Colorado Homeowners’ Insurance: On the Right Path

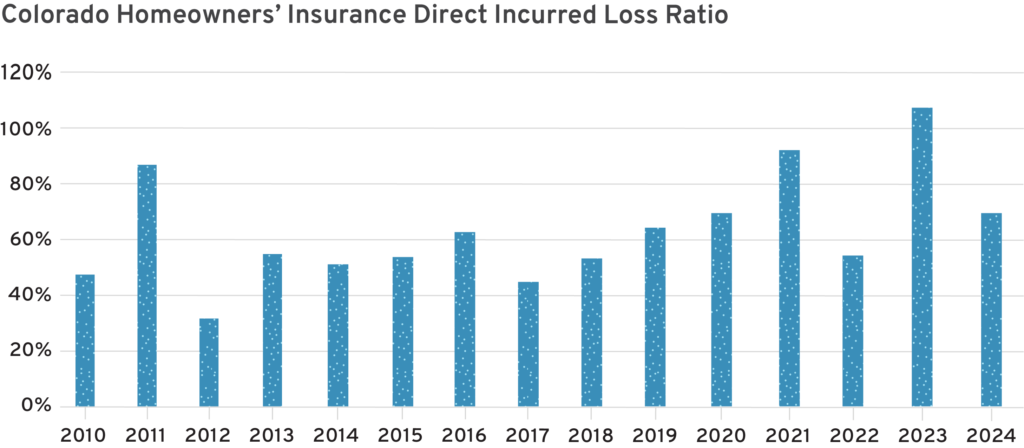

Something strange happened in the Colorado homeowners’ insurance market. Colorado was historically a profitable state for insurance companies. From 2010 to 2019, homeowners’ insurance averaged a 55 percent loss ratio, generating a 15 percent profit margin. There was only one year within that 10-year span when homeowners’ insurance delivered an unprofitable underwriting result for insurers: 2011.

From 2019 on, the picture grew markedly worse. Between 2020 and 2024, the Colorado homeowners’ insurance loss ratio averaged 78.6 percent, driving insurers to raise rates and charge higher premiums to policyholders. Profitability has varied in recent years due to drought, fire, hailstorms, and flooding—2021 and 2023 were extremely unprofitable, while 2020 and 2024 were break-even years. The only profitable year for homeowners’ insurance in Colorado was 2022. But there is good news amid these bleak numbers: Insurance regulators and state lawmakers have sprung into action, producing valuable studies analyzing the situation and passing targeted legislation to help restore market health. Other states grappling with severe weather driving up insurance rates can learn from the measures taken in Colorado.

The Colorado homeowners market is relatively concentrated. The top 10 homeowners’ insurers in the state had an 88.3 percent market share in 2024, up from 85.3 percent in 2014. Total Colorado industry homeowner premium rose dramatically in the past decade, almost tripling from $1.9 billion in 2014 to $5.2 billion in 2024. This reflects sharp rate increases in response to severe natural catastrophe activity. The state’s population growth of 10.8 percent between 2013 and 2022 accounts for some of that increase but is far outstripped by premium growth.

Colorado Homeowners’ Insurance Premium and Loss Ratio (Top 10 Insurers)

| 2024 Direct Premium Written (in $Millions) | 2024 Direct Incurred Loss Ratio | |

|---|---|---|

| State Farm | 1,139 | 99.7% |

| Liberty Mutual | 738 | 69.3% |

| USAA | 644 | 66.5% |

| Allstate | 516 | 61.3% |

| American Family Insurance | 490 | 58.2% |

| Farmers Insurance | 395 | 51.2% |

| Travelers | 339 | 67.1% |

| Nationwide | 158 | 80.7% |

| Chubb | 158 | 23.2% |

| Progressive | 54 | 66.3% |

| Top 10 | 4,631 | 64.4% |

| Total Industry | 5,245 | 69.7% |

The Secondary Shall Be Primary

Insurance lingo has long distinguished between primary and secondary perils. As sources of the largest losses, hurricanes and earthquakes were considered primary perils. All others—such as flood, fire, hail, derechos (inland hurricane-strength straight line wind), tornadoes, severe storms, drought, and extreme heat or cold—were considered secondary because they caused much less damage. But the categories flipped a few years ago, turning secondary perils into primary perils due to their increased destruction. For example, severe convective storms accounted for 65 percent of global natural catastrophe losses in 2024.

According to the U.S. Billion-Dollar Weather and Climate Disasters database maintained by the National Oceanic and Atmospheric Administration (NOAA) National Centers for Environmental Information (NCEI), 27 individual weather and climate disasters with at least $1 billion in damages occurred in 2024 (second only to 2023, which saw 28 such events).

Wildfires have become more common in Colorado; in fact, all 20 of the state’s most destructive wildfires took place within the last 20 years. The three largest—East Troublesome, Gulch and Marshall—are also among the most recent. Even so, the NOAA-NCEI database shows significantly more severe storm and drought catastrophes than wildfires between 1980 and 2024.

Nationwide Catastrophe Events (1980-2024)

| Catastrophe Event | Number of Events |

|---|---|

| Severe storm | 203 |

| Tropical cyclone | 67 |

| Flooding | 45 |

| Drought | 32 |

| Winter storm | 24 |

| Wildfire | 23 |

| Freeze | 9 |

The preceding table shows that, historically, the most frequent catastrophe events have been severe storms, hurricanes (or cyclones), flooding, and drought. In Colorado, hailstorms with hail the size of tennis balls and 70 mph winds, as in June 2025, have become common.

These increasingly frequent and destructive hailstorms may contribute to Colorado’s position as one of the most expensive states for home insurance. Its $151 million per year in hail losses is the second highest of any state. Hailstorm losses have risen by approximately 65 percent in the past three years alone. Colorado Insurance Commissioner Michael Conway commented that “[a]nywhere from 50% to 60% of the insurance premiums that people pay in Colorado is, on average, paying for hail.”

Good Reports

Faced with the prospect of insurers taking up their mat and walking out of the state due to unprofitable results, the Colorado Legislature formed a study committee that commissioned reports from consultants to research homeowners’ insurance availability and affordability in the state.

- The “Final Report to the General Assembly” is the work product of the Wildfire Matters Review Committee, which was formed to oversee and review wildfire-related prevention, mitigation, public safety, and forest health issues in Colorado.

- “Wildfire Risk, Our Homes, and Our Health” was commissioned by the Colorado insurance department to identify opportunities for the insurance industry—including state and local partners—to reduce wildfire risk and improve insurance availability and affordability.

- The “Homeowner Availability Study,” produced by consulting firm Oliver Wyman, was initiated in the wake of Colorado wildfires and the passage of “Disaster Preparedness and Recovery Resources” (SB22-206) to study the stability, availability, and affordability of homeowners insurance.

- “Analyzing Homeowners Insurance Availability and Affordability Following a Catastrophe” provided information on the methodology used for the Homeowner Availability Study.

Much of the emphasis in the above reports is on the wildfire peril. While wildfire is a significant risk in Colorado, other perils including hail, tornadoes, drought, and extreme temperatures are even more common and deserve attention as well.

Legislation

Several bills regarding Colorado homeowners’ insurance passed in the wake of the aforementioned reports and meetings of the Wildfire Matters Review Committee:

- Colorado’s “Fair Access to Insurance Requirements (FAIR) Plan” (HB23-1288) was established in 2023. As in most states, this plan created an unincorporated public entity to provide property insurance coverage when such coverage is not available from admitted companies. Policies began to be written at the start of 2025. Data on these policies and related premiums will be available at the end of the fiscal year.

- The “Homeowner’s Insurance Underinsurance” bill (HB23-1174) extended the nonrenewal notice period from 30 days to 60, allowing agents more time to find a replacement insurer if their incumbent insurer does not offer a policy renewal.

- The “Study on Remediation of Property Damaged by Fire” (HB24-1315) examines standards for the remediation of residential premises damaged by fire. It also studies properties damaged by fire-induced smoke, soot, ash, and other fire-generated contaminants and makes an appropriation.

- “Risk Model Use in Property Insurance Policies” (HB25-1182) requires insurers to factor in property and community mitigation when scoring wildfire risk. It also requires insurers to explain risk scores and pricing impacts and introduces an appeal process wherein policyholders can appeal wildfire risk scores.

- Other bills introduced involve using artificial intelligence to help fight wildfires, funding forestry and firefighter workforce education, and supporting prescribed burns.

“Increase Access Homeowner’s Insurance Enterprises” (HB 25-1302) failed to pass in May 2025. It would have required homeowners to pay 1 percent of premium to fund “Strengthen Colorado Homes Enterprise,” a grant program to harden hail-proof roofs, and a reinsurance program to reduce wildfire risk. The bill passed in the Colorado House but failed in the Senate Finance Committee (6-2).

Recommendations

The studies and presentations to the Wildfire Matters Review Committee contain a treasure trove of valuable analysis regarding the root causes of rising losses and premiums in Colorado homeowners’ insurance. Sound public policy rests on objective, fact-based evidence. The Colorado model is exemplary and can help other states facing insurance challenges from severe weather events. Georgia, for example, has recently formed two study committees—one on insurance, the other on reinsurance.

Recommendations to consider beyond those related to the new legislation include:

- Home mitigation. Homeowners can reduce fire risk by maintaining clean gutters; keeping rooftops free of debris that could ignite; and removing easily combustible material, such as bark mulch, from within 5 feet of a home. Screens can be installed over attics and crawlspaces to prevent embers from starting a fire.

- Fire-resistant materials. Fire-resistant roofs, siding, and landscaping are superior to flammable materials. Building with materials other than wood is a better alternative for new construction that could help harden homes against several catastrophe perils.

- FAIR depopulation. Colorado’s new FAIR Plan should be a true market of last resort. Like other state-backed FAIR plans, its ultimate goal is to make homeowners’ insurance available to those who cannot secure insurance in the standard market. After the private market achieves stability, it should shrink the way other FAIR plans, such as Florida’s, have done.

- Building codes. Colorado is a home-rule state, which means local municipalities or counties are authorized to pass legislation for their jurisdictions. This means there is no statewide building code; however, statewide wildfire standard code may be introduced, as it has in Boulder.

- Forest management. Prescribed burns and clearance of dry vegetation that can serve as fuel for fire should be allowed without the crippling bureaucracy of states like California.

The measures Colorado is exploring to strengthen its homeowners’ insurance market address the root causes of market challenges. If all 50 states were to draft appropriate legislation, they would all probably get A or B grades on R Street’s Insurance Regulation Report Card.