You can’t fix refinery shortages with more government intervention

In a recent letter to refiners, President Joe Biden pointed out that both gasoline prices and profits are at record levels, yet new refinery capacity is not coming online. Biden also stated that his administration is willing to use “all tools at [its] disposal” to address the issue. The picture the administration paints is that it can address these shortages with additional government policy, the specifics of which are unclear at this point. But a deeper look at refinery shortages reveals that yet another government intervention into energy markets is unlikely to produce much benefit, as the strategy is ill suited to remedying scarcity issues.

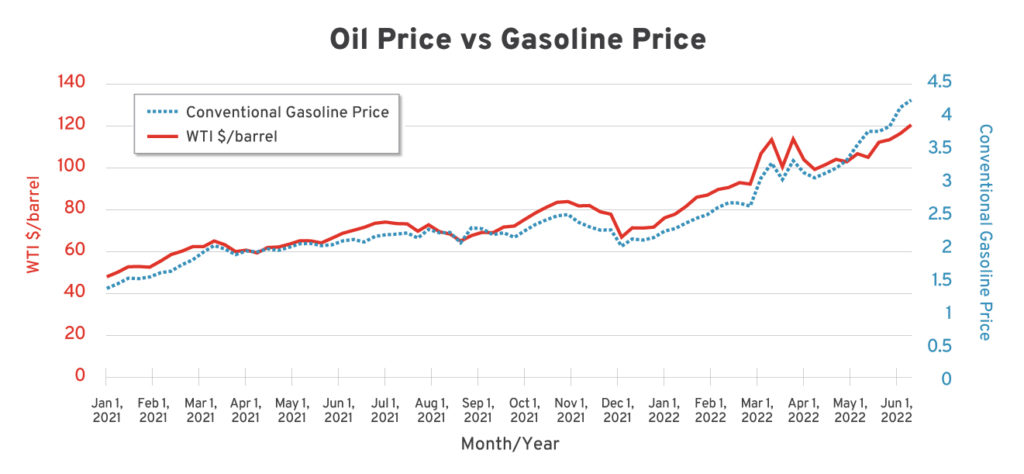

Gasoline prices are rising faster than oil prices

Generally, gasoline prices are closely tied to oil prices. Crude oil is refined into gasoline and other petroleum products, so the cost of the input—oil—is a major factor in the cost of the finished product. Recently, gasoline prices have started to rise at a faster rate than oil prices.

Source: EIA price data for oil and gasoline.

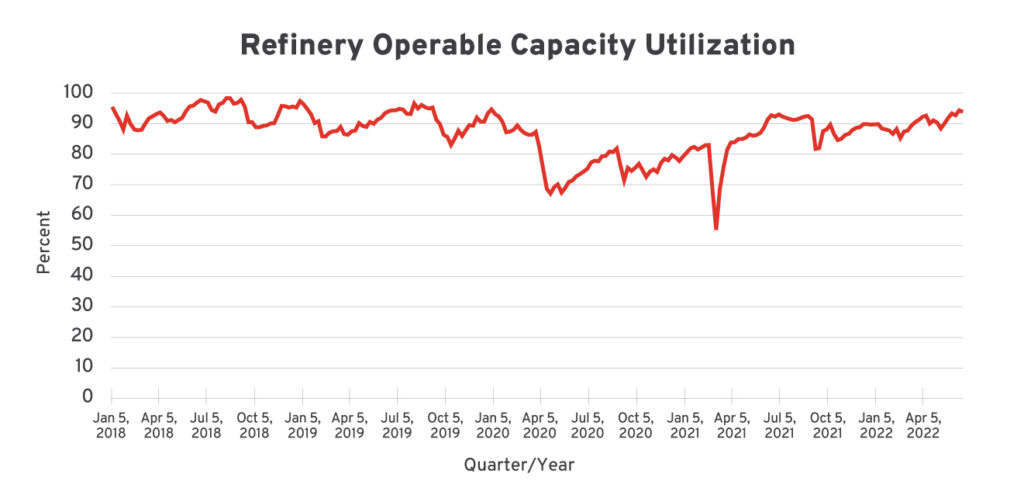

The reason gasoline prices are starting to rise faster than oil prices is because of a shortage of refinery capacity. In the United States, refinery capacity utilization is typically over 90 percent. However, this utilization is still a little below pre-pandemic levels.

Source: EIA refinery capacity utilization data.

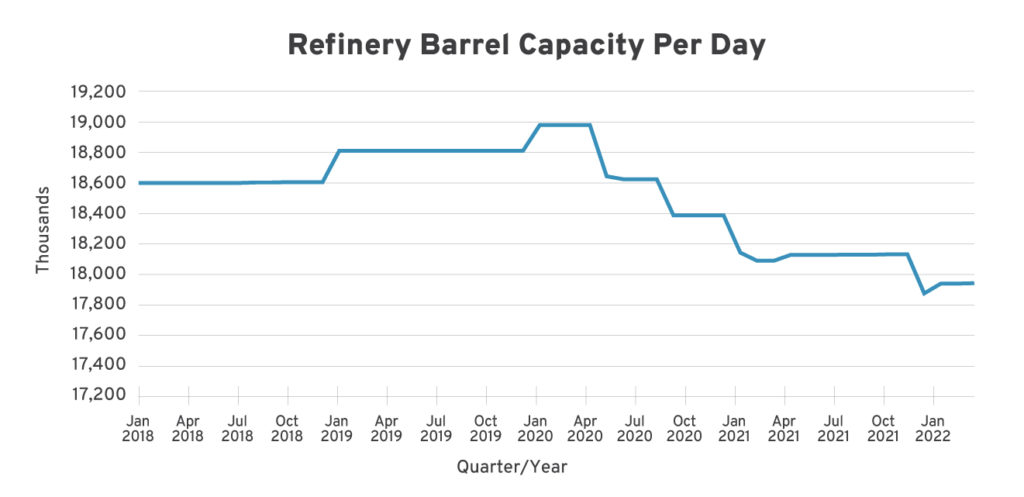

Current refinery capacity utilization is essentially as expected. However, total available refinery capacity is still below pre-pandemic levels.

Source: EIA refinery capacity data.

Compared to a January 2020 peak, total refinery capacity in the United States is down by about 5 percent.

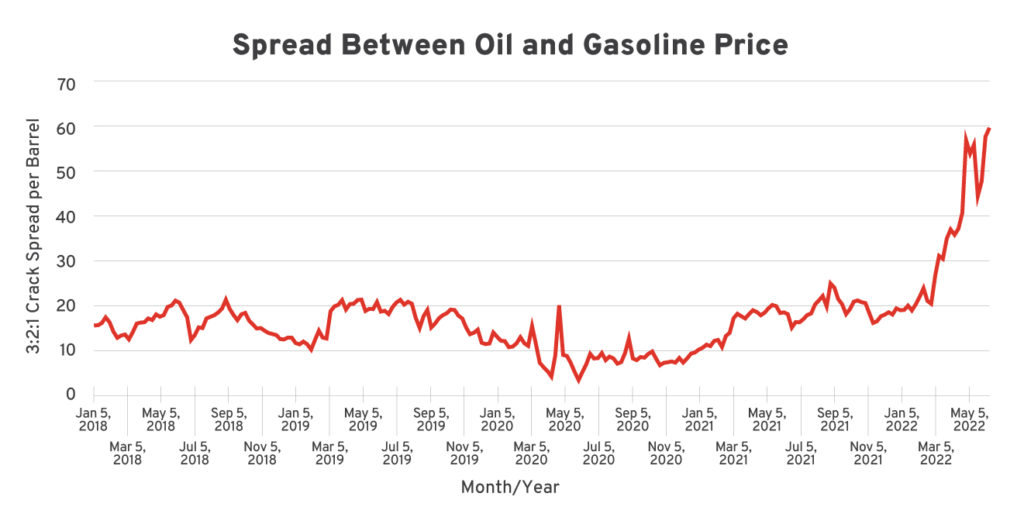

Limited refinery capacity and high demand boosts refiner revenue

The fact that finished petroleum product prices are rising faster than oil prices reflects the scarcity of refinery capacity. As a matter of course, suppliers of scarce commodities are going to profit from such a development. The measure of a refiner’s revenue per barrel can be conceptualized as the spread between the commanding price of finished commodities and the cost of oil inputs, sometimes called a “crack spread.” Notably, the crack spread generally remains stable even as oil and gasoline prices fluctuate, but with a recent shortage of refinery capacity, the crack spread has been rising sharply, increasing from about $16 per barrel in 2018 to $60 per barrel as of June 10 (calculated as a 3:2:1 spread).

Source: RSI calculations based on WTI oil price, gulf coast conventional gasoline price and gulf coast ultra-low sulfur diesel prices according to EIA methodology.

Clearly, the current market conditions make oil refining very profitable. So why aren’t more refineries coming online, as one would expect, when there is profit to be had?

Why current prices don’t immediately increase refinery capacity

The takeaway from President Biden’s letter is that because prices are high, refinery capacity should increase. This is a conventional understanding of economics: high prices induce market entry for suppliers. But in the case of refineries, the reason for a lack of market entry is more readily explained by looking at what new refinery capacity addition entails.

The most recent refinery to come online is the Hartree Partners refinery in Channelview, Texas. The refinery was originally built by Targa Resources. The project was announced in 2014, completed construction in 2018, and was first operated in 2019, for a project timeline of about five years. Refineries may be making huge profits now, but deciding whether it is reasonable to build a new refinery or expand capacity depends on projected market conditions years from now.

What’s more, refinery capacity is expensive, and it can take time before the refinery turns a profit. The Targa Resources refinery has a capacity of 35,000 barrels per day, and cost $140 million to build, for a capital cost per barrel of capacity per day of about $4,000. Excluding operating costs, the current crack spread could equal $4,000 after just 67 days, but under the 2018 crack spread it would take 246 days. When considering the operating costs of the refinery, it is likely that any refineries built today will take years to build, and then over a year to recover capital costs. It is not unreasonable to expect that refiners may be looking more towards the market conditions of 2028 to determine investment decisions today.

Unless there are easy and immediate opportunities to expand refinery capacity, additional capacity is unlikely to be a near-term solution for current gasoline prices.

Potential changes to the regulatory environment may contribute to investment decisions

It should also be noted that refinery construction, due to the high levels of pollution associated with refining oil, is strictly regulated under air quality standards. New refineries, or modifications to existing ones, must be permitted under “New Source Review” (NSR). The current administration retained the Trump administration’s changes to NSR, which changed consideration of regulatory approval to focus on net emission impacts rather than gross emissions, making it easier for potential refinery capacity additions or new construction.

However, the Biden administration has also stated in Executive Order 14008 that it would “organize and deploy the full capacity of [the administration’s] agencies to combat the climate crisis to implement a Government-wide approach that reduces climate pollution in every sector of the economy.” Additionally, the administration has stated a goal that it seeks for 50 percent of new vehicle sales by 2030 to be EVs. The Princeton University Net-Zero America report, envisioning a net-zero emission United States by 2050, estimates a decline in domestic oil production between 25 percent and 85 percent by 2050.

Oil refineries stay in operation for a long time. The EIA’s information on the “newest refineries” operating in the United States shows that of the 17 latest refineries, 12 were built before the turn of the century. A potential investor in new refining capacity is going to be thinking about the potential market conditions in 2050, since maintaining a refinery’s operation for 30 years is not unusual.

The administration’s proposed climate disclosure rule on financial regulation also promises to implement new requirements on fossil-fuel related companies. Refiners are publicly traded companies, subject to the regulations of the Securities and Exchange Commission (SEC), and it is not yet clear how proposed requirements such as the disclosure of Scope 3 emissions from fossil fuel companies (e.g. emissions from employee commuting, emissions from material suppliers, etc.) will impact refiners.

Essentially, the administration is sending mixed signals to refiners. On the one hand, high gasoline prices are harming Americans and the administration is pressured to respond by forcing a supply increase. On the other hand, the administration is promising to transition away from refiners’ products and to implement new regulations with which they must comply. It is not unreasonable to expect that potential refiner investors see political risk from a fossil fuel investment, or what the SEC calls transition risk.

Policy Implications

The administration’s actions up until this point are unlikely to spur new investment in petroleum product supply. Oil prices are heavily influenced by factors outside the control of the administration, such as the war in Ukraine, rising global energy demand and manipulated supply from the Organization of Petroleum Exporting Countries (OPEC). However, the solution to rising prices is the market entry of new suppliers, which is not happening.

Part of the reason for limited growth in petroleum product supply can be explained by the fact that market conditions that are likely to change, such as the war in Ukraine or OPEC’s market manipulation, meaning that the profitability of new refineries may not be sustained long enough to justify new capacity investment.

But the administration is wrong to downplay the impacts of its own policies on investor decisions. In his letter to refiners, President Biden promises to use all the authority at his disposal to expand refinery capacity, but in his executive order on climate he promised to do the same to end climate pollution, implying a reduction in the use of fossil fuels. Already, the administration has undertaken significant actions that impact the oil and gas sector, such as an oil and gas lease moratorium (which was shot down in court), government intervention in markets to support renewable energy via the Defense Production Act and a proposed significant expansion of financial regulation related to fossil fuel-related companies through the SEC.

The administration is claiming that its executive actions will have a significant impact on energy policy in the United States. Simultaneously, the administration is arguing that its policies have had no deleterious effect on petroleum product supply, that high prices are instead a result of bad actors or foreign events. These cannot both be true. Rather, exogenous factors and the administration’s policies are all contributing factors to supply scarcity.

The administration is learning that—as RSI has repeatedly explained—its repeated and inappropriate market interventions are altering market dynamics by elevating the importance of political connectedness and diminishing the ability of price signals to stimulate market entry. It is unclear at this point exactly what policies the administration would intend to use to bolster refinery capacity, but given its predilection towards the DPA, that could entail either an expansion of fossil fuel subsidies through the DPA that would circumvent congressional legislation, or some form of deregulation on the environmental permitting requirements of fossil fuel refiners. Alternatively, if the administration believes that refiners are price gouging, it may try to mandate some sort of limit on profitability or other restrictive measure, which would only further deter market entry. None of these would be good policies, as they would worsen the mismatch of market incentives where productivity improvements become less important to economic competitiveness than political preference from the administration.

The administration should keep in mind two key points: firstly, current gasoline prices are exacerbated by refinery capacity shortages but reducing the input costs for refiners—i.e. oil prices—can also reduce costs to consumers. Arguably, addressing oil supply scarcity is a more reliable and immediate opportunity to reduce gasoline prices since the infrastructure required to expand refinery capacity may not come online in the near term. Secondly, each intervention in the market only worsens the dynamics of investment decisions, as investors become less and less certain that their industry will not become subject to a new whim of the political class.

At the end of the day, there is no substitute for functional market dynamics where supply, demand and consumer utility guide producers toward efficient decision making. The administration should not abuse its power to selectively subsidize or deregulate fossil fuel suppliers, nor should it attempt to further interfere in industry dynamics lest it exacerbate prices by further constraining supply and deterring investment.

Image: pdm