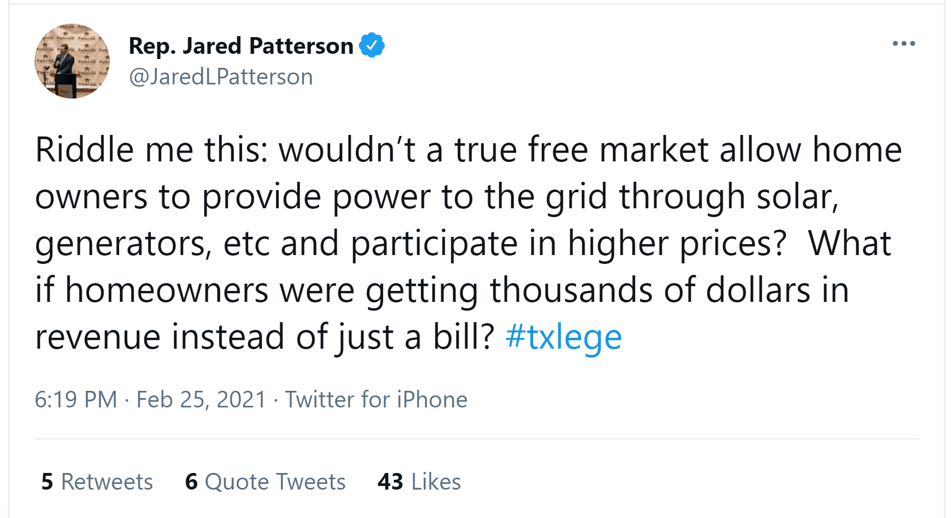

How can customers help avoid future widespread outages in Texas?

Rep. Patterson raises an important point regarding the Electric Reliability Council of Texas (ERCOT) market—generators that were able to provide electricity during the emergency were paid the cap price, $9,000/megawatt per hour (MWh). For comparison, average prices fall in the $20-$40/MWh range. On the demand side, the ERCOT directed the distribution utilities, which operate the transmission and distribution system, to turn off power across the region in order to maintain reliability—some 4.5 million customers across the state had their power turned off. These customers faced uniform, involuntary service curtailment whereas many voluntary curtailment opportunities were bypassed because customers were not able to participate directly in the ERCOT market. This would have at least mitigated the extent that the ERCOT had to resort to involuntary widespread outages. Further, constraining customer access to the market hamstrings the development of distributed energy resources (DERs), which can help consumers self-supply and sell excess back to the bulk system. Rather than being able to help, retail customers, instead, bore the brunt of the outage, with some customers going four days without electricity. This is a glaring example of the lack of participation by customers and DERs.

In considering this opportunity for DERs, it should be noted that they can be used in three different ways in the ERCOT market: 1) as a source of on-site service, such as a behind the meter-distributed generation or rooftop solar; 2) as a resource that is capable of responding to a price signal, such as demand response or energy storage (i.e., price-responsive demand (PRD)); or 3) treated as a supply resource when allowed to participate directly in ERCOT markets on a comparable basis to other supply resources. In the first two options, market mechanisms do not compensate them—although they could—but a customer recovers its investment by avoiding a retail rate. For the third option, that would be compensated comparably with a supply side resource. However, all three options are capable of providing services and value to the market, yet are mostly not utilized. DERs such as solar and solar+storage provide opportunities for all three options, if ERCOT markets were constructed in a way that provided an opportunity to participate directly or in an aggregation. Instead, ERCOT markets skew heavily toward large, centralized power plants, when they could look at a broader set of options that would offer them greater flexibility and diversity.

Part of the problem with determining their ability to participate and how to compensate them is that there are existing programs to compensate excess solar production that are paid an administratively determined price. So, even though solar was producing power during the daytime while millions of people were without power, they were not being paid the market clearing price, even though they were contributing to meeting supply across the ERCOT market. Most programs in Texas compensate solar at the retail rate or a value of solar tariff that is also administratively determined. In most circumstances, that would be the end of the conversation. However, for excess solar production during the emergency, those resources would have been compensated under its net metering rate, even though the wholesale market price was many times the retail rate paid under a net metering tariff. For example, if a customer had a retail contract with a third party provider at $.10/kilowatts per hour (kWh), then if that provider had a net energy metering (NEM) offering, it would buy any excess solar back at the $.10/kWh rate. During the outages, if a customer produced excess solar, rather than be paid at the market price of $9,000/MWh, the customer would be paid $.10/kwh or $100/MWh, or 90 times less than the market cap price. However, the retail electric provider would be subject to that wholesale price, so they should have an incentive to work with customers to minimize that market risk by relying on that excess solar production. This is opposed to a monopoly utility who is able to spread wholesale market prices across a captive rate base and has less incentive to minimize its wholesale market risk.

From a market perspective, all resources that are capable of providing services should be allowed to participate. The Federal Energy Regulatory Commission (FERC) has spent the better part of 25 years, since the issuance of FERC Order No. 888, to lower barriers in markets for competition in organized wholesale markets. While those rules do not apply to the ERCOT, people often model Texas as an example of a market not burdened by rules or tariffs designed to protect incumbents at the expense of competition. Rather, the ERCOT and Texas generally have a long-standing aura of being pro-market and enabling the development of new offerings in conjunction with customer demands. Yet, during the emergency over Valentine’s Day weekend, there was little evidence of participation by the demand side, even though the demand side eventually bore the brunt of the failure of the system.

Rep. Patterson highlights that despite the ERCOT and Texas’ reputation as a being pro-competition, it still lags in enabling opportunities for more resources to participate, especially those that are located on the distribution side. Historically, Texas’ system is a summer peaking system, which means whatever demand response programs are developed, those programs are targeted for summer. For example, summer demand response programs would include air conditioning programs where customers would agree to have the thermostat raised and then be paid for that response. There are far fewer programs available to the ERCOT in winter months. The lack of participation by DERs in wholesale markets is certainly not an ERCOT-only phenomenon; this persists throughout the country, including in other organized markets.

It is not for lack of available DER market products that is a problem for the ERCOT as many retail energy providers offer such services and options to customers. For example, NRG Energy has a touted summer demand response program with Nest. By signing up with the program, a customer gets a free Nest thermostat but also agrees to allow NRG to control the customer’s thermostat during certain hours in the summer to reduce consumption as prices and demand increase. The ability to respond quickly to events is not necessarily unprecedented; in August 2017, a total solar eclipse was going to occur across a large portion of the United States. Nest sent out notifications to Nest owners across the area of the United States in the path of the eclipse allowing people to voluntarily allow Nest to control their thermostat during the event, as planners worried about the impacts of the eclipse on solar production. Across Texas, there were voluntary measures to encourage people to reduce consumption, such as calls for people to conserve or asking large facilities to reduce or shut down their plants. Voluntary plans have a long history, notably in California where Flex Alerts are common during the summer months, and, increasingly, in winter months as well. When customers voluntarily reduce their usage, they avoid their retail rate, but are not compensated for the benefit of this aggregated response at the wholesale level. This voluntary participation is valuable to ensure the continued operation of the electric system, which helps the energy provider avoid purchasing electricity in high-priced hours; however, they do not share those savings with the customer. By acting as a hedge against higher-priced electricity, retail providers should have an incentive to deploy greater amounts of demand response, yet during the middle of February 2021, customers remained treated as either on or off, without much opportunity for customers themselves to participate as a solution or be compensated for their actions.

The Texas emergency also exposes a common feature of wholesale markets that is increasingly tenuous—keeping supply and demand separated means that the market operator has limited the variety of solutions it has at its disposal. By allowing demand-side resources to be treated similar to supply and be included in the supply stack, it means that the system operator can mix and match its options to balance supply and demand, but also pay those demand-side resources for their response. By not including DERs in their stack of solutions, the ERCOT—and market operators generally—discount the role and benefits that DERs can provide to the operation of wholesale markets.

With increasing amounts of electrification, systems like Texas will likely see increased consumption in winter, as traditional natural gas demand—like heating and water heaters—switch to electricity. This means that the system will need to be planned and operated differently than in the past, including developing DER opportunities in wholesale markets throughout the year, not just for summer.

Another opportunity to highlight the role and opportunities DERs have to provide support to the electricity system is by leveraging their capabilities for local resource needs. Greater visibility and transparency into the distribution system could assist in identifying optimal locations for DERs to provide services to the distribution system, including the provision of resilience and reliability services, such as balancing resources or demand response.

The FERC is addressing this inequity through Order No. 2222, and regional transmission organizations (RTOs) around the country are considering tariffs and rules to enable participation of DERs into those markets. While Order No. 2222 does not apply to the ERCOT, it provides an important perspective on the increasing importance and value that DERs can provide to wholesale markets. The need for more flexibility is readily apparent across the country, of which DERs can be a prime resource to use to help manage that flexibility. As such, Texas would be wise to allow DERs explicitly to participate directly in ERCOT markets and look to expanding opportunities across the year; this would allow those resources to participate and be paid for their response rather than simply have their electricity turned off without any compensation. Instead, the current system is largely to the benefit of central plant generation and limits customer participation, which suppresses voluntary demand reduction and DER development. As Rep. Patterson notes, a freer market would allow customers to offer their resources into the market and be paid for their participation and what they provide. For DERs to take on a more active role as either a price-responsive product or as a solution on the supply side, policymakers will need to direct the ERCOT to lower barriers to entry for these resources.

Image credit: Ted Pendergast