Liberty never looked so green: Policy implications of private carbon-free energy commitments

However, the commercial ecosystem to reduce electricity emissions is woefully underdeveloped. Extensive policy reforms are needed to unleash hundreds of billions of dollars in clean investment with billions of tons in avoided carbon potential.

Outmoded regulation impedes the flow of clean capital and quality information. Conventional business practices, such as traditional renewable energy credits, or RECs, are outdated and imprecise indicators of the emissions displacement that result from clean energy investments. The time is ripe to liberate energy investment and link it to emissions reduction ambitions.

Corporate environmental leaders are well ahead of government policy. Many are committing to a form of “around the clock” carbon-free energy targets. These goals strengthen the link between generation and consumption, yielding greater emissions displacement than traditional annual clean energy goals. Companies have begun piloting “premium clean” products like time- and location-based energy attribute certificates. These granular certificates create the potential for verifiable emissions-based products. Experimentation in environmental products and accounting is often frustratingly inconsistent but, like any set of new and complex services, it is a necessary and healthy phase of maturation.

The federal government joined the party last December when President Joe Biden issued an executive order requiring at least half of federal power procurement to come from local carbon-free energy on a 24/7 basis by 2030. This will create additional demand given the scale and procurement power of the federal government. It should also motivate federal reforms that galvanize private markets more than public procurement on its own.

Historically, reducing emissions was presumed to be at odds with economic development. Fortunately, unleashing market environmentalism aligns with our economic self-interest. Policy priorities for the electricity industry include:

- Expanding and improving organized wholesale electricity markets.

- Expanding and improving competitive retail electricity markets.

- Instilling granular emissions transparency.

- Refining financial regulation.

Beyond convention

Traditional RECs served an early-stage role in the evolution of clean energy, but they are not workable at scale to realize deep emissions reductions. RECs match average annual renewable production with consumption irrespective of location. However, emissions displaced by a clean energy generator or attributable to a single consumer varies sub-hourly across thousands of electricity nodes resulting from grid congestion and rapid supply-demand shifts. Traditional RECs reward quantity over value, which becomes a growing concern as parts of the grid become saturated with wind and solar.

Aligning energy procurement practices with emissions pledges ahead of the wave of corporate clean energy investment can have a huge emissions impact. The Brattle Group found that directing clean energy deployment to its greatest value in Texas could double the carbon abatement of traditional energy matching approaches.

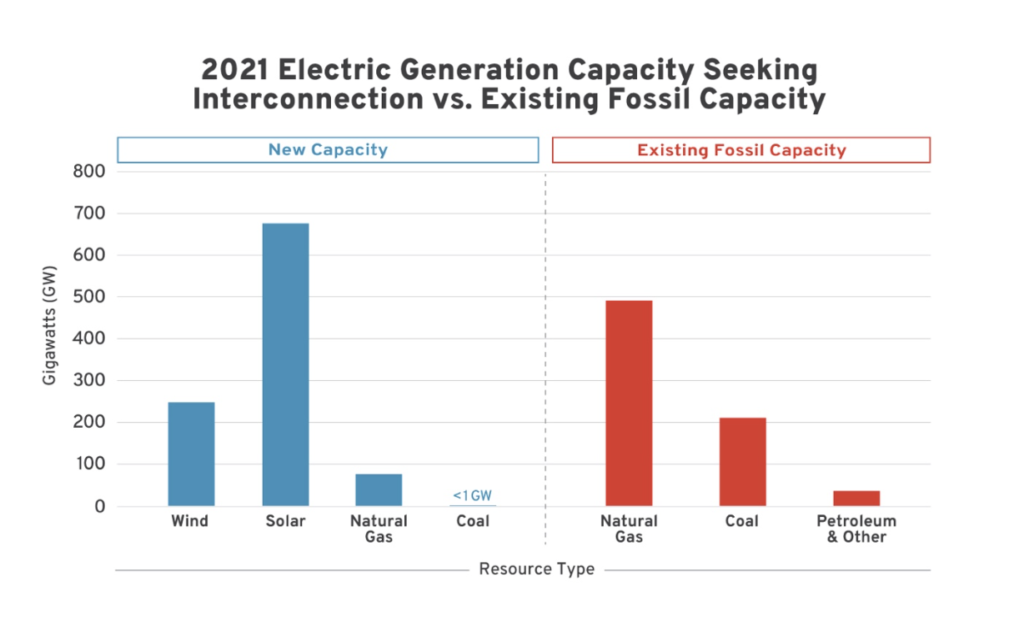

Nationally, siting new generation to optimize emissions reductions is at a critical juncture. The amount of new wind and solar capacity in the interconnection process exceeds that of the entire existing fossil fleet. Even discounting that a considerable proportion of interconnection capacity is not commercially serious, the scale of new zero- and low-carbon supply portends massive emissions displacement potential. Granular time-and-location emissions markets will also spur innovation in “clean firm” technologies like geothermal, advanced nuclear and storage to fill the gaps in renewable generation and augment reliability. On the demand side, new loads like data centers and crypto mining increasingly base siting decisions and operations on clean energy access and emission profiles.

Source: new resource data from Lawrence Berkeley Lab and existing resource data from the U.S. Energy Information Administration.

There are two policy strategies that can capture this potential. First, the role of electricity regulation must complete a transition to facilitating competition, rather than substituting for it. Second, market environmentalism underscores the role of limited government to define property rights, lower transactions costs and reduce information deficiencies.

Organized wholesale electricity markets

The shared fate of voluntary emissions reductions and sound economic policy centers on granular, transparent and accurate price signals of the transmission system’s marginal energy producer and congestion. Fortunately, locational marginal pricing reflects just that. It is the bread-and-butter of organized wholesale electricity markets run by regional transmission organizations.

Pre– and post-studies of RTOs clearly indicate economic benefits that far exceed costs. Additionally, studies likely understate unquantified benefits like enhanced reliability more than they understate unaccounted costs like participants’ time in stakeholder processes. RTO net benefits are projected to grow given the dynamics of renewables integration. While deeper studies on RTO costs and benefits are warranted, policymakers should appreciate the overwhelming evidence of RTO advantage.

Without question, RTOs have been a major upgrade over bilateral-only “markets” whose opacity, illiquidity and barriers to independent suppliers and consumer choice render them better suited to the label “utility cartels” than markets. To be clear, the Southeast Energy Exchange Market or SEEM, is not deserving of the title of “market” either. In April, Southern Company, the co-architect of SEEM, implicitly admitted that congestion costs cannot be measured outside of RTOs, let alone transacted upon and managed efficiently.

That said, RTOs have immense potential to improve, especially by enhancing their core functions. These include refining energy price formation; improving ancillary service market design; bettering transmission planning and operations; overhauling interconnection processes; and enacting governance reforms that ensure RTO independence from market participants, especially incumbent transmission owners.

Steps to improve granularity and liquidity for congestion management like forward periods and better credit risk policies would reduce artificial costs and risk for developers, traders and consumers, especially of the clean variety. The Federal Energy Regulatory Commission should also clarify what constitutes market manipulation, as the current practice chills commodity market liquidity and innovation, which is increasingly valuable to clean energy developers and purchasers in managing curtailment and basis risks.

Competitive retail electricity markets

Ensuring wholesale market benefits flow to end users requires complementary retail market reforms. For example, Midwest monopoly utilities do not respond to RTO price signals, which creates reliability problems and uneconomic power plant decisions. Competitive generation procurement is a solid, incremental upgrade. It lowers costs and accelerates the clean transition. But it does not address problems with retail monopolies, which leaves customers at risk of errors in the quantity, timing and product type associated with regulated procurement. Only retail choice remedies this.

Research shows that properly designed and implemented competitive retail markets lower costs, send more accurate price signals and enable innovative products. Competitive retail providers offer products with a variety premium services, including cleaner supply, flexible payment options and superior risk and consumption management. Retail choice expands clean energy access and procurement, lowers the “clean premium” and ensures the premium is fairly allocated based on individuals’ voluntary preferences.

Choice also holds intrinsic value; autonomy is paramount to energy consumers, large and small. Consumers increasingly seek market access and the ability to self-supply, be it for reliability, green ambitions or cost savings. Residential consumers favor choosing their own electricity provider by a margin of ten-to-one.

Public utility commissions need to do a better job of implementing retail choice in states that have it. This includes supporting product differentiation, improving licensing and disclosure rules, supplier consolidated billing, enhancing transparency and preventing monopoly distribution utilities from contaminating competitive services. States and Congress should prioritize legislation that liberates consumers in monopoly states to choose their supplier.

Granular emissions transparency

Even with textbook electricity markets, granular emissions transparency is imperative. Currently, companies motivated to reduce their indirect emissions hit an information wall. Emissions information from the U.S. Environmental Protection Agency is severely lagged and lacks time and location granularity to inform indirect emissions. Fixing this requires prompt, public access to real-time and historical data on the marginal emissions in a given location based on dynamic transmission congestion.

Early efforts have proved fruitful. Last year, PJM began posting five-minute marginal emission rates at the nodal level. Emissions transparency is a top stakeholder request in some other RTOs as well, yet bottom-up initiatives face roadblocks. FERC does not have authority to push a top-down approach — it is not an environmental regulator — while the EPA lacks energy sophistication. Perhaps an interagency memorandum of understanding could match expertise with jurisdiction and help put the Department of Energy’s Infrastructure Investment and Jobs Act funding to good use. Congress could require utilities or balancing authorities to publicly disclose at least average hourly emissions for each pricing node within a specified timeline, which has already been introduced in a Senate bill this year.

Emissions transparency also serves a broader economic strategy as the cost of capital becomes a function of environmental performance abroad. Capital increasingly flows to where investors can validate their environmental theses. This requires global lifecycle emissions analysis across complex supply chains, where international comparisons highlight the clean comparative advantage of U.S. industries. With all the recent controversy over EPA’s regulatory climate authority, perhaps the agency’s best climate role is instead to enhance emissions transparency that encourages an environmental race-to-the-top in financial markets.

Refined financial regulation

Harnessing the corporate sustainability juggernaut requires fixing its credibility problem. Market confusion and regulatory uncertainty undermine confidence in commercial pathways for civil society to express environmental preferences in financial markets. Financial players welcome regulators who “stay in their lane,” such as enhancing transparency, but warn that missteps will exacerbate risk and create new corporate liabilities.

Aspects of the Securities and Exchange Commission’s climate disclosure proposal may enhance markets by furnishing investors with better information on climate-related risk and standardization of definitions — including carbon offsets and RECs — for firms that claim to be offsetting or negating climate-related risk. However, several aspects of the proposal would interfere with markets, obfuscate material information to investors and worsen private-sector led emission mitigation efforts. Similar themes apply to the Commodity Futures Trading Commission, which released a request for information on climate-related financial risk in June.

Financial regulators could address greenwashing and legitimize voluntary carbon markets. Clarifying the rules of the road should unlock chilled capital that remains weary of unclear regulatory interpretations, but overly restrictive rules would undermine product experimentation that drives environmental innovation. For example, the SEC record reflects a disconnect in the environmental claims of some REC market participants. Whether the SEC’s response spurs premium environmental products or spooks innovators with nebulous greenwashing definitions and enforcement remains to be seen.

Putting reforms in context

Our struggling climate, economy and public finances face a triple reckoning. Enabling private capital to voluntarily flow to its most productive uses benefits all three. It also orients domestic institutions in a manner that is replicable and scalable globally. This is especially important considering the bulk of global emissions come from countries unwilling to sacrifice economic self-interest.

It is time to realign the clean energy and climate agenda with economic self-interest. In an era in which the private sector is willing to finance the clean energy transition, subsidies for mature technologies constitute a massive public-to-private wealth transfer with taxpayer costs exceeding emissions benefits, implying a welfare loss to society. Policymakers must decipher such rent-seeking from productive lobbying, such as pushes to bolster transparency and swap monopolies for markets. Similarly, policymakers must distinguish the environmental ambitions of those who put their own capital at risk — consumers and competitive suppliers — from monopoly utilities who pass costs onto captive customers.

Climate leadership is about enabling market environmentalism to flourish. The best public leadership empowers private leadership. Liberty never looked so green.