Comments for the 2023-2028 National OCS Oil and Gas Leasing Proposed Program

October 6, 2022

Bureau of Ocean Energy Management

Attn: National OCS Oil and Gas Leasing Program Development Coordination Branch

45600 Woodland Road

Sterling, VA 20166-9216

Re: Comments for the 2023-2028 National OCS Oil and Gas Leasing Proposed Program, Docket ID: BOEM-2022-0031

Dear Ms. Kelly Hammerle,

The R Street Institute (RSI) is submitting this public input on the proposed 2023-2028 National Outer Continental Shelf Oil and Gas Leasing Program to inform policymakers on the potential tradeoffs and considerations for three key topics:

- Environmental impacts of U.S. offshore oil and gas leasing policy.

- Economic impacts of U.S. offshore oil and gas leasing policy.

- Energy security implications of U.S. offshore oil and gas leasing policy.

In offshore oil and gas leasing, the complexity regarding the interactive effects of environmental, economic and national security policy complicates policy implications. This comment aims to inform policymakers of mitigating and exacerbating factors that may affect outcomes in each of these policy areas.

Generally, this comment points out that the current array of evidence on the climate impacts from offshore oil and gas production indicates that a change in leasing policy is unlikely to yield any climate benefits. Additionally, the current and near-term heightened demand for oil and gas, as well as Russian curtailment of energy sales to Europe, means that there is a strong likelihood that delayed or reduced offshore energy leasing would have a deleterious economic effect and worsen energy security concerns that have been recently exacerbated.[1]

I. Environmental Impacts of U.S. Offshore Oil and Gas Leasing

Given the current economic and environmental literature, we think that it is unlikely that any reduction in near-term output from U.S. offshore oil and gas production would lead to materially significant greenhouse gas (GHG) emission reduction. Additionally, literature assessing the environmental impact of U.S. offshore oil and gas production indicates that reduced production may lead to increased global emissions.[2] This is due to the lack of available energy substitutes, foreign oil and gas production potential, and expectedly lower lifecycle emission profile of U.S. offshore oil and gas production.

A. Lack of Available Substitutes Diminish Environmental Impact of U.S. Offshore Energy Policy

The key to determining if there is an environmental benefit from reduced U.S. oil and gas production in general is the sensitivity of consumers to price and the elasticity of resource consumption in either consuming less through efficiency or substituting fuel types. In both cases, there seems to be minimal opportunity for impact through the 2028 period of the lease proposal.

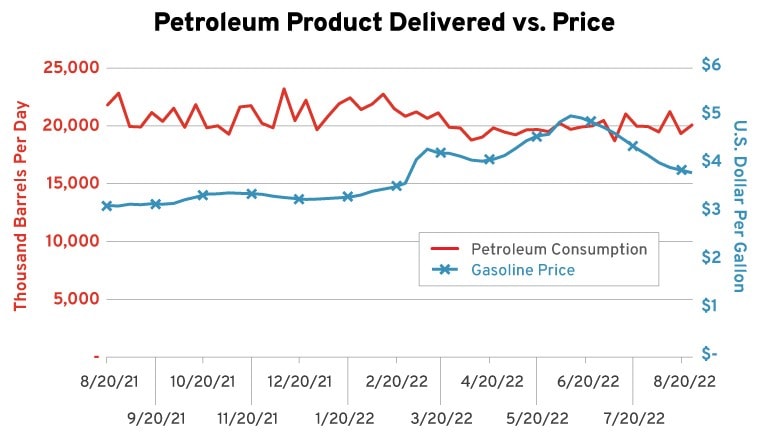

Reduced offshore oil and gas production would lead to increased prices from constrained supplies, which could potentially drive consumer behavior to reduce consumption. However, we are already in a period of exceptionally elevated prices for both oil and natural gas, and demand has not abated. The chart below shows petroleum product supplied, which indicates consumption, relative to gasoline prices, which offer a rough corollary of overall petroleum product costs.

Source: U.S. Energy Information Administration Petroleum & Other Liquids Data.[3]

An important insight from the chart displayed is that at peak prices for this year in mid-June, with costs over $5 per gallon, supplied petroleum product to the market was only 5 percent below what it was in January. At the lowest point of product supplied in April, prices were $4.09 per gallon, but in mid-July of 2022, gasoline prices were 10 percent higher than in April and product supplied was 12 percent higher. Even extraordinarily large shifts in price do not significantly diminish near-term demand for liquid fuels, which is likely due to the utility that consumers derive from them as a transportation fuel that enables other economically significant activity (work commuting, product transportation, etc.).

U.S. offshore crude oil production in 2021 was 1.7 million barrels per day, down from 1.9 million barrels per day in 2019. Domestic offshore oil production represents approximately 15 percent of overall U.S. crude oil production, and about 2 percent of global production. [4] Simply, U.S. offshore energy production is a materially significant resource where reduced or increased production is likely to have a measurable effect on price. However, even if supply is reduced, the environmental benefits that could be realized from reduced consumption are unlikely, as current evidence reveals an inelasticity of consumption even in the face of high prices.

Part of the reason that elevated energy prices or reduced domestic production is unlikely to result in any reduction of global GHG emissions is that higher liquid fuel costs have also elevated demand for alternative vehicles, and thus increased their costs substantially. In June, Tesla, one of the largest suppliers of electric vehicles (EVs) to the U.S. market, increased the cost of all vehicles by $2,500 to $6,000.[5] This may be in part because lithium, a major component in EVs, has dramatically risen in cost—now over 10 times more expensive than it was in January 2021.[6] Another major EV component, cobalt, is also experiencing elevated prices. Cobalt prices have fallen considerably from their earlier peaks this year, but remain roughly 46 percent higher today than they were in January 2021.[7] Materials scarcity for liquid fuel substitutes mean that consumers are more likely to source liquid fuels from alternative suppliers rather than transition to EVs or other products that can abate demand.

Natural gas produced from offshore resources is also unlikely to result in fuel substitution if its production is reduced. While conventional political discourse often focuses on the expansion of renewable energy and storage technology, in practice the deployment of these resources is stymied by two major factors. First, there is a large volume—near equal to the total existing electric capacity—of renewable energy capacity that is already attempting to interconnect U.S. electric grids.[8] Demand for renewable energy resources already exceeds supply, but supply is limited by regulatory barriers to market entry, meaning that a depression of natural gas supply would only raise costs, but would not accelerate the rate of renewable energy adoption in the market.[9]

Second, most renewable energy in the electric power sector comes from wind and solar, which are imperfect substitutes for natural gas. The 24/7 availability of natural gas power plants means they often service energy demand during times when renewable resources are unavailable. The more readily available substitute for natural gas is coal; by displacing coal, increased natural gas production in the United States reduced GHG emissions.[10] Reduced natural gas supply in the United States would lead to the retention of coal plants needed to service demand periods that renewables cannot, and similarly would improve the economic viability of coal plants abroad—especially in Europe and Asia. Analysis on the exports of U.S. produced natural gas has found that, owing to the substantially higher emission profile of coal, which is its primary competitor, it is unlikely that U.S. production of natural gas for export would increase global GHG emissions.[11]

Additionally, even though natural gas prices in the United States are elevated at $8.22/thousand cubic feet today compared to $3.33/thousand cubic feet in January 2021, prices are far higher in Europe, at 243 euros per megawatt hour (MWh) compared to 19 euros per MWh in January 2021.[12] These high prices suggest that even though the market is seeking to substitute natural gas with renewable energy wherever possible, scarcity of natural gas may also be driving coal consumption that raises emissions. This is not merely hypothetical, but observable, as Germany has restarted coal plants to face looming energy demand in the winter.[13]

Currently, we find little evidence to suggest that any reduced natural gas production in the United States would lead to lower emissions in the near term, owing to the increased demand for higher-emitting coal and already high renewable demand that is stymied by grid interconnection issues.[14]

B. Comparative Life-Cycle Emissions of U.S. Offshore Energy Production

Another question of if emissions might fall from delayed or diminished U.S. offshore energy production is if competing oil and gas resources have a higher or lower life-cycle emission profile. Currently, there is no consensus on if offshore U.S. oil and gas production has a worse or better emission profile than other sources, but existing literature suggests that U.S. offshore-produced oil and gas is lower in life-cycle emissions than alternative sources.

A study performed last year by Wood Mackenzie assessing the carbon footprint of crude oil produced from the Gulf of Mexico (GOM) relative to other domestic and foreign supplies found that U.S. GOM oil was among the least emission-intensive oil sources.[15] This is consistent with similar assessments, such as the Carnegie Endowment’s 2015 study comparing the lifecycle emissions of various oil sources and finding that U.S. GOM oil had among the lowest upstream GHG emissions of any available oil source.[16] Similarly, a Bureau of Safety and Environmental Enforcement study performed by Argonne National Laboratory found that in assessing opportunities to reduce offshore energy production emissions, the United States is among the least flaring-intensive countries (flaring being a major source of GHG emission in oil and gas production).[17] And most recently, McKinsey & Company found that oil produced from the GOM “has among the lowest emissions per barrel of all major basins in the world.”[18] Generally, literature has shown U.S. GOM-produced oil and gas to be cleaner than foreign suppliers, and sometimes even cleaner than onshore production.

One recent study published in Environmental Research Letters has cast into doubt the potential for emission benefits from U.S. GOM energy relative to other suppliers, noting that observed methane (a highly potent greenhouse gas) plumes from offshore facilities were considerably higher than that of onshore facilities.[19] The study relied on observed methane plumes, rather than estimates, improving its credibility. However, it should be noted that the study found that select facilities with higher-than-expected emission rates account for most of the methane emissions. Since the study only analyzed facilities with an observable methane plume, it is difficult to know if the findings are applicable to all offshore facilities. The major takeaway, though, is that since some facilities, likely older ones, are responsible for most methane emissions from U.S. GOM oil and gas production, new production from new leases that use modern equipment may be less likely to have above-expected emissions. Additionally, since the emissions are contingent upon methane loss rates due to infrastructure deficiency, emissions can be mitigated through facility improvement.

A 2016 assessment on the lifecycle emissions impact from U.S. offshore oil and gas production performed by the Bureau of Ocean Energy Management (BOEM) concluded that “U.S. GHG emissions would be slightly higher if BOEM were to have no lease sales, assuming no major market or policy changes … Emissions from substitutions are higher due to the exploration, development, production, and transportation of oil from international energy sources being more carbon-intensive.”[20] At this time, RSI generally concurs with BOEM’s 2016 conclusion that the emissions impact from lease sales is minimal, or potentially negative, due to the continued high demand for both oil and natural gas from foreign sources, scarcity of alternative energy sources and the imperfect substitutability of alternative energy sources.

If BOEM uses a climate change-focused justification for a delay or reduction of offshore oil and gas leasing, there should be a high bar for credible analysis to make such a case when conventional expectations are that there is minimal or no climate benefit from such policy.

II. Delayed Offshore Energy Leases Would Have Economic Impacts

U.S. federal resources represent an interesting economic case. In a perfectly functioning economy, consumer demand is met by private suppliers that compete among each other to set prices, which signals to both consumers and producers what activity has value. When it comes to federal resources, the issue is complicated by the fact that access to those resources is determined by politicians, not by market signals. As a result, there is the potential for inefficiency when viable resources are rendered unproductive due to political—rather than market—conditions.

Government stewardship of natural resources is an important and underappreciated role of public policy since the government should represent public interests. National parks, for example, are an important conservation effort in which the utility to the public is not always easily measured in terms of economics, even though there might be some economic benefit from an alternative use of the land.

When it comes to offshore energy leases, the government must determine public benefit and implicit tradeoffs. Policymakers should understand, though, that the current and near-term high demand for oil and gas, elevated prices and the importance of energy supplies in the economy mean that delayed or diminished offshore oil and gas leasing would have a deleterious economic impact on the United States and other countries.

In this comment, we do not attempt to estimate the economic impact of various leasing scenarios, but it is important for policymakers to understand that the extent of economic impact is contingent upon the level of substitutability among resources, and the potential for alternative supplier market entry. Earlier in this comment, we noted that alternative energy sources that would substitute for offshore oil and gas are constrained from market entry by regulatory barriers, materials scarcity and the inability to service specific market demands. Additionally, the currently elevated oil and gas prices indicate that available oil and gas supplies would enter the market if they could, meaning that policymakers should not expect that a decrease in U.S. offshore production would necessarily entail an increase in onshore or foreign production.

Given the current market conditions, policymakers should expect that reduced or delayed offshore oil and gas leasing would have a larger economic impact than is typical. Policymakers should endeavor to estimate the economic costs at the domestic household level from the potential scenarios of its leasing actions before making final policy determinations.

III. Current Energy Security Challenges will be Exacerbated by Delayed or Reduced Offshore Oil and Gas Production

The current war between Ukraine and Russia has demonstrated that many Western nations remain deeply reliant on potentially adversarial regimes for energy. Russia is the world’s second largest oil and gas producer, second only to the United States.[21] In 2020, Russia accounted for 29 percent of the European Union’s crude oil imports and 43 percent of its natural gas imports.[22] Now, Russia is threatening not to resume natural gas exports to Europe for the winter unless sanctions are lifted.[23] Natural gas prices in Europe have increased by about twenty fold since before the pandemic, and household energy costs in the United Kingdom are expected to nearly double by the end of this year. [24] Fossil fuel suppliers, despite policymaker’s desires, are still able to inflict severe economic pain on select nations.

During periods of low energy prices, policymakers often oversimplify energy security issues, speaking of renewable resources or alternative energy types that can reduce dependency. But despite decades of such efforts, fossil fuels still are the primary energy sources in developed nations. So long as this remains true, foreign powers will be able to inflict economic harm on the United States and its allies. Currently, high energy prices may accelerate some substitution of fossil fuels where possible but should not be expected to be a near-term solution to energy security needs as the capital stock involved in energy production and consumption does not turn over quickly.

Reduced U.S. oil and gas production results in a larger share of other producers’ market influence. While companies often bear the brunt of scrutiny around oil and gas production, governments control most such production. These governments regularly manipulate output to meet political or economic objectives.[25] The counter to this influence is the free market, in which higher prices caused by artificially constrained supply incentivizes the market entry of new producers. However, if public policy curtails access, the influence of foreign oil and gas producers will only increase.

Importantly, policymakers should understand that oil and gas are traded in global markets. Reduced oil production in any country affects price everywhere in the world. Even if the United States can produce enough oil and gas for its own needs, diminished production results in higher prices both at home and abroad due to global demand and resource fungibility across producers.

From a national security perspective, diminished energy security is a problem not just due to the need for energy for national defense purposes, but because of the increased ability of foreign producers to raise the costs of U.S. foreign policy decisions. In the 1970s, for instance, countries levied embargoes against the United States over its support of Israel in an attempt to force the United States into withdrawing aid.[26]

In the 1970s, the United States did not yield to the economic impact of the embargo, but it was an important lesson on the need to reduce energy costs to avoid foreign powers being able to punish U.S. policy decisions. The United States and its European allies are in a similar situation as before though, where Russia is hoping that higher energy prices will force Western nations to abandon their sanctions and support of Ukraine. Russia’s ability to increase the economic costs of the West’s support for Ukraine is exacerbated by diminished oil and gas production in the United States, and dampened by increased U.S. production and export to Europe.

Policymakers should understand that U.S. offshore oil and gas leasing policy will affect the energy availability of other nations, and reduced production in the United States will result in increased influence of energy-producing authoritarian regimes abroad.

IV. Conclusion

RSI notes that current market dynamics and existing research suggest that any significant climate impact or benefit from a change in offshore oil and gas leasing behavior is unlikely. Reduced U.S. energy production could, in fact, have deleterious economic impacts, as well as elevate the influence of rival foreign powers that leverage energy supplies to elicit foreign policy concessions. As policymakers prepare the 2023-2028 oil and gas leasing program, they should consider these tradeoffs.

RSI respectfully requests the Bureau to consider the public input offered herein.

Respectfully submitted,

Philip Rossetti

Senior Fellow, Energy & Environment

R Street Institute

1212 New York Ave. NW

Suite 900

Washington, D.C. 20005

[email protected]

[1] Sam Meredith, “Russia has cut off gas supplies to Europe indefinitely. Here’s what you need to know,” CNBC, Sept. 6, 2022. https://www.cnbc.com/2022/09/06/energy-crisis-why-has-russia-cut-off-gas-supplies-to-europe.html.

[2] “OCS Oil and Natural Gas: Potential Lifecycle Greenhouse Gas Emissions and Social Cost of Carbon,” Bureau of Ocean Energy Management, November 2016, p. 36. https://www.boem.gov/sites/default/files/oil-and-gas-energy-program/Leasing/Five-Year-Program/2017-2022/OCS-Report-BOEM-2016-065—OCS-Oil-and-Natural-Gas—Potential-Lifecycle-GHG-Emissions-and-Social-Cost-of-Carbon.pdf.

[3] “Petroleum & Other Liquids: Weekly U.S. Regular All Formulations Retail Gasoline Prices,” U.S. Energy Information Administration, Sept. 26, 2022. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPMR_PTE_NUS_DPG&f=W; “Petroleum & Other Liquids: Weekly U.S. Product Supplied of Petroleum Products,” U.S. Energy Information Administration, Sept. 21, 2022. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WRPUPUS2&f=W.

[4] “Petroleum & Other Liquids: Crude Oil Production,” U.S. Energy Information Administration, Aug. 31, 2022. https://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbbl_m.htm; “World Crude Oil Production,” YCharts, April 2022. https://ycharts.com/indicators/world_crude_oil_production.

[5] Fred Lambert, “Tesla (TSLA) significantly increases its electric car prices across its lineup,” Electrek, June 15, 2022. https://electrek.co/2022/06/15/tesla-tsla-increases-electric-car-prices-across-lineup.

[6] “Lithium,” Trading Economics, last accessed Sept. 27, 2022. https://tradingeconomics.com/commodity/lithium.

[7] “Cobalt,” Trading Economics, last accessed Sept. 27, 2022. https://tradingeconomics.com/commodity/cobalt.

[8] “Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection,” Lawrence Berkeley National Laboratory, last accessed Sept. 27, 2022. https://emp.lbl.gov/queues.

[9] Ibid.

[10] Glenn McGrath, “Electric power sector CO2 emissions drop as generation mix shifts from coal to natural gas,” U.S. Energy Information Administration, June 9, 2021. https://www.eia.gov/todayinenergy/detail.php?id=48296.

[11] Selina Roman-White et al., “Life Cycle Greenhouse Gas Perspective on Exporting Liquefied Natural Gas From the United States: 2019 Update,” National Energy Technology Laboratory, Sept. 12, 2019. https://www.energy.gov/sites/prod/files/2019/09/f66/2019%20NETL%20LCA-GHG%20Report.pdf.

[12] “Natural Gas: U.S. Natural Gas Electric Power Price,” U.S. Energy Information Administration, Aug. 31, 2022. https://www.eia.gov/dnav/ng/hist/n3045us3m.htm; “EU Natural Gas,” Trading Economics, last accessed Sept. 27, 2022. https://tradingeconomics.com/commodity/eu-natural-gas.

[13] Siobhan Robbins, “Tough choices for Germany as coal power stations return to keep people warm this winter,” Sky News, Aug. 30, 2022. https://news.sky.com/story/tough-choices-for-germany-as-coal-power-stations-return-to-keep-people-warm-this-winter-12685534.

[14] “Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection.” https://emp.lbl.gov/queues.

[15] “Carbon emissions performance in US GoM: a low emitter in the crossfire,” Wood Mackenzie, Feb. 8, 2021. https://www.woodmac.com/reports/upstream-oil-and-gas-carbon-emissions-performance-in-us-gom-a-low-emitter-in-the-crossfire-468085.

[16] Deborah Gordon et al., “Know Your Oil: Creating a Global Oil-Climate Index,” Carnegie Endowment for International Peace, 2015, p. 17. https://carnegieendowment.org/files/know_your_oil.pdf.

[17] Argonne Venting and Flaring Research Team, “Venting and Flaring Research Study Report,” Bureau of Safety and Environmental Enforcement, January 2017, p. 19. https://www.bsee.gov/sites/bsee.gov/files/research-reports//5007aa-508-compliant.pdf.

[18] Jeremy Brown et al., “How the Gulf of Mexico can further the energy transition,” McKinsey & Company, Sept. 21, 2022. https://www.mckinsey.com/industries/oil-and-gas/our-insights/how-the-gulf-of-mexico-can-further-the-energy-transition.

[19] Alana K. Ayasse et al., “Methane remote sensing and emission quantification of offshore shallow water oil and gas platforms in the Gulf of Mexico,” Environmental Research Letters 17:8 (Aug. 11, 2022). https://iopscience.iop.org/article/10.1088/1748-9326/ac8566.

[20] “OCS Oil and Natural Gas: Potential Lifecycle Greenhouse Gas Emissions and Social Cost of Carbon.” https://www.boem.gov/sites/default/files/oil-and-gas-energy-program/Leasing/Five-Year-Program/2017-2022/OCS-Report-BOEM-2016-065—OCS-Oil-and-Natural-Gas—Potential-Lifecycle-GHG-Emissions-and-Social-Cost-of-Carbon.pdf.

[21] “World total energy supply by source,” International Energy Agency, 2021. https://www.iea.org/reports/key-world-energy-statistics-2021/supply.

[22] “From where do we import energy?” Eurostat, last accessed Sept. 27, 2022. https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html.

[23] Meredith. https://www.cnbc.com/2022/09/06/energy-crisis-why-has-russia-cut-off-gas-supplies-to-europe.html.

[24] “EU Natural Gas.” https://tradingeconomics.com/commodity/eu-natural-gas; “Households across the U.K. are about to experience an 80% jump in energy costs,” National Public Radio, Aug. 26, 2022. https://www.npr.org/2022/08/26/1119567595/households-across-the-u-k-are-about-experience-an-80-jump-in-energy-costs.

[25] Ian Bremmer, “The Long Shadow of the Visible Hand,” The Wall Street Journal, May 22, 2010. https://www.wsj.com/articles/SB10001424052748704852004575258541875590852.

[26] “Oil Embargo, 1973-1974,” U.S. State Department Office of the Historian, last accessed Sept. 27, 2022. https://history.state.gov/milestones/1969-1976/oil-embargo.