from other sources, estimates that every dollar of resilience investment yields six dollars of benefit in the form of lower losses.[17]

Federal Programs Not Advised

There have been voices characterizing the rise in personal insurance cost as constituting an insurance crisis. For example, a senator issued a statement in February citing a looming “insurance collapse.”[18] In September the alarmist testimony of a consumer activist before the Senate Committee on Banking and Urban Affairs used the term “crisis” or “insurance crisis” twenty times.[19]

Notwithstanding some challenging results in 2022 and 2023 to date, especially in personal insurance, overall the property and casualty insurance industry maintains a strong balance sheet, with $2.79 trillion in assets in H1 2023, up from $2.64 trillion in 2022, and up from $2.2 trillion in 2019. Arguments that the insurance industry is on its knees are often accompanied by pleas for the government to step into the (imagined) breach and establish federal insurance and reinsurance programs. The proposal to introduce federal insurance programs after a major catastrophe is not a new idea. In 2007, a year and a half after the devastation from hurricanes Katrina, Rita and Wilma (KRW), the Senate Banking Committee, chaired by Senator Christopher Dodd, convened a hearing on “The Availability and Affordability of Insurance in Coastal Regions to Adequately Protect Americans’ Homes, Businesses and their families from Natural Disasters.”[20]

Should there be Federal Intervention in Property & Insurance Markets?

If the federal government were to intervene to shore up private insurance markets, what form might such government intervention take? There are four alternatives, some of which were discussed at the 2007 hearing. First, the government could create a program where disaster risk is shared between the federal government and the private insurance market. Second, the federal government could bear the entirety of disaster risk, with no risk-sharing with the private insurance market. Third, the federal government could subsidize insurance buyers or insurance companies, making disaster insurance more affordable. Fourth, regulations in some states could be rolled back so as to allow the private market to operate more freely absent government intervention that has contributed to market troubles.

Unintended Consequences

Lawmakers concerned that the insurance industry’s balance sheet may be at risk in the wake of mega-catastrophes are well-intentioned. But like most government programs involving subsidies and government market takeover, the proposed programs would backfire and make catastrophe insurance less available and less affordable.

Introduction of a government program offering catastrophe insurance would crowd out the private market. To the extent the insurance is subsidized to make it more affordable, a federal disaster program would go the way of government monopoly (or near-monopoly) insurers such as the National Flood Insurance Program and the Federal Crop Insurance program. Both of these government insurance programs offer insurance at rates so disconnected with risk magnitude that they have created an ocean of debt and massive deficits that will eventually be socialized and paid out by all taxpayers.[21]

More importantly, a federal disaster insurance program would undermine incentives to mitigate risk. By offering below-market-rate products, insurance buyers would not be encouraged to take measures to reduce risk.

Advocates of government insurance intervention point to rising reinsurance rates as a factor contributing to insurance market tightness, and propose that the federal government’s balance sheet should act as reinsurer, providing a backstop for disaster losses. What such government reinsurance proponents fail to grasp is that the private global reinsurance market reduces insurance market risk significantly by spreading it around the world to global reinsurers in the U.K., in continental Europe, Bermuda and Asia. Lloyd’s had 1.4 billion GBP of losses from Katrina: Munich Re had 1.1 billion Euro of Katrina losses, and Swiss Re bore $1.2 billion of Katrina losses. Bermuda reinsurers paid out $1.3 billion for KRW.[22] [23] To be sure, it has been estimated that half or close to half the insurance losses from hurricane Katrina were borne by non-U.S. reinsurers.

What is more, the enormous hurricane-caused losses of 2004 and 2005 did not bring the (re)insurance industry to its knees or require any form of government intervention. On the contrary, the collective impact of hurricanes Charley, Frances, Ivan, Jeanne, Katrina, Rita and Wilma in those years stimulated a huge inflow of private capital that created a dozen new property catastrophe reinsurers, the so-called “class of 2005.”[24] The market, not the government, responded, restoring stability to the market.

The global reinsurance market and the primary insurance market it serves is remarkably creative. A government program displacing reinsurance or primary industry risk assumption would squelch the numerous innovative ways the private market has devised to bring capital to bear to take on disaster risk. These include insurance-linked securities (catastrophe bonds), insurance-linked warranties, sidecars, parametric triggers, fully collateralized reinsurance, and a variety of reinsurance products, including aggregate cover, excess of loss, and quota-share insurance. The market is a better and more innovative risk manager than government.

Solutions

The most effective way to bring down the cost of personal insurance products is to bring down the risk. In the homeowners’ insurance context, this means homeowners undertaking measures to protect and prevent losses as much as possible. When this takes place, risk magnitude goes down, and the operation of a competitive marketplace will result in insurers offering lower than expiring rates. Another approach is to introduce community risk programs, exemplified by the recent launch of the Community Disaster Resilience Zones (CDRZ), which makes funding available to communities that adopt protective measures.[25] The CDRZ creates disaster resilience by driving federal, public and private resources to the most at-risk and in-need jurisdictions. The worker-friendly and employer-friendly situation in today’s workers’ compensation insurance market, where lower risk has led to lower insurance cost, is an encouraging development, demonstrating that insurance costs can go down as well as up, and pointing to solutions to address costly personal insurance premiums.

Thank you for your consideration of my views. Please do not hesitate to contact me if I can be of further assistance to you and the subcommittee’s important work.

Sincerely,

/s/

Jerry Theodorou

Director, Finance, Insurance and Trade

R Street Institute

[1] FRED Economic Data. Producer Price Index by Commodity: Special Indexes: Construction Materials. https://fred.stlouisfed.org/series/WPUSI012011

[2] FRED Economic Data. Average Hourly Earnings of All Employees, Construction.

https://fred.stlouisfed.org/series/CES2000000003

[3] U.S. Inflation Rates. Ycharts. https://ycharts.com/indicators/us_inflation_rate

[4] FRED Economic Data. Consumer Price Index for All Urban /consumers: Motor Vehicle Maintenance and /repair in U.S. City average. https://fred.stlouisfed.org/series/CUSR0000SETD

[5] FRED. Consumer Price Index for all Urban Consumers: Used Cars and Trucks in U.S. City Average. https://fred.stlouisfed.org/series/CUSR0000SETA02

[6] FRED. Consumer Price Index for All Urban Consumers: New Vehicles in U.S. City Average. https://fred.stlouisfed.org/series/CUUR0000SETA01

[7] “Gallagher Re Natural Catastrophe Report: First Half 2023.” July 17, 2023. Gallagher Re. https://www.ajg.com/gallagherre/news-and-insights/2023/july/2023-natural-catastrophe-report/

[8] “Chart: Guy Carpenter Global Property Catastrophe Rate on Line Index 2000 – 2023.” Guy Carpenter.

https://www.guycarp.com/insights/2023/01/chart-guy-carpenter-global-property-catastrophe-rate-on-line-index-2000-2023.html

[9] Jerry Theodorou. “The Scourge of Social Inflation.” December 2021. R Street Institute. https://www.rstreet.org/wp-content/uploads/2021/12/RSTREET247.pdf

[10] Jason Woleben. “US personal lines insurers see combined ratios deteriorate in Q2.” S&P Global Market Intelligence. Sept 11, 2023. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-

personal-lines-insurers-see-combined-ratios-deteriorate-in-q2-77392131

[11] Charley Grant. “S&P 500 Profit Margins Set to Fall for Sixth Straight Quarter.” Wall Street Journal. February 15, 2023 https://www.wsj.com/livecoverage/stock-market-news-today-02-15-2023/card/s-p-500-profit-margins-set-to-fall-for-sixth-straight-quarter-KAGmhnfHNdpDsPP3FJSD

[12] “Auto Insurance CPI: Repair Cost Serving as the Last Headwind?” Morgan Stanley. August 10, 2023. file:///Users/jerrytheodoru/Downloads/MSNA20230809366281%20(1).pdf

[13] “Why Workers’ Compensation Rates are Decreasing.” SFM. July 11, 2023. https://www.sfmic.com/why-workers-compensation-rates-are-decreasing/

[14] “Commercial Auto CPI/PPI Trends.” Inside P&C. Sept. 15, 2023. https://www.insidepandc.com/article/2c6zub5n8rxrk9xweadc0/commercial-lines/commercial-insurance-cpi-trends-a-closer-look-at-property-auto-and-workers-comp

[15] FRED Economic Data. Indexes of Aggregate Weekly Payrolls of all Employees, Total Private. https://fred.stlouisfed.org/series/CES0500000017

[16] “Adapting to Hurricane Risk: A Florida Case Study.” Insurance Journal.

https://www.insurancejournal.com/app/uploads/2023/10/Moodys-on-bldg-codes.pdf

[17] “For Every Dollar Invested in Climate-resilient Infrastructure Six Dollars are saved, Secretary-General Says in Message for Disaster Risk Reduction Day.” UN Secretary General Press Release. 10 October 2019.

https://press.un.org/en/2019/sgsm19807.doc.htm#:~:text=For%20every%20dollar%20invested%2C%20six,ease%20and%20prevent%20human%20misery.

[18] “Whitehouse: Costs and Economic Risks of Climate Change are Piling Up.” U.S. Senate Committee on the Budget. Feb 15, 2023. https://www.budget.senate.gov/chairman/newsroom/press/whitehouse-costs-and-economic-risks-of-climate-change-are-piling-up

[19] “Testimony of Douglas Heller before the Subcommittee on Housing, Community Development and Insurance, House Financial Services Committee.” Consumer Federation of America. September 7, 2023 https://www.banking.senate.gov/imo/media/doc/heller_testimony_9-7-23.pdf

[20] “The Availability and Affordability of Insurance in Coastal Regions to Adequately Protect Americans’ Homes, Businesses and their families from Natural Disasters.” Hearing of U.S. Senate Committee on Banking, Housing and Urban Affairs. April 11, 2007. https://www.govinfo.gov/content/pkg/CHRG-110shrg50313/html/CHRG-110shrg50313.htm

[21] “Introduction to the National Flood Insurance Program.” Congressional Research Service. Updated October 16, 2023 https://sgp.fas.org/crs/homesec/R44593.pdf “Reduce Subsidies in the Federal Crop Insurance Program.” Congressional Budget Office. December 13, 2018. https://www.cbo.gov/budget-options/54714

[22] “Lloyd’s Katrina Estimate within Expectations” Fitch. https://www.fitchratings.com/research/banks/lloyd-katrina-estimate-within-expectations-15-09-2005#:~:text=Fitch%20currently%20believes%20that%20a,from%20U.S.%20hurricanes%20of%20GBP1.

[23] “Munich Re Updates Loss Estimate for Hurricane Katrina.” Munich Re. September 28, 2005. https://www.munichre.com/en/company/investors/mandatory-announcements/ad-hoc-announcements/2005-09-28-ad-hoc.html “Swiss Re Doubles Katrina Loss Estimates.” Financial Times. https://www.ft.com/content/3663cc40-235f-11da-b56b-00000e2511c8 “Bermuda Reinsurers Lose $11.3 billion after Hurricanes.” Canadian Underwriter.

https://www.canadianunderwriter.ca/insurance/bermuda-reinsurers-lose-us-11-3-billion-after-hurricanes-1000050454/

[24] Rupal Parekh “Bermuda Class of 2005 Awarded Secured Ratings.” Business Insurance.https://www.businessinsurance.com/article/20060101/ISSUE01/100018121/bermuda-class-of-2005-awarded-secure-ratings

[25] Community Disaster Resilience Zones. FEMA. https://www.fema.gov/partnerships/community-disaster-resilience-zones