Flood insurance a key issue in Louisiana Senate race

“Amusingly to me, both Bill Cassidy in the House and Mary Landrieu in the Senate expressed annoyance when we pointed out the inconvenient truth that Louisiana Senate politics has been driving a great deal of this,’’ said Andrew Moylan, a senior fellow at the R Street Institute, a libertarian think tank.

Featured Publications

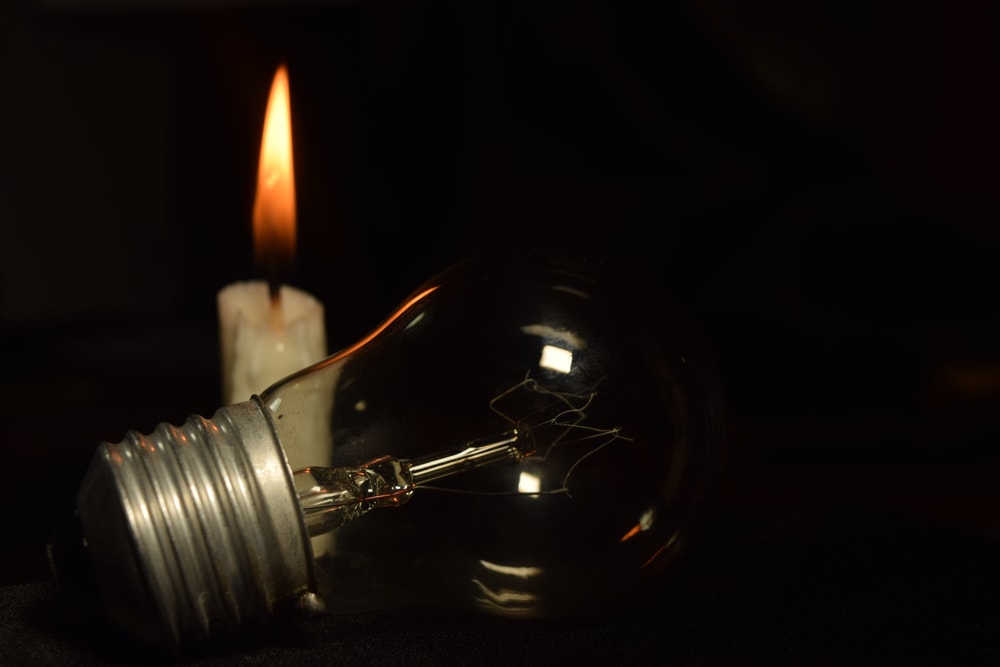

Low-Energy Fridays: Turn Down (the Power) for What?

California and Other States Threaten to Derail the AI Revolution