Texas Moves Closer to Boosting Private Flood Market

The nation’s second-largest market for flood insurance may soon join more than a dozen other states in waiving requirements that insureds first search the admitted market before placing a private flood insurance policy with a surplus lines carrier.

In a 8-0 vote May 10, the Texas Senate Business and Commerce Committee passed H.B. 1306 for consideration on the Senate floor. The bill, which previously cleared the full state House of Representatives in a similarly unanimous April 18 vote, needs only to meet that final floor hurdle before the May 27 close of the Texas Legislature’s biennial session to be sent on to Gov. Greg Abbott for his signature.

Under the terms of H.B. 1306, a consumer seeking private flood insurance would be freed from diligent search requirements that would otherwise mandate he or she first see that no authorized insurer is actually writing that class of coverage in the state, or that the coverage amounts are in excess of those available from authorized insurers. To qualify for the waiver, the bill requires that the surplus lines writer must have a financial strength rating of A- or better from A.M. Best Co.

Should the measure make it into law, which is beginning to appear likely, Texas would join a growing list of states that have waived diligent search requirements for private flood insurance. Whether by legislative or regulatory means, similar rules are now in place in Alaska, Arizona, Connecticut, Florida, Idaho, Louisiana, New Jersey, Oklahoma, Pennsylvania, Rhode Island, Virginia, West Virginia and Wisconsin.

Texas would represent a major addition to that list. It currently ranks behind only Florida in premium in-force written through the National Flood Insurance Program, a 50-year-old federal agency that operates under the auspices of the Federal Emergency Management Agency. The $435.2 million of premium the NFIP wrote in Texas in 2018 represented roughly 12 percent of the federal program’s total.

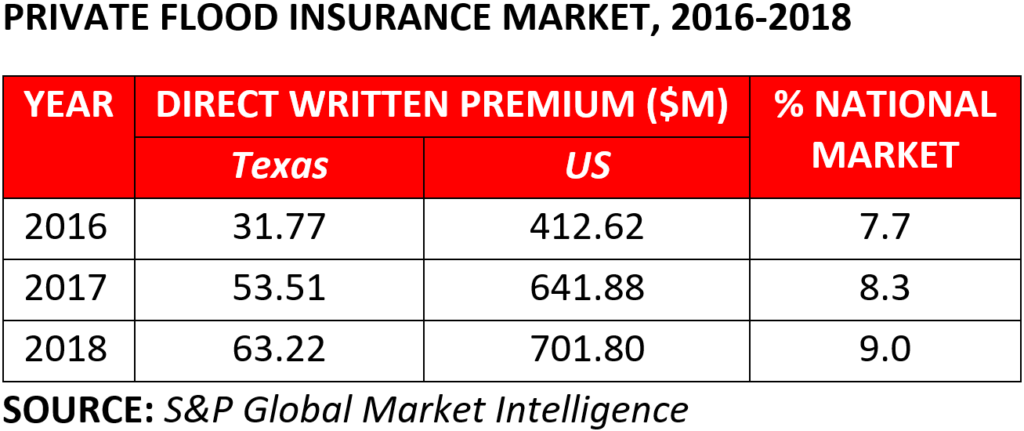

While the NFIP remains the dominant provider of flood insurance in the United States, the private market has been growing steadily, and Texas is proving to be a significant portion of that market. According to statutory insurance data reported by S&P Global Market Intelligence, private flood insurance premiums in Texas have roughly doubled over the past two years, growing from 7.7 percent to roughly 9 percent of the national private flood market.

This private market growth is great news for consumers, as research shows the overwhelming majority of the NFIP’s Texas policyholders would find more affordable options in the private market. In fact, according to a July 2017 study by the actuarial firm Milliman, roughly 92 percent of the more than 500,000 single-family homes insured through NFIP in Texas would find cheaper private flood insurance options. That includes 84 percent of properties in the high-risk A zone and 88 percent of properties in the coastal high-risk VE zone.

By streamlining the process to access the surplus lines market, H.B. 1306 should make those savings easier to realize for more Texans. But this isn’t just about shifting policies from the federal program to the private market, even if that may be considered an added benefit, given that the NFIP has had to borrow $40 billion from the U.S. Treasury in recent years to cover its claims. More importantly, by making affordable flood coverage easier to access, H.B. 1306 could help expand the universe of properties statewide that have insurance protection for flood.

Given how many properties were shown to be completely uninsured for flood in the wake of Hurricane Harvey, passing this bill represents a big step Texas lawmakers can take this year to help close that protection gap.