Top 10 States for Insurance Regulation

If someone owns a home and a car, or even just one of those, then they have some type of insurance coverage. Insurance helps with recovery from financial setbacks such as fender benders, hailstorms, fires and other unexpected accidents. It is critical financial protection for the most expensive items many Americans own. But most people don’t give it much thought beyond paying the monthly bill or when there is a need to cover a damaged roof or repair damages from a car accident.

Underneath the hood, the insurance industry is remarkably complex. The risks it bears stem from a number of factors. To be successful and continue to offer insurance, insurance companies must conquer not only risk issues, but a mountain of legal, compliance and regulatory issues.

Adding to the complexity, property and casualty insurance—as it’s more officially known––is regulated at the state level, with rules and regulations enshrined in state law and court decisions. Because individual states are responsible for regulating their own insurance industries, the U.S. insurance market is effectively 50 markets, with differences from state to state. Depending on the state coverage of one’s residence, experiences with property and casualty insurance could vary widely. In some states, it’s easy for individuals to choose the insurance they want. In others, insurers may not be able to provide desired insurance products for their customers. Fostering healthy, competitive insurance markets is key to solving both of these problems.

That is why, for the past decade, R Street has asked a seemingly simple question: What states are best at regulating their insurance industries? This year’s 2022 Insurance Regulation Report Card examines this question and author Jerry Theodorou analyzes the effectiveness of states in regulating property and casualty insurance and assigns a letter grade to all 50 states.

The report also looks at the current landscape of U.S. insurance regulation; reviews recent, relevant, federal and state-based regulatory changes; and presents a detailed evaluation of the effectiveness of each state’s regulation of insurance in seven key categories:

- Solvency regulation (20 percent of score)

- Underwriting freedom (20 percent of score)

- Residual markets (15 percent of score)

- Fiscal efficiency (15 percent of score)

- Politicization (10 percent of score)

- Auto insurance market competitiveness (10 percent of score)

- Homeowners insurance market competitiveness (10 percent of score)

With these categories in mind, here are the top 10 states for insurance regulation:

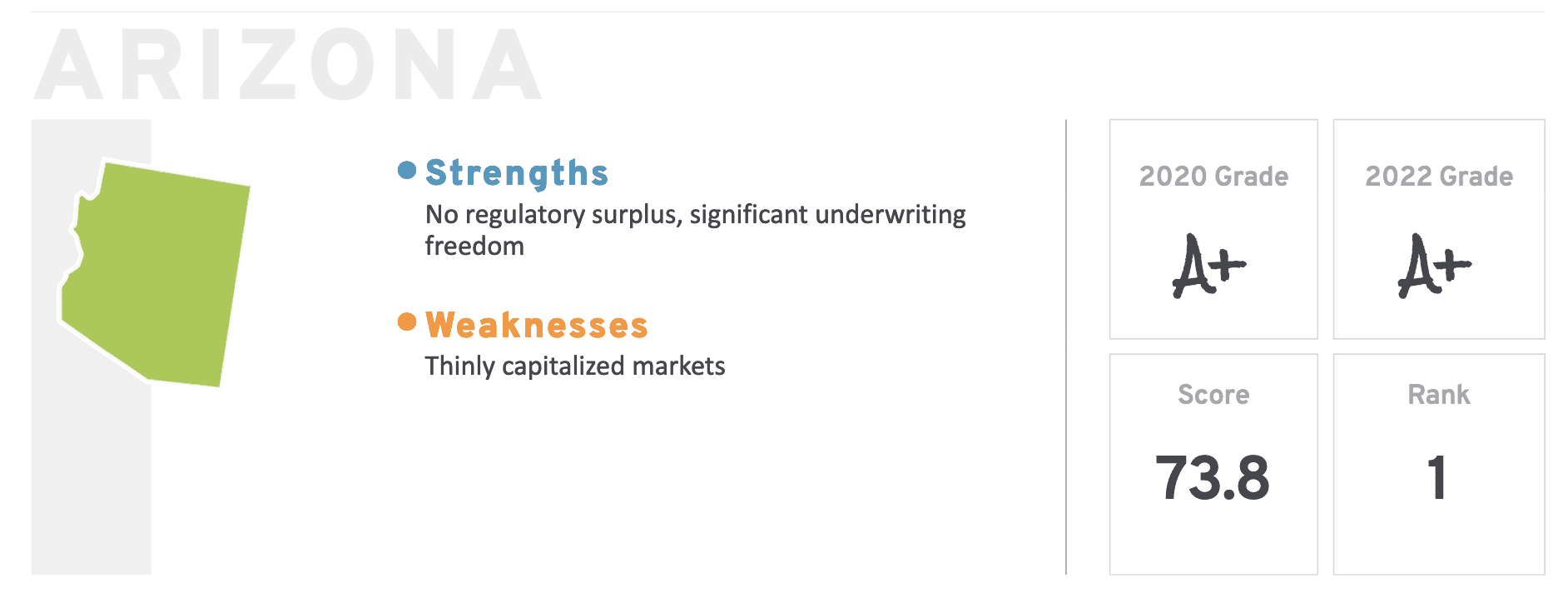

1. Arizona – 73.8 (A+)

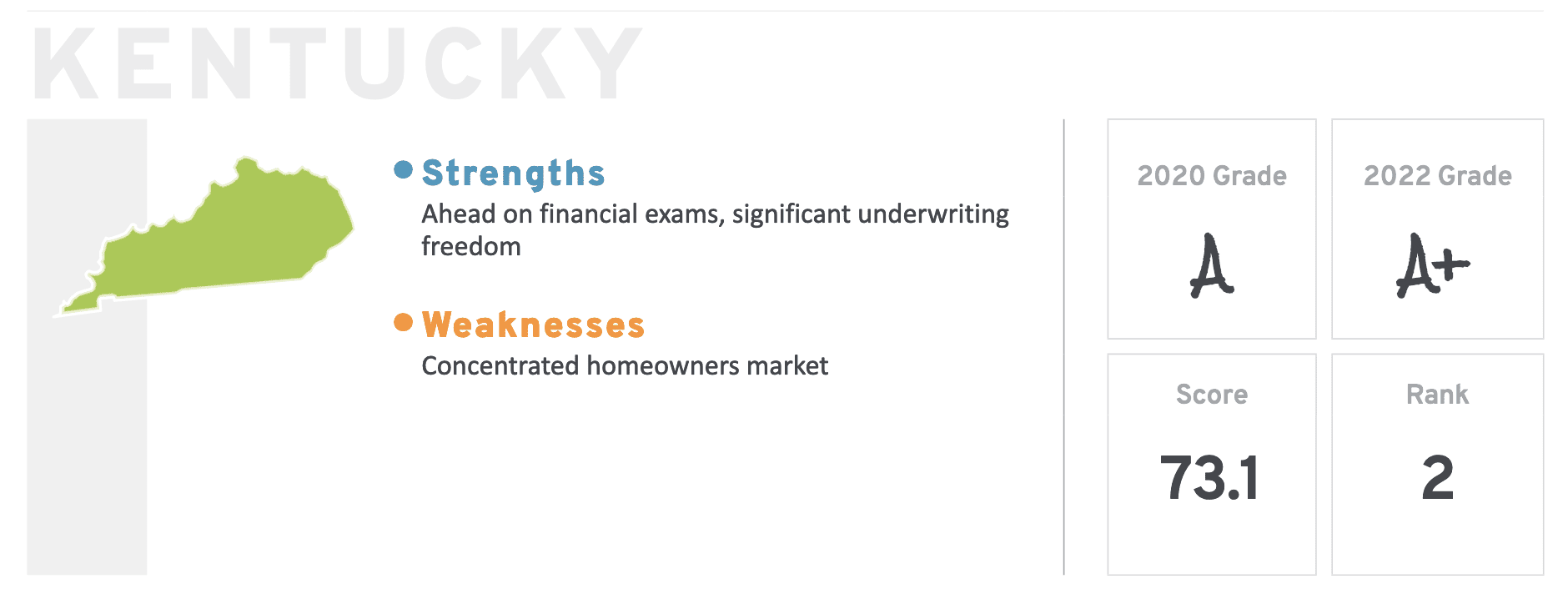

2. Kentucky – 73.1 (A+)

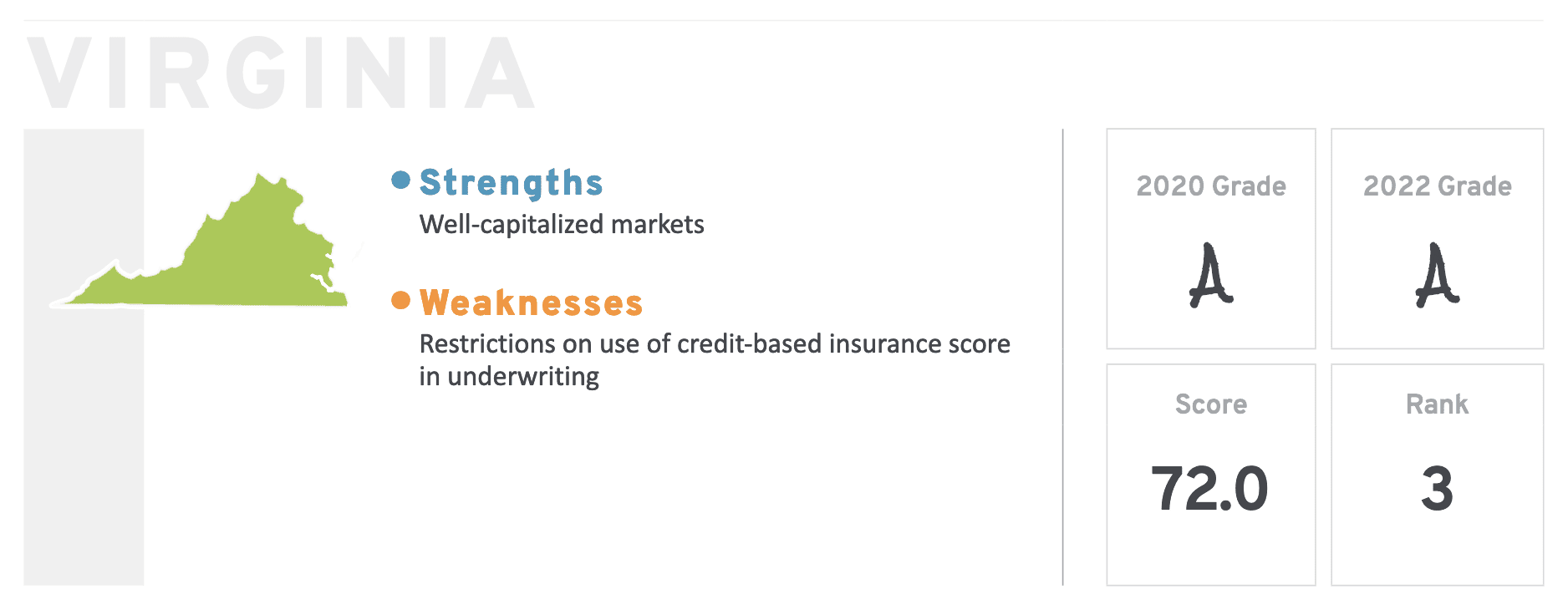

3. Virginia – 72.0 (A)

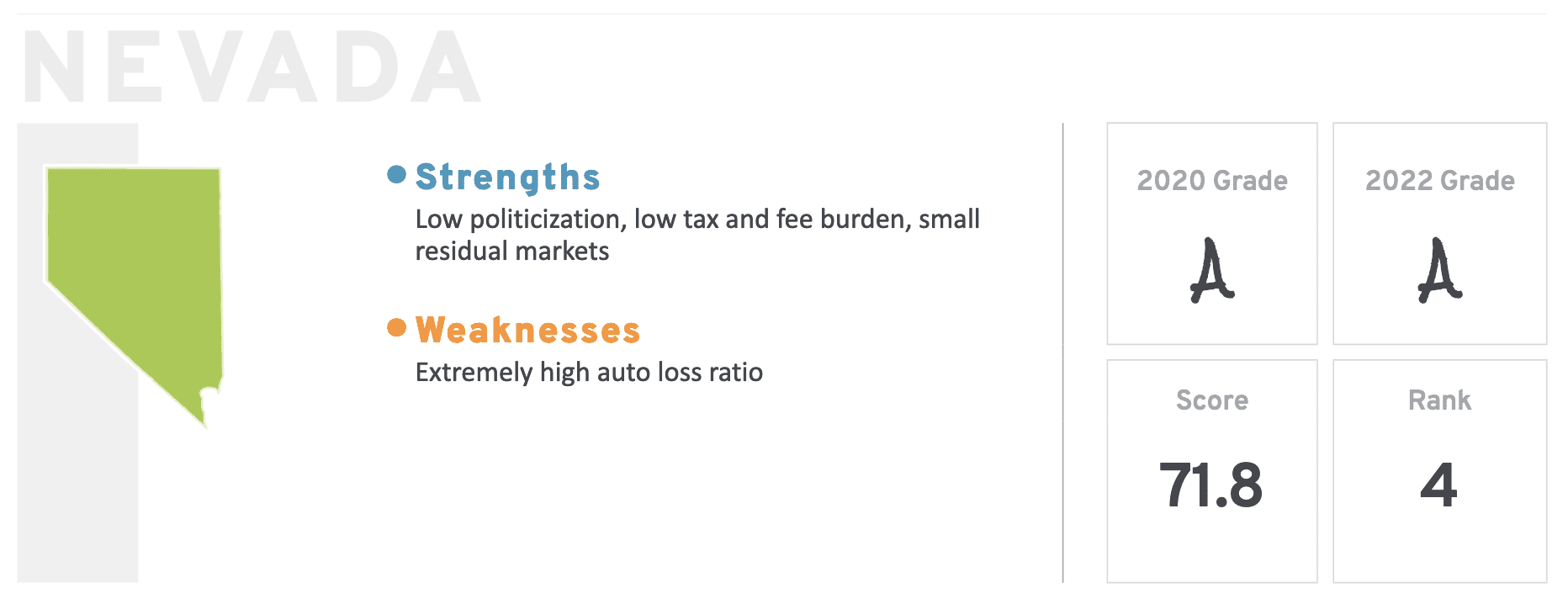

4. Nevada – 71.8 (A)

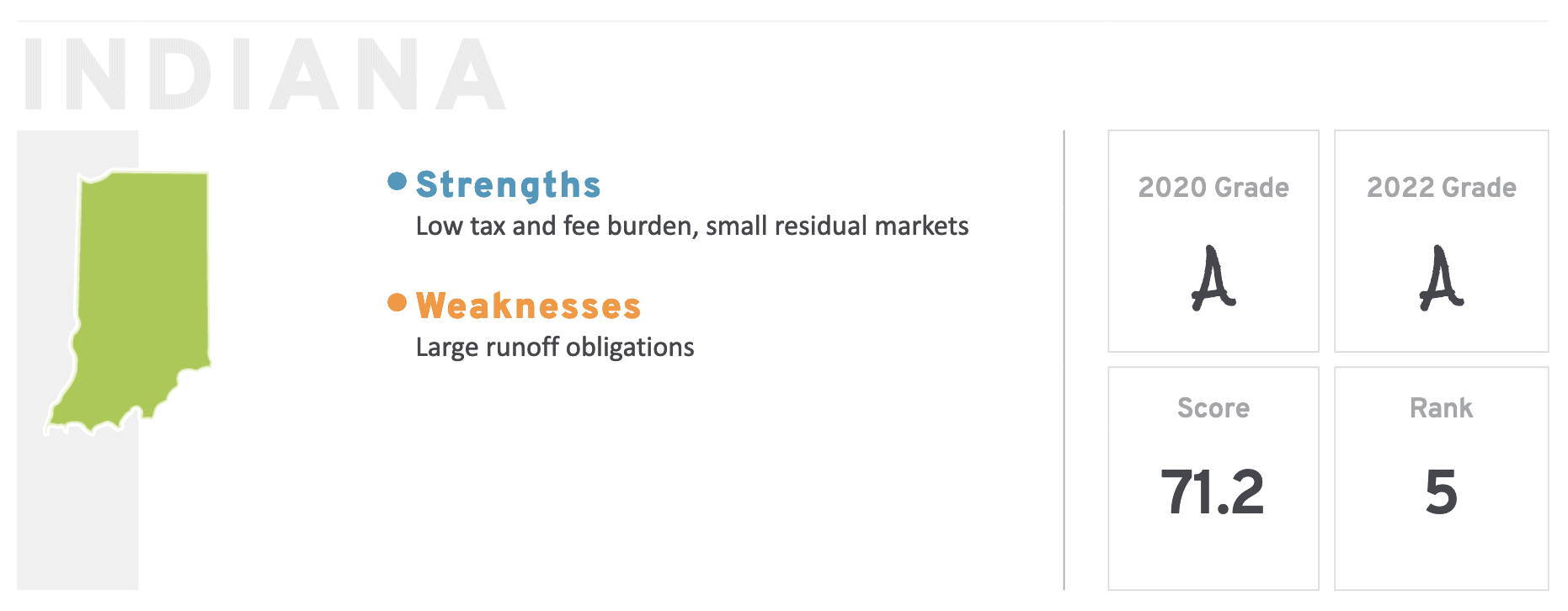

5. Indiana – 71.2 (A)

6. South Dakota – 70.9 (A)

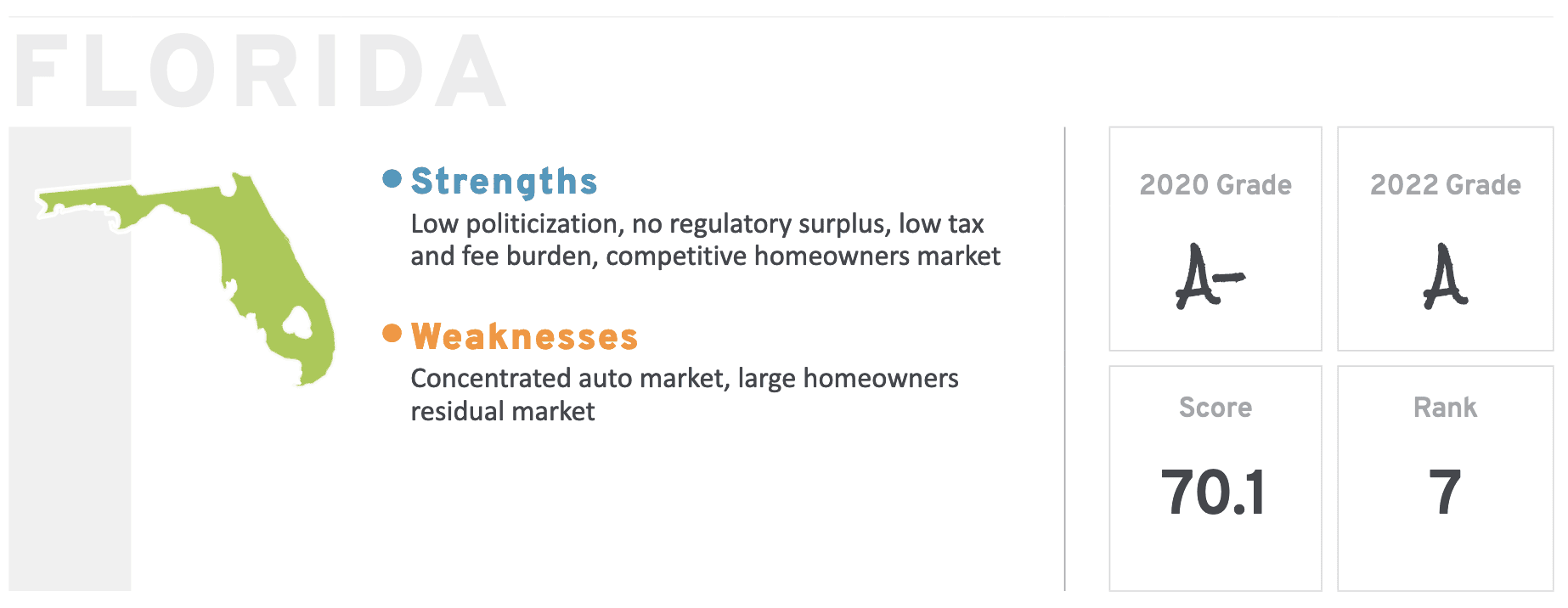

7. Florida* — 70.1 (A)

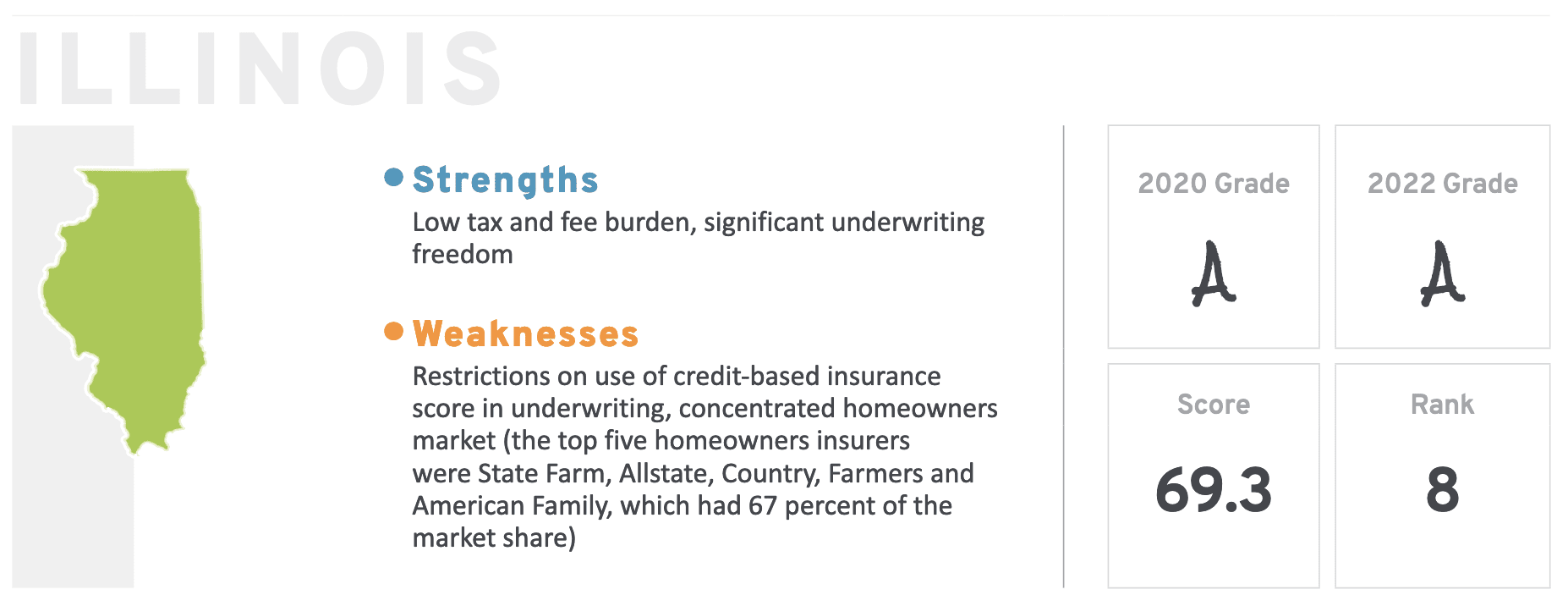

8. Illinois – 69.3 (A)

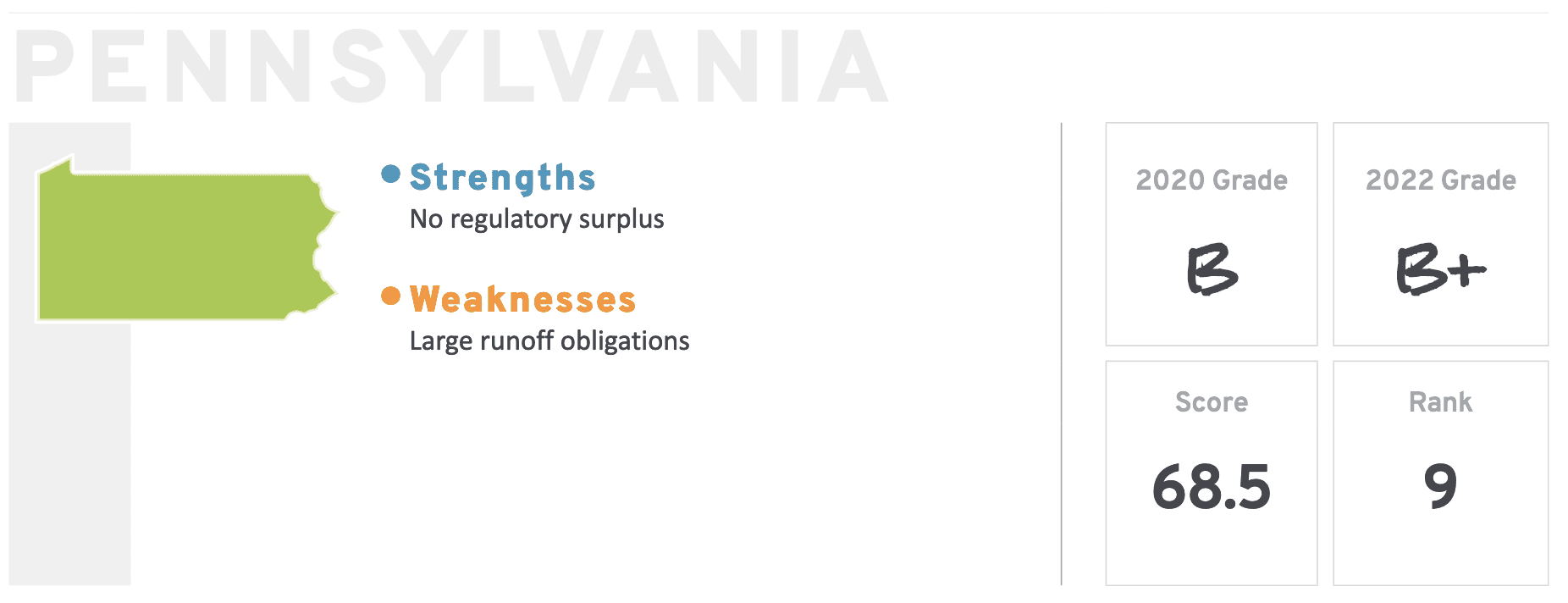

9. Pennsylvania – 68.5 (B+)

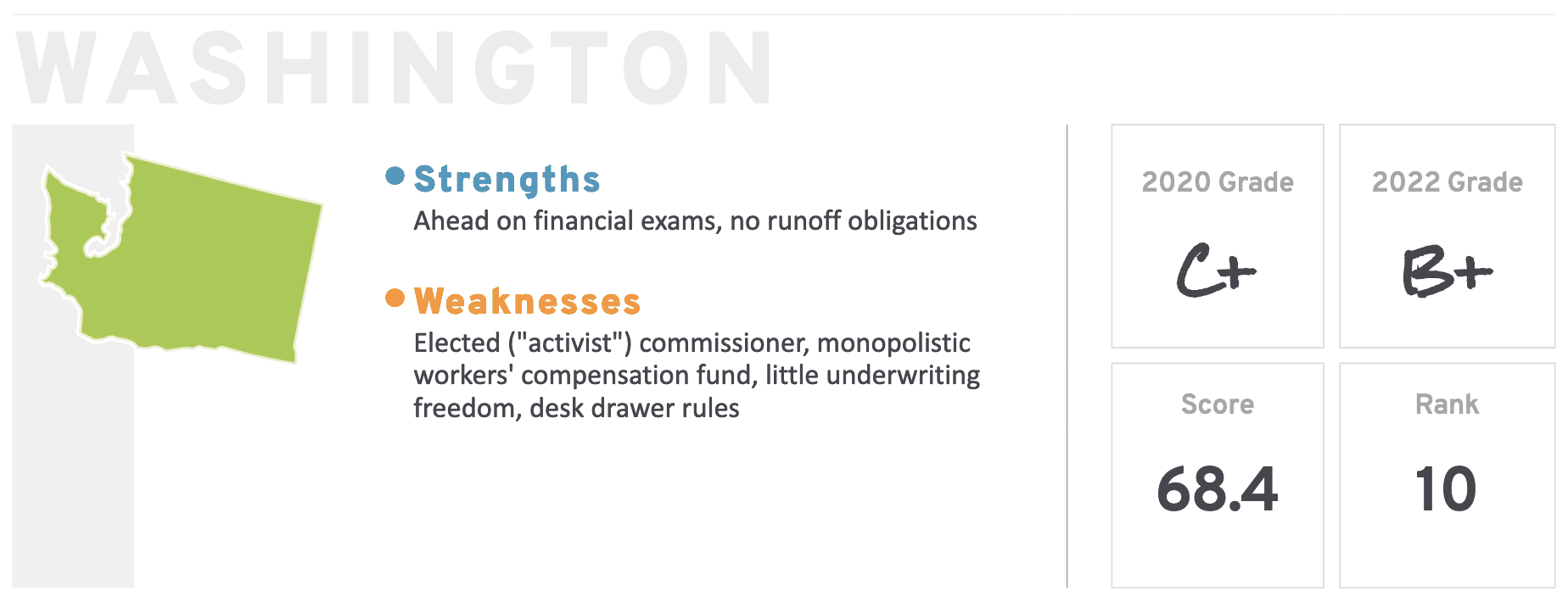

10. Washington – 68.4 (B+)

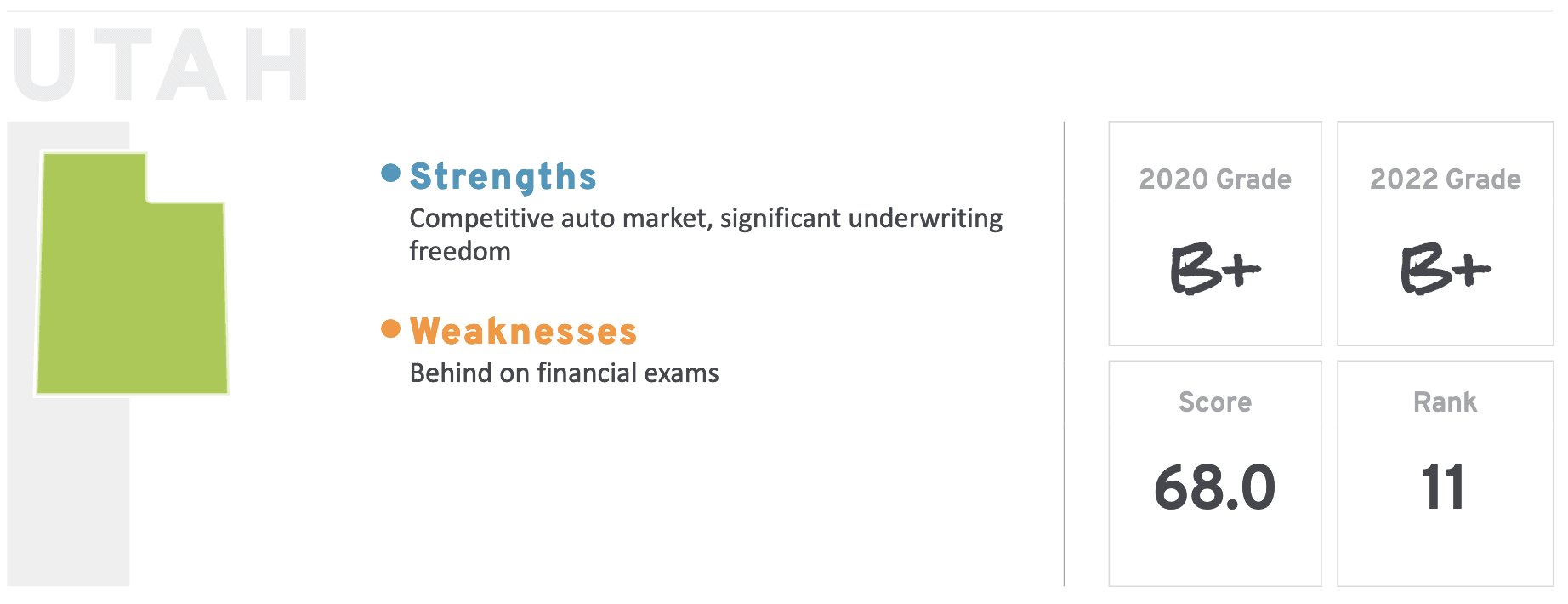

11. Utah – 68.0 (B+) (honorable mention – since Florida’s grade is an outlier)

*Florida—In an Insurance League of Its Own

Florida received an A grade, but for homeowners, it’s far from insurance paradise. This is because of off-the-charts levels of litigation and exposure to hurricanes. Neither of these are picked up in the criteria used for grading in this report card. They are issues created by factors beyond regulation; it’s not possible to control epidemics of trial lawyers and bad weather that plague the state.

On the plus side, Florida does well in regulating rates. Unlike California, insurers can get rate increases easily when needed. In addition, insurance commissioners in the state must be highly qualified. Specifically, Florida law requires commissioners to have five years of private sector experience in the insurance industry and five years of experience as a senior examiner or employee in a state or federal regulatory agency overseeing the insurance industry. Both of these five-year periods must have come immediately preceding the person’s role as a commissioner.

You can download and read the full 2022 Insurance Report Card here.

Image credit: thodonal