Finishing Generator Interconnection Reform

Regulatory barriers to power plant development create mounting cost and grid reliability concerns. They are also the prime determinants of energy emissions. In November, the CEO of the North American Electric Reliability Corporation bluntly stated that the United States has not proven its ability to develop infrastructure to support a reliable energy transition. Industry surveys cite regulatory approvals for permitting and grid interconnection as the largest barriers to power plant development today. Congress passed incremental permitting reform in the Fiscal Responsibility Act of 2023, while the Federal Energy Regulatory Commission (FERC) did so for interconnection in issuing Order 2023 this summer. However, in both cases, the heavy lifting remains undone.

Congress is quite familiar with permitting reform. Resolving sticky issues like judicial review and community engagement are next on the slate. Congress is quickly getting up to speed on how to resolve outstanding problems in generator interconnection. Meaningful congressional engagement requires understanding interconnection basics, the impact of Order 2023, the outstanding reforms that remain and the best role for Congress in finishing interconnection reform.

Interconnection Basics

Interconnection refers to the rules that new power generators must follow to connect to the electric grid. Regional grid operators, typically regional transmission organizations (RTOs), have differing interconnection rules that fall within FERC parameters. Generally, regions require generators to submit an interconnection request, after which they wait in a queue as multiple studies assess the grid impact of the new power plant. The studies identify if transmission upgrades are needed to connect the plant safely and reliably. They also inform upgrade costs and how costs are allocated according to specific regional procedures. Once all conditions are satisfied, the owner of the transmission system and the plant owner execute an interconnection agreement that delineates operational terms and cost responsibilities.

Most regions use a three-part study series: feasibility, system impact and facilities. These studies use limited assumptions and consider only conventional technologies, such as building new lines, as options for solving identified potential system overloads. The studies are resource-intensive and are often redone if a proposed generator higher in the queue withdraws a project because its absence may change the upgrade needs for other proposed generators.

Most regions allocate nearly all upgrade costs to the generator under the assumption that the vast majority of benefits accrue to the individual generator. This holds true for local upgrades, such as transmission facilities adjacent to a generator. But a broader array of generators benefit from network upgrades that occur on the larger transmission system, such as rebuilding older lines or substations.

Interconnection processes were designed 20 years ago for fewer and larger centralized power plants with predominantly vertically-integrated utilities, in which one company owned the generation and transmission facilities. A decade ago, about 100 gigawatts (GW) of new capacity entered interconnection queues annually, which ballooned to 700 GW in 2022. In addition to a surge in volume, the geographic composition of new generators is far more dispersed. The ownership composition has also changed, with competitive generators comprising the bulk of interconnection requests in many regions. Meanwhile, the transmission system has less slack, necessitating more network upgrades to accommodate new power plants.

Interconnection Problems

Past interconnection processes are unfit for today’s purposes. The sheer volume of interconnection requests, paired with unnecessarily complex study requirements, has overwhelmed grid-operator workforces. Grid operators’ study processes remain manually intensive, using conventional tools and administrative processes rather than embracing automation and advanced computing. Low information transparency and lack of predictability of interconnection costs has exacerbated the volume of interconnection requests because developers intent on building a single project submit multiple requests simply to obtain information on interconnection costs to inform their site selection.

All this translates into project development delays—a mounting concern for grid reliability, especially given the revival of demand growth that may outpace supply expansion. The average wait time in interconnection queues doubled from two to four years between the 2000s and 2010s. A typical generation project in 2022 spent five years waiting for interconnection approval, and the trend is worsening. The backlog is staggering; over 2,000 GW of capacity sits in interconnection queues currently, exceeding the installed capacity of the entire domestic generation fleet.

Inefficient generator interconnection also aggravates costs, especially when used to drive network upgrades on an individual generator basis. This incremental approach adds to the complexity of study requirements and foregoes least-cost solutions that would serve a broader array of generators. It increases upgrade costs by multiples and adds tens of billions of dollars in extra costs per region. Network upgrade costs are exacerbated by inaccurate study assumptions, little consideration of advanced transmission technologies, and varied modeling approaches and criteria across grid operators. Although generators pay these costs directly, they are mostly passed through to customers.

A good example is the PJM Interconnection, the largest grid operator in the country, which services the Mid-Atlantic through Chicago. Average interconnection costs grew eightfold from 2017-2019 to 2020-2022, primarily because of network upgrades. Local upgrade costs, which are appropriate for interconnection process scope, remain modest at $12/kilowatt (kW) compared to $71/kW for network upgrade costs. Developers report interconnection delays of six years on projects initiated in 2019, when the queue was less than half as backlogged as it is now. PJM’s 2023 reliability analysis found that low rates of new supply entry may put its system in a capacity shortfall by 2027 and stressed interconnection reform as one of three key reliability reform initiatives.

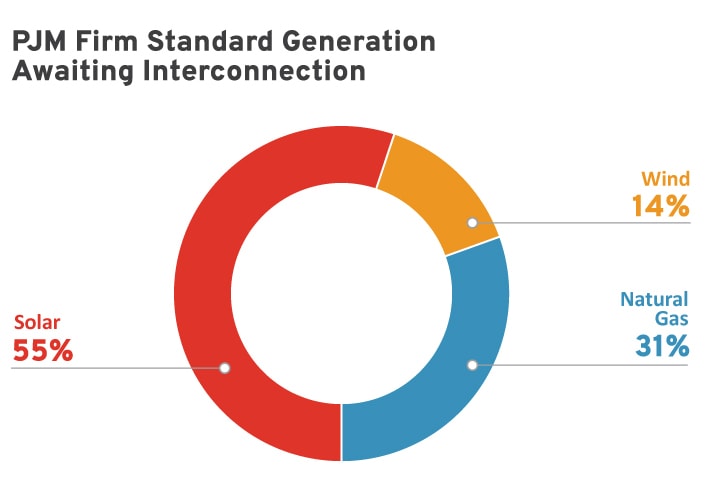

Source: R Street calculations and chart. Data from S&P Global, Lawrence Berkeley National Laboratory and PJM.

Note: Methodology augments nameplate capacity in the PJM interconnection queue as of June 28, 2023, using capacity-weighted interconnection completion rates and PJM’s capacity accreditation based on effective load-carrying capability. This includes standard generation only, which excludes hybrid, battery storage and trace levels of other resources.

Reliability woes are punctuated by the fact that any fuel or technology class under development is delayed by interconnection processes. It is easy to perceive interconnection as almost exclusively a renewable generator problem. As of June 2023, wind and solar comprised 92 percent of PJM’s standard generation interconnection queue capacity, with natural gas at 8 percent. However, project completion rates in the interconnection queue and the reliability value assigned to generator capacity vary by fuel type. Accounting for these, PJM’s firm generation capacity queue backlog is 69 percent renewables and 31 percent natural gas.

The Post-Order 2023 Landscape

In July, FERC issued a unanimous, bipartisan decision in Order 2023 to improve generator interconnection processes. The centerpiece was a requirement on grid operators to adopt a cluster-study approach to review interconnection requests in groups rather than one-by-one, as well as secondary reforms like improved transmission system transparency. While beneficial, the rule will not shift the status quo appreciably. Five of the six RTOs under FERC’s jurisdiction already used or planned to use the cluster-study approach.

Anticipating an underwhelming rule, energy consumer groups organized by the R Street Institute filed a letter at FERC in June calling for reforms to go beyond what FERC had proposed. In particular, it made the consumer and free-market case to reexamine drivers of cost-effective network upgrades, ensure transparent and realistic interconnection study assumptions, simplify interconnection requirements, expand information tools, and propel best queue management practices like automation and advanced computing. FERC leadership responded by acknowledging that Order 2023 was only a start and that deeper reforms would be necessary. But no game plan has emerged.

The consumer letter and various industry experts flag one RTO as a model for future interconnection: the Electric Reliability Council of Texas (ERCOT). ERCOT happens to be the only RTO not subject to FERC jurisdiction. ERCOT facilitates a transparent interconnection process, does not have complex generator-deliverability requirements and handles network upgrades efficiently through regional transmission planning. This slashes the cost of network upgrades and drastically lowers regulatory barriers to new generators. Full project development takes two to three years in ERCOT, whereas the interconnection study alone takes longer than that in most other regions. As a result, Texas tops the country in new generation development to keep pace with “remarkable load growth.”

A key difference between ERCOT and other RTOs is that ERCOT does not use a capacity market. Capacity-market resources face a higher deliverability test, which interconnection criteria have been synced to. The ERCOT model does not require generators to pass an extensive deliverability test, instead informing prospective generators of how their deliverability outlook affects their transmission congestion and curtailment risk. This approach places siting risk on generators, whereas other RTOs play a gatekeeper role based on crude assessments of generators’ deliverability. Even in capacity-market regions, interconnection criteria could be simplified to connect “as-available” resources to energy markets initially, with an option to upgrade later as a capacity resource.

Congressional Action

Congress can play a crucial role in expediting interconnection reforms without wading into technocratic decision-making. The knowledge of what should be done, categorically, is well known. FERC has authority to make the changes. However, FERC is backlogged just as badly as interconnection queues are and would have to procedurally reestablish a record with elongated comment periods before moving forward on a supplemental rulemaking to Order 2023. Further, FERC’s institutional deficiencies were evident in why Order 2023 fell short, diminishing confidence in how well the agency could initiate deeper reforms.

Congress could ensure key reforms get done and expedite reform by at least two years while delegating technical parameters to FERC and industry stakeholders. Given the year-to-year sensitivity of reliability conditions, finishing interconnection reforms on an expedited track is imperative. Congress could categorically call on FERC to:

- Require grid operators to use accurate and consistent study assumptions for all generation types based on actual operating practices.

- Adopt the most cost-effective network upgrades policy, with an emphasis on reexamining the role of proactive regional transmission planning.

- Ensure interconnection studies evaluate advanced transmission technologies and system redispatch for least-cost upgrade solutions and transparently explain solution selection criteria.

- Permit fast-tracking of interconnection requests for generators willing to accept “as-available” interconnection service and bear the risks of curtailment and congestion.

- Ensure grid operators have support and direction to employ advanced computing technologies, including automation and artificial intelligence, to expedite interconnection studies.

Given the parallels to permitting reform, packaging permitting and interconnection reform has obvious appeal. Such a bill to expedite infrastructure through regulatory modernization would considerably improve the outlook for energy reliability, affordability and environmental performance.